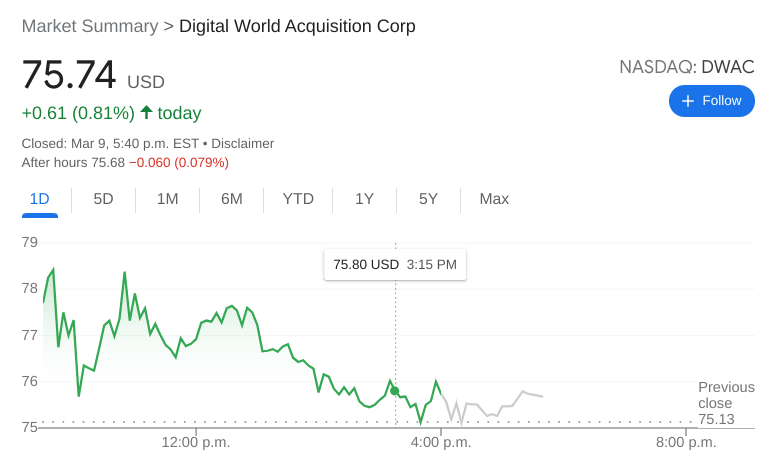

DWAC Stock Price: Digital World Acquisition edges higher as markets rally on sinking oil prices

- NASDAQ:DWAC gained 0.81% during Wednesday’s trading session.

- Trump and his inner circle are noticeably absent from Truth Social.

- Devin Nunes says the Truth Social team is working around the clock.

NASDAQ:DWAC managed to eke out a small gain on Wednesday, although the SPAC stock still underperformed the broader markets. Shares of DWAC inched higher by 0.81% and closed the trading session at $75.74. It was a stark contrast to the first two days of the week as all three major indices soared out of the open. The Dow Jones erased most of its losses from Tuesday, gaining 653 basis points, while the S&P 500 jumped by 2.57% for its single best session since June of 2020. The NASDAQ also climbed by 3.59% as big tech stocks surged higher to anchor the markets.

Stay up to speed with hot stocks' news!

Throughout the botched launch of the Truth Social app, the Trump family and his inner circle have been noticeably absent from the platform. Most notably, former President Trump himself has only posted one Truth since its launch in February. Former First Lady Melania Trump is on the app but has recently dedicated her social media presence to another app called Parler. None of Trump’s children have verified accounts either, despite the fact that Donald Trump Jr. was actively promoting the launch of Truth Social on other social media platforms.

DWAC stock forecast

Truth Social CEO and former Republican Congressman, Devin Nunes, has taken heat for the lackluster rollout of the app. Nunes has stated that the development team is working around the clock to fix all of the bugs that have plagued the app since its launch. Nunes also said that there should be an Apple app update in the next few days that will solve many of the complaints that early users have raised.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet