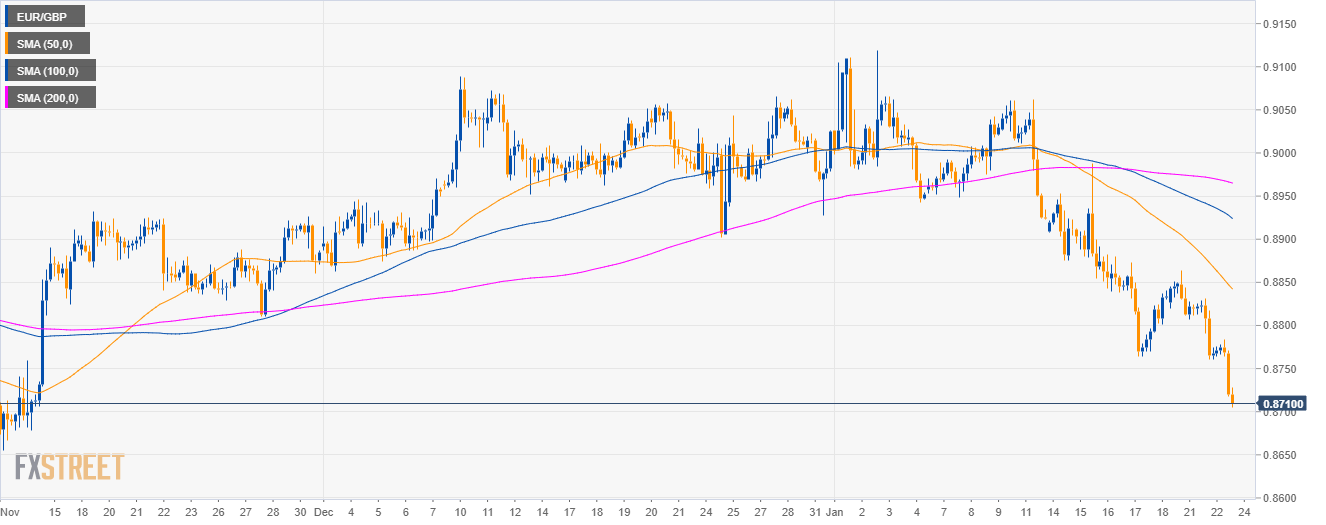

EUR/GBP daily chart

- EUR/GBP is trading in a sideways trend below the 50, 100 and 200-day simple moving averages (SMAs).

- As discussed, failure to hold price above the 0.8760 support lead to a drop to the 0.8710 level.

EUR/GBP 4-hour chart

- EUR/GBP is trading below the main SMAs as the currency cross is trading at new 2019 lows.

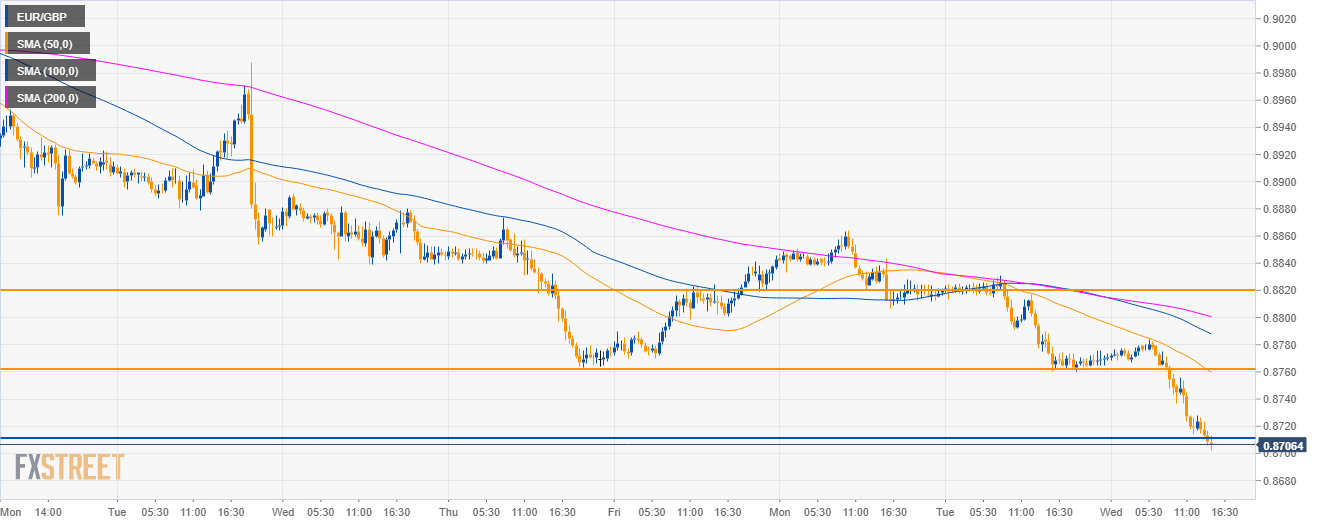

EUR/GBP 30-minute chart

- As EUR/GBP is trading below its main SMAs the bears are in control of the market.

- If the sellers can keep EUR/GBP below 0.8710 a drop to 0.6560 can be on the cards.

- On the flip side, bulls will try to reclaim the resistances near 0.8760 and the 0.8820 level.

Additional key levels

EUR/GBP

Overview:

Today Last Price: 0.8709

Today Daily change: -0.0056 pips

Today Daily change %: -0.64%

Today Daily Open: 0.8765

Trends:

Daily SMA20: 0.8937

Daily SMA50: 0.8933

Daily SMA100: 0.8889

Daily SMA200: 0.8867

Levels:

Previous Daily High: 0.8831

Previous Daily Low: 0.876

Previous Weekly High: 0.8988

Previous Weekly Low: 0.8764

Previous Monthly High: 0.9089

Previous Monthly Low: 0.8863

Daily Fibonacci 38.2%: 0.8787

Daily Fibonacci 61.8%: 0.8804

Daily Pivot Point S1: 0.874

Daily Pivot Point S2: 0.8714

Daily Pivot Point S3: 0.8669

Daily Pivot Point R1: 0.8811

Daily Pivot Point R2: 0.8856

Daily Pivot Point R3: 0.8882

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.