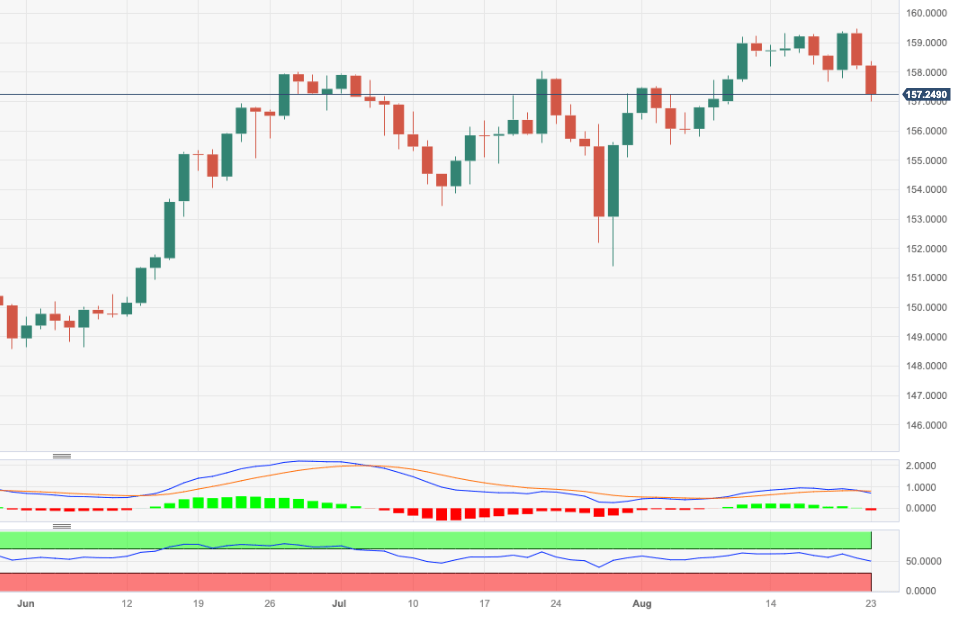

EUR/JPY Price Analysis: Interim support comes near 156.00

- EUR/JPY adds to Tuesday’s losses and revisits 157.00.

- A deeper decline could meet transitory support near 156.00.

EUR/JPY accelerates its downside momentum and drops to multi-day lows in the 157.00 neighbourhood on Wednesday.

In case the corrective retracement gathers further impulse, the cross could extend the move to the provisional 55-day SMA around 156.00, which should hold the initial test. South from here emerges the 100-day SMA near 152.50 prior to the July low of 151.40 (July 28).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 147.51.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.