When are the UK jobs and how could they affect GBP/USD?

UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the November month Claimant Count figures together with the Unemployment Rate in the three months to October at 07:00 AM GMT. Although Brexit and coronavirus (COVID-19) are likely to keep the driver’s seat, the recent doubts over whether the BOE is geared towards the negative rates or not highlight the importance of today’s employment day for GBP/USD traders.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to October, to rise from the previous 1.3% to 2.2%, while ex-bonuses, the wages are seen improving from 1.9% to 2.6% during the stated period.

The number of people seeking jobless benefits, namely the Claimant Count Change, is expected to jump from -29.8K previous to +50K in November. Further, the ILO Unemployment Rate may pick up from 4.8% to 5.1% during the three months ending in October.

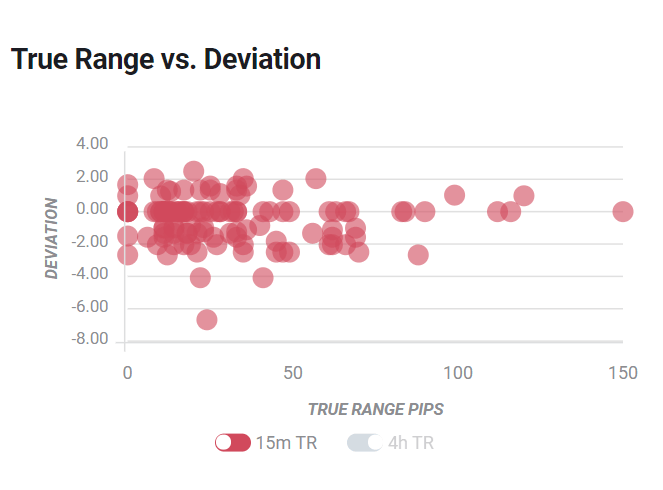

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBP/USD eases from an intraday high of 1.3348 to 1.3330 while heading into Tuesday’s London open. The Cable benefited from the broad US dollar weakness the previous day before eroding gains amid fears of a no-deal Brexit and the coronavirus (COVID-19) wave 2.0.

Following UK Health Minister Matt Hancock’s comments relating to the new variants of the covid, global markets turned risk-off even as the vaccinations have begun in the UK, Canada and the US. Also on the negative side could be the woes relating to the return of London’s strictest activity measures and UK PM Boris Johnson’s strong expectations of no-deal Brexit.

It should, however, be noted that the BOE’s cautious optimism and the Tory government’s readiness to do whatever it takes to safeguard the nation, be it versus the European Union’s (EU) Brexit challenges or pandemic’s economic burden, favor the GBP/USD bulls. The same may gain momentum if the employment figures mark a surprise improvement in November, which is less likely. Even in that case, the sterling bulls should consider the bounce as a knee-jerk reaction considering the current uncertainty over Brexit and covid fears.

Technically, the ability to cross 100-bar EMA directs GBP/USD buyers towards a falling trend line from December 04, at 1.3410 now. However, a clear upside beyond the same will be critical to watch. Meanwhile, a downside break below 100-bar EMA, currently around 1.3320, will recall the sellers targeting 1.3250 and the monthly low near 1.3130.

Key notes

UK Jobs Preview: Data set to reflect reality, potentially pounding the pound

GBP/USD Price Analysis: Bulls look to revisit short-term resistance line around 1.3400

GBP/USD Forecast: Handing by a Brexit’s thread

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.