EUR/JPY Price Analysis: Rallies to a four-day high, above 158.00

- EUR/JPY touches a four-day high of 158.26, buoyed by a sharp rally in EUR/USD, before settling around 158.05.

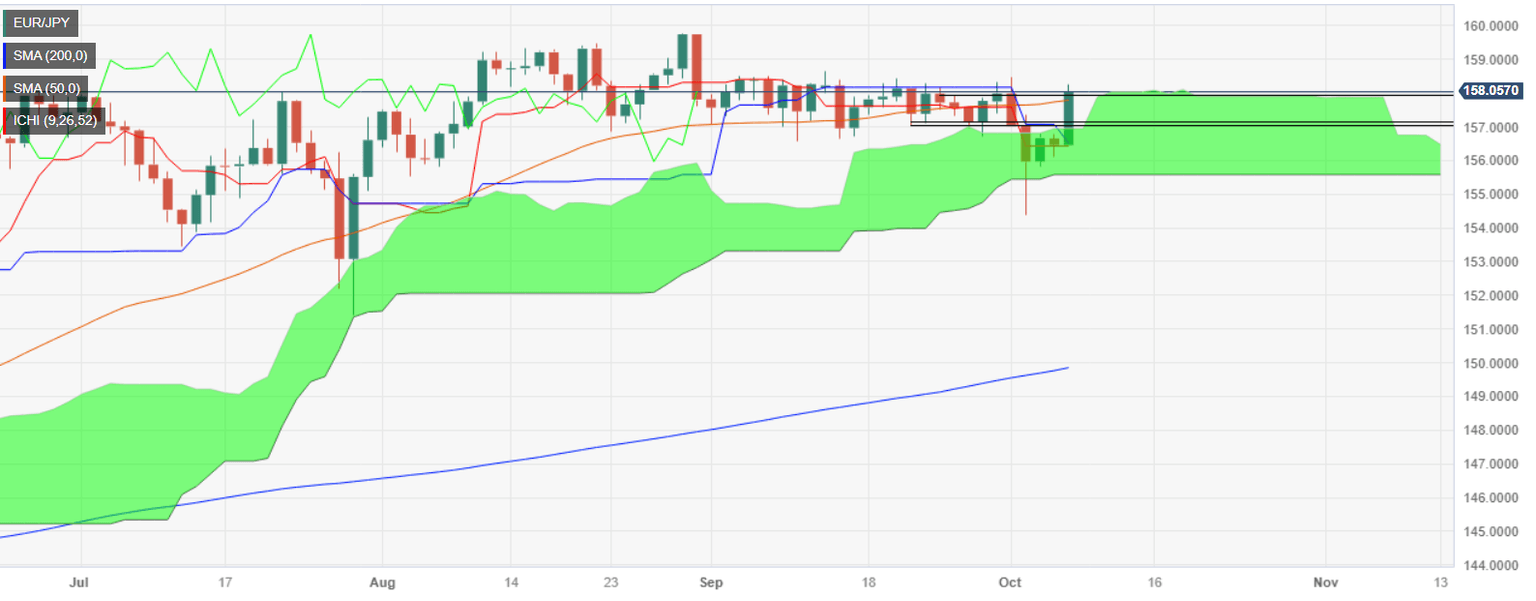

- Despite breaching the Ichimoku Cloud, immediate resistances at 158.47 and 158.65 cap further upward momentum.

- Potential downside could see the pair target 156.45, with further declines possibly testing the October 3 low of 154.34.

EUR/JPY prints solid gains of more than 0.90% on Friday after the EUR/USD rallied sharply towards a daily high of 1.0600, which lifted the cross-currency pair towards a four-day high of 158.26 before reversing toward current exchange rates at around 158.05.

From a technical perspective, the EUR/JPY remains consolidated in the daily chart despite breaking above the Ichimoku Cloud (Kumo), which is usually seen as a bullish signal, but immediate resistance would cap the Euro’s intentions of higher prices. If the pair aims higher, the first resistance is seen at the October 2 high of 158.47, followed by the September 13 daily high of 158.65, before challenging 159.00

On the flip side, if EUR/JPY drops inside the Kumo, it could dive towards the Senkou Span A at 156.45 before challenging the bottom of the Kumo at 156.49. Once those two levels are cleared, the pair could aim towards the October 3 daily/weekly low of 154.34.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.