EUR/GBP Price Analysis: Fades recovery moves above 0.9100 ahead of UK jobs report

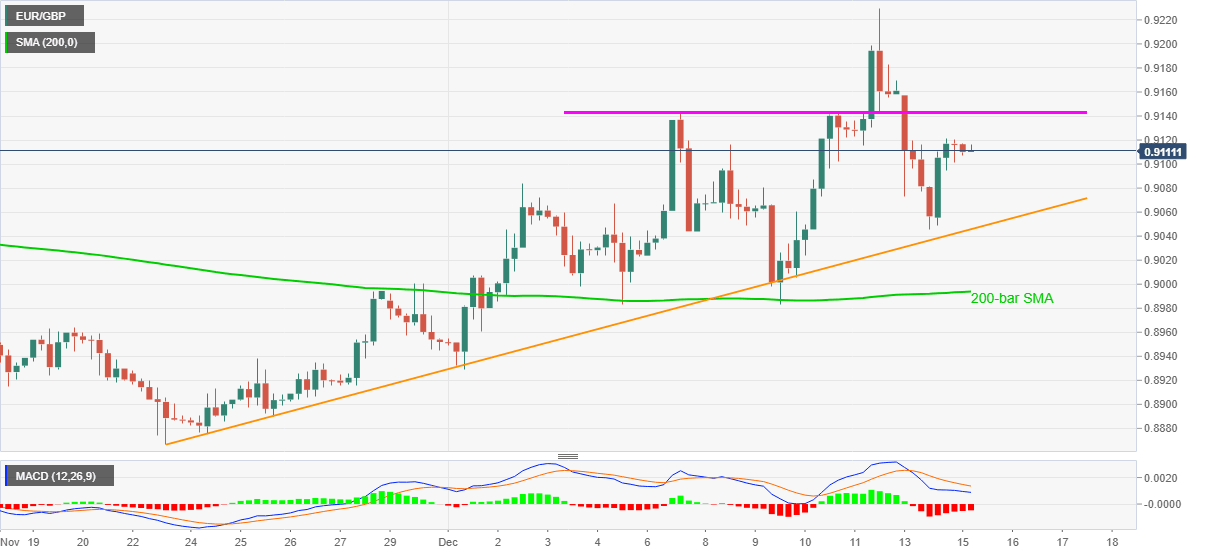

- EUR/GBP eases inside the choppy range between 0.9120 and 0.9100.

- Three-week-old rising trend line, 200-bar SMA probe bears.

- UK employment figures for November likely to portray another challenge for the Pound bulls.

EUR/GBP drops to 0.9112 during the pre-London open on Tuesday. Even so, the quote keeps the 20-pips range established above the 0.9100 since early Asia.

While recovery moves ahead of the short-term key support line favor EUR/GBP buyers, the pair traders await the latest employment data from the UK for fresh impulse.

Read: When are the UK jobs and how could they affect GBP/USD?

Although forecasts suggest a downbeat scenario for the British currency, a one-week-old horizontal resistance line near 0.9145 offers an immediate upside hurdle before directing the EUR/GBP buyers towards the monthly peak near 0.9230.

During the run-up, the 0.9200 round-figure can offer an extra filter.

Alternatively, a downside break below the stated support line, at 0.9045 now, will shift the market’s attention to the 200-bar SMA level surrounding 0.8995.

In a case where the EUR/GBP bears dominate past-0.8995, the monthly low of 0.8930 will become their favorite.

EUR/GBP four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.