- EUR/GBP’s sell-off likely to extend amid rising channel breakdown on the 4H chart.

- A test of the critical support at 0.8605 remains on the cards.

- RSI points south, outlook appears bearish in the short term.

EUR/GBP is nursing losses around mid-0.8600s in Monday’s Asian trading, having felt the heat from steep losses in the EUR/USD pair, as the US dollar rebounds amid broad risk-aversion.

Meanwhile, the Cable remains on the defensive but resilient so far, in the wake of resurgent US dollar demand, as the UK re-opening and vaccine optimism remains supportive of the pound.

The focus this week remains on the US infrastructure spending bill and the European Central Bank (ECB) policy decision.

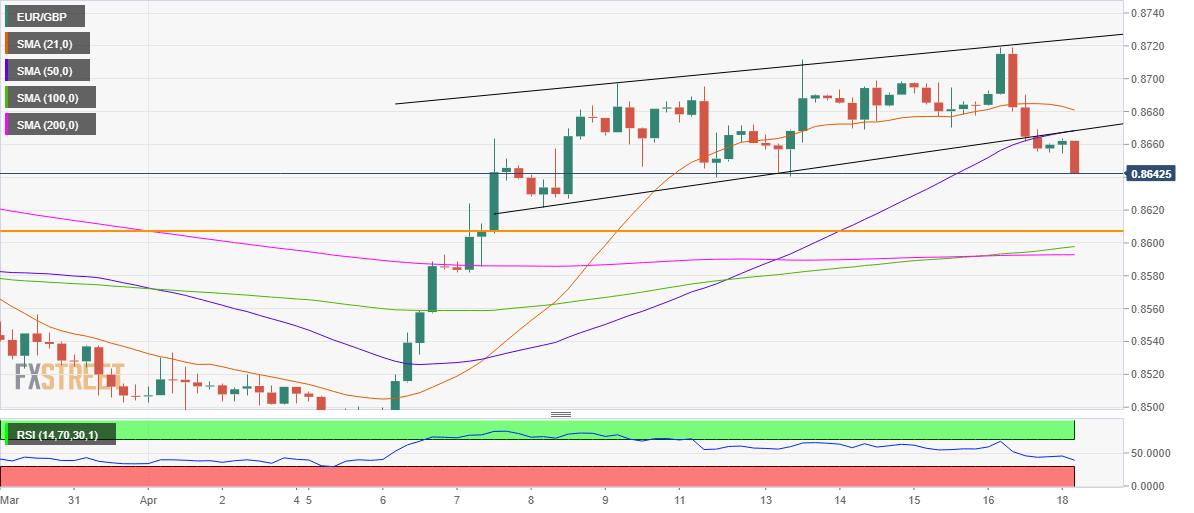

From a near-term technical perspective, the path of least resistance for EUR/GBP appears to the downside, especially after the cross confirmed a rising channel breakdown on the four-hour chart in the US last session.

After a brief downside consolidation in early dealing this Monday, the bears have resumed the declines, as the immediate support is now envisioned at 0.8605 – the horizontal (orange) trendline.

Further south, a confluence of the 100 and 200-simple moving averages (SMA) around 0.8590 could emerge as crucial support.

The Relative Strength Index (RSI) is edging towards the oversold territory, currently at 39.11, suggesting that there is more scope to the downside.

EUR/GBP four-hour chart

Alternatively, any recovery attempts could meet strong resistance at 0.8668, the intersection of the rising wedge support and upward-sloping 50-SMA.

The next barrier for the bulls is aligned at the bearish 21-SMA at 0.8806. Acceptance above the latter is critical to unleashing further recovery gains.

EUR/GBP additional levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays weak near 1.0700 ahead of key EU inflation, GDP data

EUR/USD is keeping the red near 1.0700, undermined by a broad US Dollar rebound and a mixed market mood early Tuesday. Germany's Retail Sales rebound fail to impress the Euro ahead of key Eurozone inflation and GDP data releases.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold struggle with $2,330 extends, as focus shifts to Fed decision

Gold price is looking to build on to the previous downside early Tuesday, as traders continue to take profits off the table in the lead-up to the US Federal Reserve (Fed) interest rate decision due on Wednesday.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.