EUR/JPY Price Analysis: Dropped but holds to 140.50s, as bears eye the 200-DMA

- The EUR/JPY cut last Friday’s gains, dropping towards the 200-day EMA, as sellers target 140.00 and below.

- EUR/JPY Price Analysis: The pullback towards the 200-DMA might pave the way for a deeper correction before resuming the uptrend.

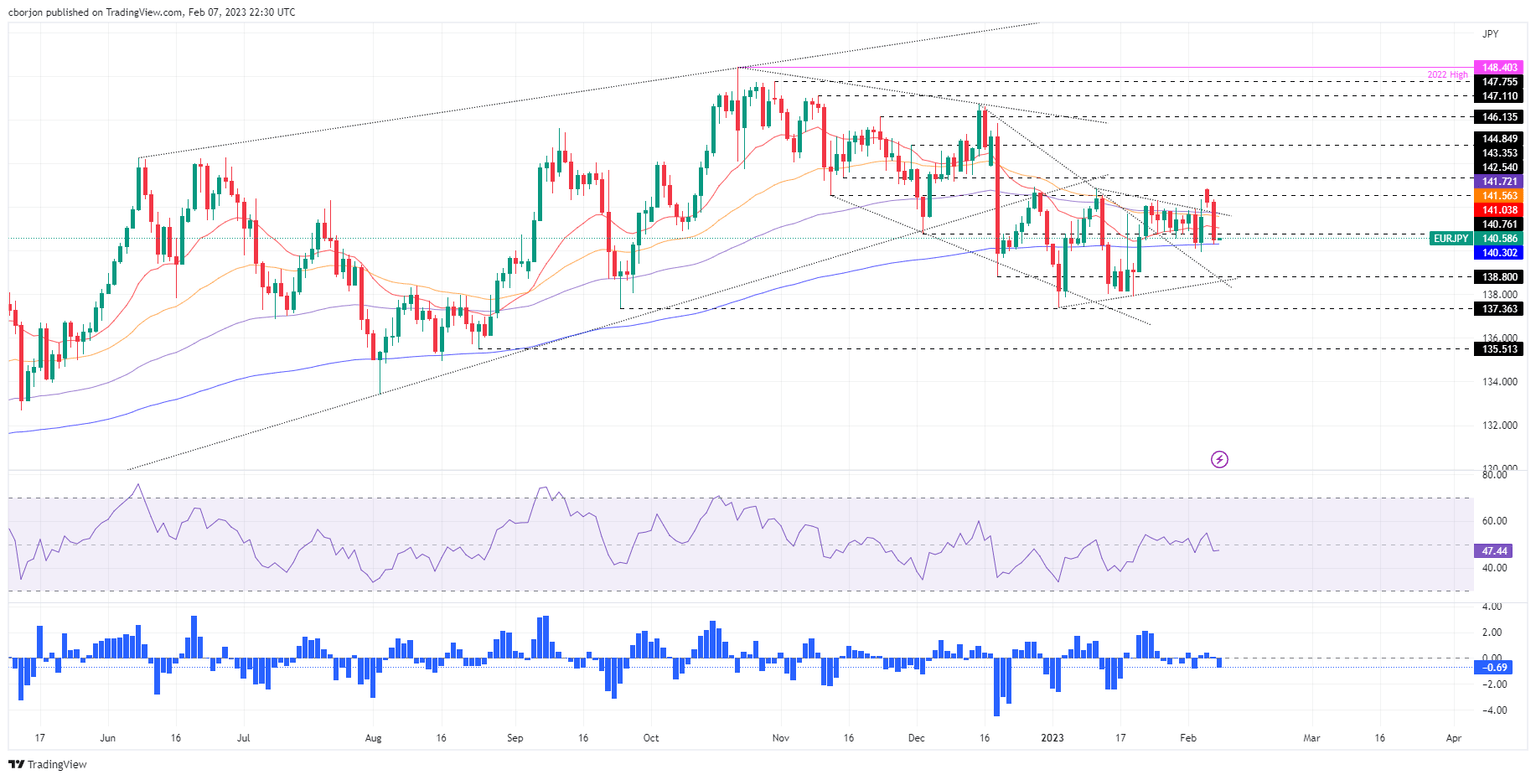

EUR/JPY continued to trade lower for two consecutive days, retracing most of last Friday’s gains, and reclaimed the 50 and 20-day Exponential Moving Averages (EMAs), on its way south. The Euro’s (EUR) collapse was capped by the trend-setter 200-day EMA at 140.30, though it would likely remain under pressure. At the time of writing, the EUR/JPY is trading at 140.52, with losses of 1.20%, as Tuesday’s session ends.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY shifted to neutral from neutral-upwards, according to the daily chart, following Tuesday’s fall beneath essential demand zones. In addition, the EUR/JPY pair could turn neutral downwards as the spot price hovers nearby the 200-day EMA, which, once cleared, could pave the way for further losses.

The Relative Strength Index (RSI) and the Rate of Change (RoC) supported the above-mentioned scenario, meaning that in the short term, the EUR/JPY might pull back before resuming its uptrend.

Therefore, the EUR/JPY first support would be the 200-day EMA at 140.30. A breach of the latter will send the pair sliding towards the 140.00 figure, which, once cleared, the EUR/JPY might fall toward the January 20 daily low of 139.03.

As an alternate scenario and the current trend, the EUR/JPY first resistance would be the 20-day EMA at 141.03. A break of that supply zone and the EUR/JPY might rally toward the psychological 142.00 area followed by the February 7 high fo 142.33.

EUR/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.