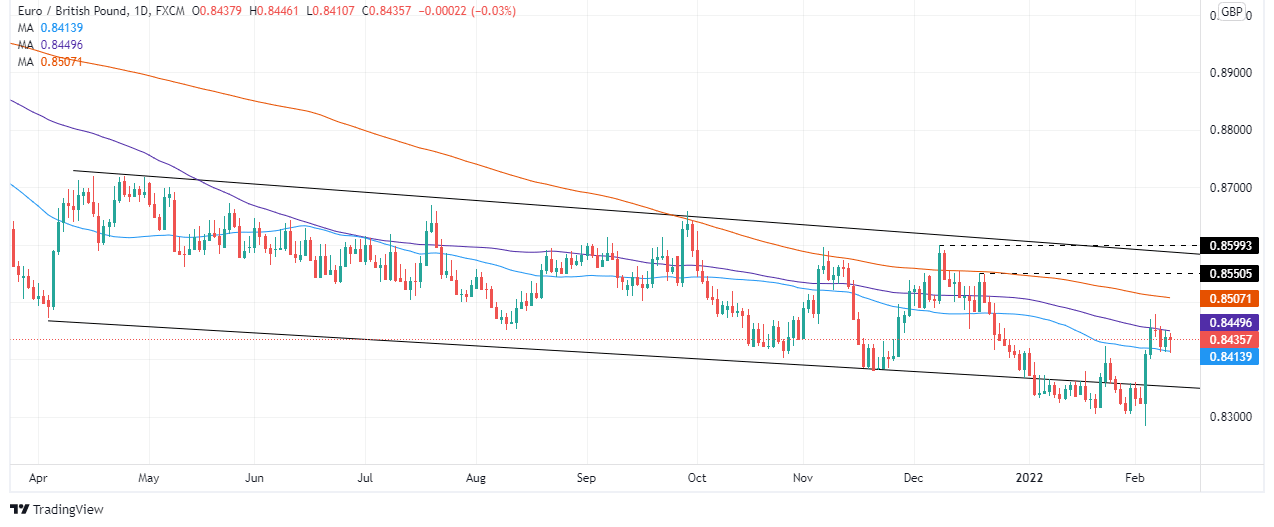

EUR/GBP Price Analysis: Rangebound as it consolidates within the 50 and the 100-DMA around 0.8410

- The cross-currency is almost flat during the day, as both currencies are the main gainers in the FX complex.

- The EUR/GBP is trapped between the 50 and the 100-DMA, a 36-pip range.

- EUR/GPB is neutral biased but could shift neutral-upwards with an upbreak of the 100-DMA.

The EUR/GBP is barely down during the North American session. At the time of writing, the EUR/GBP is trading at 0.8413.

A risk-off market mood looms the global financial markets. The US Department of Labor reported that US inflation for January rose 7.5% more than estimated, spurring a sell-off in US equity markets. In the FX complex, the history is different. The gainers are the EUR and the GBP, while the laggards are the CAD and the JPY.

That said, the EUR/GBP Thursday’s price action was confined to a 36-pip trading range, as investors’ eyes were on US macroeconomic data.

EUR/GBP Price Forecast: Technical outlook

Since the last week, the EUR/GBP jumped from under 0.8350 towards 0.8478, following the Bank of England (BoE’s) rate hike, and the European Central Bank (ECB) pivot forwards a tilted “hawkish” monetary policy stance.

At press time, the EUR/GBP sits comfortably between the 50-day moving average (DMA) at 0.8413 and the 100-DMA at 0.8449, suggesting the pair as neutral biased. Nevertheless, an upside break of the 100-DMA would shift the trend to neutral-upwards because the 200-DMA resides above the exchange rate, resting at 0.8501. In that outcome, the first resistance would be the 200-DMA at 0.8501. Breach of the latter would expose December 20, 2021, high at 0.8550, followed by a nine-month-old downslope trendline around the 0.8590-0.8600 range.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.