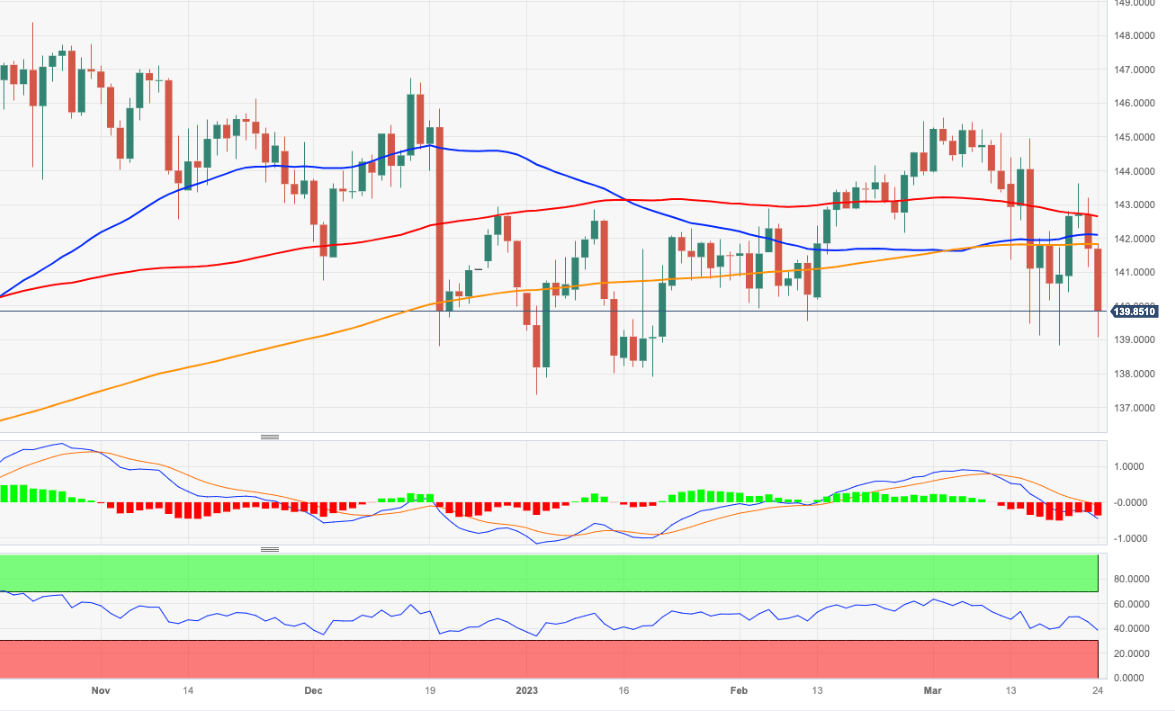

EUR/JPY Price Analysis: Renewed downside could test 2023 lows

- EUR/JPY drops sharply and challenges 139.00 on Friday.

- A move to the YTD low near 137.40 appears on the cards.

EUR/JPY adds to Thursday’s losses and drops markedly well below the key 200-day SMA (141.79) at the end of the week.

In case the selling pressure gathers extra steam, the cross could extedn the decline to the 2023 low at 137.38 (January 3).

In the meantime, extra losses remain in store while the cross trades below the 200-day SMA.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.