Copper to continue rising to as high as $12,000 – OCBC

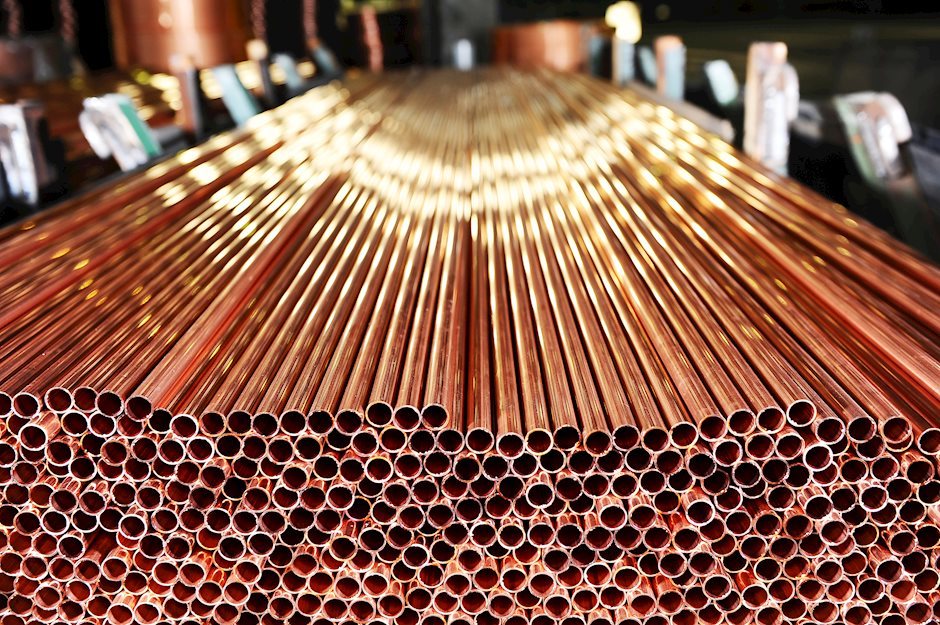

Copper and iron ore have both set new record highs in the past week. Strong demand from China, both from construction and ex-construction usage, is expected to continue driving copper and iron ore prices higher. Strategists at OCBC Bank see copper and iron ore testing $12,000/mt and $250/mt in the next 12-18 months.

See – Copper Price: New all-time highs and more to come – Commerzbank

Copper benefits more from China’s infrastructure plans than iron ore

“While we expect both copper and iron ore prices to continue rallying in the short to medium term, we expect the gains in copper to outpace that of iron ore. In addition to China’s relentless demand for infrastructure raw materials, copper has the added tailwind of the ongoing Green Revolution, particularly in the global push for electrification.”

“Since China’s new infrastructure plan heavily focuses on the further digitalisation and electrification of the economy, the demand for copper is expected to be more relevant than steel, especially in the later stages.”

“While we expect both copper and iron ore to continue rallying in the next 12-18 months, we expect copper to outperform other base and ferrous metals. Hence, while we expect another 20% upside for copper, the upside for iron ore is more limited at a further 10%.”

“We see copper topping $12,000/mt and iron ore at $250/mt within the next 12-18 months.”

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.