EUR/JPY Price Analysis: Scope for further decline

- EUR/JPY reverses the recent weakness and bounces off 130.00.

- Gains remain in the pipeline above the two-month line.

EUR/JPY leaves behind the negative performance witnessed in the second half of last week and manages to regain some shine on Monday.

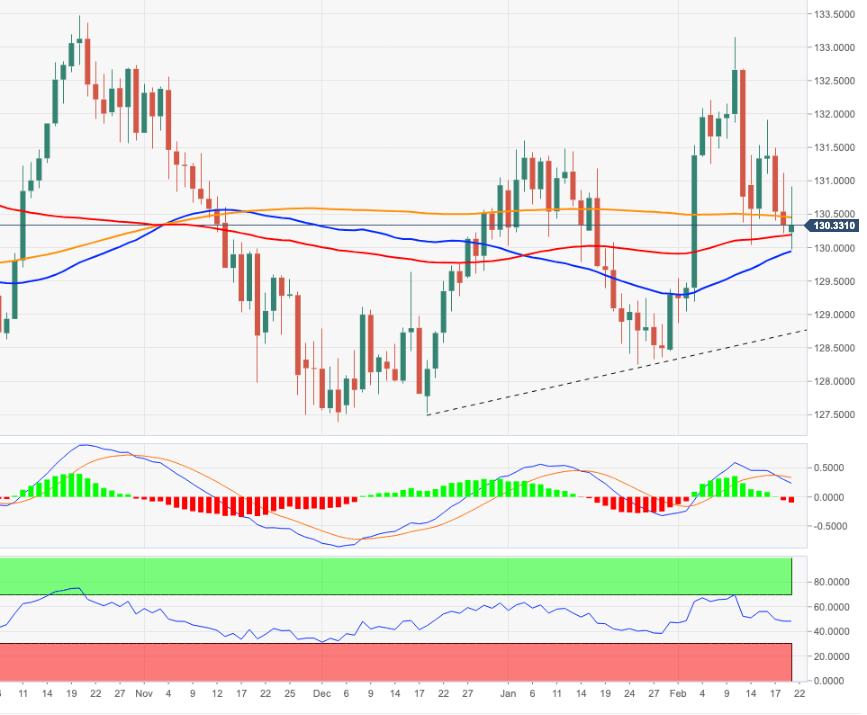

EUR/JPY broke below the key 200-day SMA (130.41) and in doing so it has opened the door to extra losses in the very near term. The 55-day SMA around 129.90 emerges as an interim support prior to the two-month line, today situated near 128.80.

While above this line, further upside in the cross should remain on the table in the very near term. In the longer term, the outlook for the cross is seen as negative as long as it trades below the 200-day SMA.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.