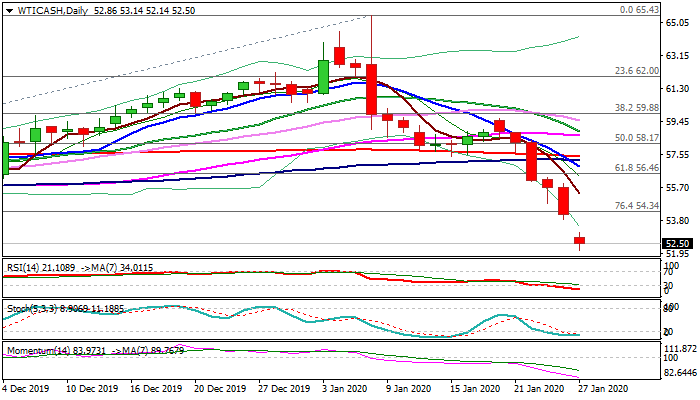

Crude Oil News and Forecast: WTI retreats from 3-month lows near $52.00

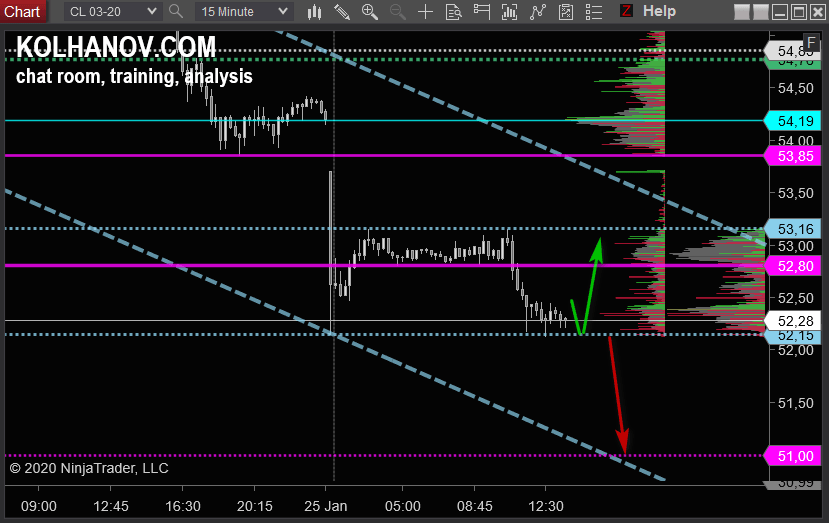

WTI Crude oil may start uptrend from support 52.15 to resistance 53.16

Uptrend

An uptrend will start from support level 52.15, which will be followed by moving up to resistance level 53.15.

Downtrend

WTI retreats from 3-month lows near $52.00

There is no respite for the barrel of WTI on Monday, as prices of the American benchmark for the sweet light crude oil tumbled to the $52.00 region in early trade, area last visited in early October 2019.

WTI focused on China, data

Prices of the West Texas Intermediate dropped to the boundaries of the $52.00 mark per barrel earlier on Monday amidst rising concerns on the fast-spreading coronavirus in China and its probable impact on the economic outlook of the second world oil importer.

In addition, traders’ concerns regarding an oversupplied oil market remain far from abated for the time being and are forecasted to keep hurting the sentiment and undermining any attempt of recovery in prices. Read more...

WTI Oil Outlook: crude oil falls further after gap-lower opening as virus concerns weigh heavily

WTI oil price started the week with 130-pips gap lower and extended to the levels last traded in early Oct, pressured by concerns that virus spread could have strong negative effect on oil demand. The price holding firmly in red for the sixth straight day, with massive weekly bearish candle of last week (WTI contract was down nearly 9% for the week) weighing heavily. Bearish daily/weekly studies add to negative signals as bears eye key med-term supports at ($50.91/49 weekly higher base. Read more...

Author

FXStreet Team

FXStreet