Dow Jones Industrial Average edges up in a thinned holiday session

- Dow Jones ticks up Tuesday in a calm pre-Easter trading session.

- Market sentiment is moderately positive, buoyed by hopes that the Fed will start cutting rates in June.

- Trading volume remains at low levels with investors awaiting Friday’s PCE Prices Index data.

The Dow Jones Industrial Average (DJIA) shows marginal gains on Tuesday. Wall Street has opened the session in green, with mega-cap growth stocks leading gains although the main indexes remain trading close to the opening levels.

Today's gains leave the index in no man's land, well below the historic highs reached on Thursday. The dovishly-tilted monetary policy statement by the Federal Reserve boosted investors’ confidence that the Fed will start rolling back its restrictive policy in June, pushing global equity markets higher last week.

The US calendar is light this week, and investors are focusing on Friday’s US Personal Consumption Expenditures Prices Index data for further clues about the Fed’s monetary policy outlook.

Dow Jones news

The Dow Jones Industrial Average is 0.18% higher on afternoon trading. A moderately positive market sentiment is buoying equity markets in an otherwise snoozy session ahead of the Easter holidays.

Down to sectors, Consumer Discretionary and Communication Services are leading gains, while Energy and Utilities are the worst performers.

United Health Group (UNH) is leading gains on Tuesday with a 1.3% advance, followed by Honeywell International (HON), up 1.1%, and Goldman Sachs (GS) with a 1.0% advance. On the downside, 3M (MMM) is the worst performer, losing 1.5%, followed by Boeing (BA), 1.2% down, on the back of news that CEO Jeremy Calhoun is leaving the company.

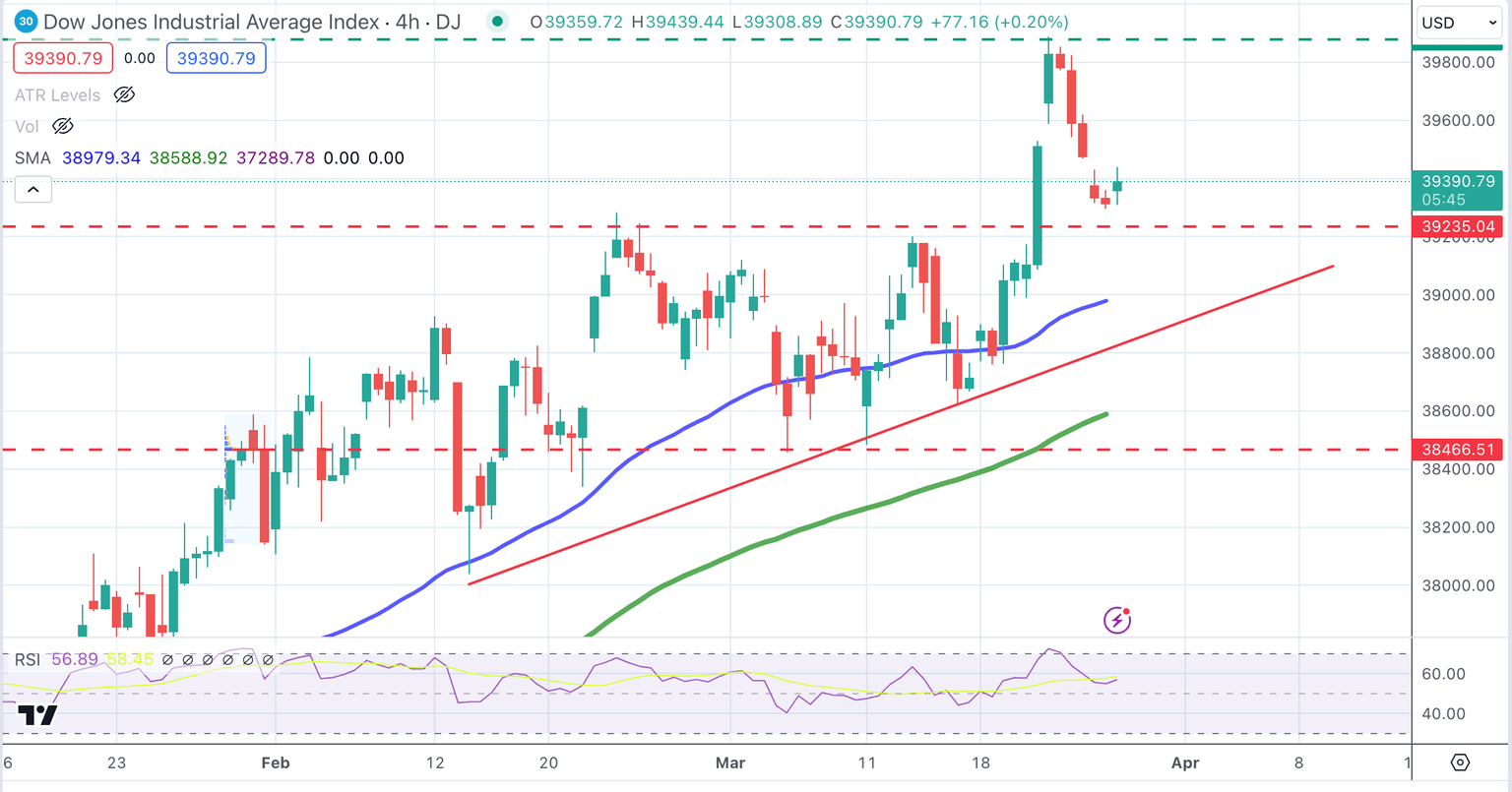

Dow Jones technical outlook

The broader bias for the Dow Jones Index remains bullish despite the recent reversal from all-time highs. Bears have been contained above previous highs, at the 39,260 area, which leaves the trend of higher highs and higher lows intact so far.

Sellers should breach that level to increase bearish momentum and open the path toward 39,000 and 38,650. On the upside, resistances are at the 39,900 previous high and the 40,000 psychological level.

Dow Jones Industrial Average 4-Hour Chart

Economic Indicator

United States Personal Consumption Expenditures - Price Index (MoM)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US).. The MoM figure compares prices in the reference month to the previous month. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.