Churchill Capital Corp IV (CCIV) Stock Price and News: Rises as Lucid Motors merger remains elusive

- Churchill Capital Corp (CCIV) is a Special Purpose Acquisitions company (SPAC).

- SPAC companies are created with the sole purpose of purchasing an existing company.

- SPACs have two years to acquire a target or they have to return cash to shareholders.

Update February 12: Churchill Capital Corp IV (NASDAQ: CCIV) has kicked off Friday's trade with a surge of 8% to around $34. While the blank-check company's levels are below the highs seen in premarket trading, it seems that expectations will help it end a turbulent week higher. Investors continue speculating about the merger with Lucid Motors, which remains elusive. Will both sides use the long weekend to finalize a deal? There are no new reports to shed new light on the matter which is critical to the next moves in CCIV. Follow more stocks news here

Update: The post-market trading saw a major turnaround in the shares of Churchill Capital Corp IV (NYSE: CCIV), as the bulls fought back control and reversed the intraday drop of 4%. The CCIV shares rebounded as much as 13% after hours and closed in on the record highs of the $36 mark. The stocks are set to clinch fresh record highs as the valuation of the blank check company seemingly assumes a merger with Lucid Motors. Chatters that Lucid Motors’ flagship Lucid Air EV sedan could give a tough competition to Tesla’s Model S sedan also remain supportive of the bullish bias.

Update: As witnessed in pre-market trading, Churchill Capital Corp IV (NASDAQ: CCIV) has kicked off Thursday's session with a moderate decline, changing hands at just under $32, a slip of nearly 3%. Some of those that have ridden the shares in anticipation of the Lucid Motors SPAC merger have been taking profits. Will a hookup be announced on "Merger Monday?" That remains an open question that is pitting bulls against bears. It is essential to note that despite the decline, CCIV shares are holding onto a substantial portion of their gains, trading closer to the all-time highs of $36 than the 52-week low of $9.60.

Update: CCIV is trading at around $32 on Thursday's premarket session, a decline of an additional 2.6% compared with Wednesday's closing price. With every day that passes without an announcement of a merger with Lucid Motors – or at the very least credible news reports of the matter – additional doubters sell-off. Will this downtrend continue? Bloomberg and the Los Angeles Times were among the outlets discussing the Churchill-Lucid SPAC merger, so traders would be wise to follow their publications. Rival EV maker Rivian is to look for an IPO later this year with a potential $50 billion valuation according to Bloomberg.

Update: Churchill Capital Corp IV (CCIV) shares came under heavy selling pressure into the daily closing on Wednesday, having faced rejection at $34.50. The stock shed about 1.50% aftermarkets, settling just under $32.50. Industry experts believe that speculative interest is likely to keep the CCIV shares supported amid prospects of the merger with Lucid Motors, although there is no clarity about the same. The all-time-highs of $36 remains in sight so long as the bulls manage to hold above the key $30 support.

Update: Churchill Capital Corp IV (CCIV) shares dropped to $30 area for the third straight day on Wednesday and staged a rebound, suggesting that buyers continue to defend this level. At the time of press, CCIV was trading at $31.72, losing 4.75% and 8.7% and on a daily and weekly basis, respectively. Considering the fact that the stock is still up nearly 40% in February, it's fair to assess the recent pullback as a technical correction as investors await clarity on the highly-anticipated merger with Lucid Motors. Moreover, the stock remains within a touching distance of the all-time high it set at $36 on February 5.

Churchill Capital Corp IV (CCIV) is as the name suggests the fourth incarnation of Churchill Capital. Churchill was set up by Michael Klein, an ex-Citigroup financier once rumoured to be the next Citi CEO.

CCIV Stock Forecast and News

Special-purpose acquisition companies (SPACs) such as CCIV have been back in demand of late due to the amount of cash washing through the equity market looking for deals. In a zero or negative rate environment, SPACs offer better returns with potential upside from reinvigorating a sluggish company or funding further growth opportunities for younger, developing companies.

In 2019 SPACs raised over $13 billion in capital, while in 2016 the comparable figure was just $3 billion. Virgin Galactic (SPCE) was funded by a SPAC stake before launching its IPO. SPAC’s generally IPO at $10 and must keep this IPO cash raised ($10 times the number of shares issued) in a trust. If after two years the SPAC has not acquired a business, it must return the initial investment to shareholders. This is why most SPACs trade slightly above $10 before any deal has been rumoured or initiated.

It is worth mentioning again that SPACs have no underlying business, revenue stream, EPS etc. A SPAC is set up purely to raise cash to fund an acquisition. The SPAC share price will be determined by the perceived skill and experience of the underlying SPAC founders, the sector and/or company the SPAC will target.

In the case of the Churchill (NYSE:CCIV) SPAC, the experience of Michael Klein is a strong case for shareholders to back. Not only was he rumoured at one time to replace Sandy Weill as Citigroup CEO, Klein also advised Dow Chemical when it merged with Dupont in a $130 billion deal. Klein's advisory firm counts former US Treasury Secretary Larry Summers as a consultant employee. Klein has also worked with the Dubai government on restructuring for Dubai World. Michael Klein’s investment firm has advised Saudi Arabia’s sovereign wealth fund on its global strategy and investments. Connections in the Middle East could prove useful as we shall see.

CCIV Stock price history

So far so easy, our SPAC, CCIV, has raised its capital, has a strong lead founder and is ready to go! Back on January 11, shares in Churchill finally spiked from $10, spiking nearly 40% at one stage. Lucid Motors was to be Churchill’s target, according to a report from Bloomberg.

Lucid motors merger news

So who are Lucid Motors? Lucid Motors is the Tesla killer! Well except it is going after an even higher price point. Lucid Motors is an electric vehicle (EV) manufacturer with plans to launch its first EV in summer 2021. The entry price will be $169,000! Lucid plans cheaper (not their word, mine!) more affordable versions after it launches its premium offering.

Lucid has just made public via Twitter that European deliveries will be in late 2021.

Lucid Motors CEO Peter Rawlinson was chief engineer at Tesla (TSLA) on the Model S, so he knows his product and market well.

Lucid Motors is also in talks with Saudi Arabia to build a new factory in the Kingdom according to the Financial Times. Given the Saudi sovereign funds backing of Lucid, this should be a straightforward discussion.

Now here is where it gets interesting.

Lucid Motors is backed by the Saudi sovereign wealth fund and as we have seen Churchill Capital (CCIV) founder Michael Klein has multiple high-level contacts in Saudi, having advised the Saudi fund already. A marriage of convenience! It should be noted that Klein’s investment firm advised the Saudi sovereign fund back in 2017 and there is no evidence that he is still an advisor. But one has to imagine that Lucid Motors' main investor will be happy to see Michael Klein and his Churchill Capital IV (CCIV) as the main suitor. A face they know well and trust.

Further serendipitous connections can be found, Lucid Motors Chairman Andrew Liveris is a former CEO of Dow Chemical and worked with Michael Klein during the aforementioned DuPont transaction.

Churchill Capital Stock charged up

January was a highly unusual and speculative month for the stock market as the /wallstreetbets phenomenon played out. Companies were pushed hugely away from their valuations as retail mania took over.

Shares in CCIV became caught up in the ride as the company trended on /wallstreetbets. As explained, $10 is essentially breakeven for most SPACs and this is the case for CCIV.

January 11 saw a Bloomberg report on the potential merger between CCIV and Lucid for the first time. Shares in CCIV jumped from $10 to $14. Ok, probably justified!

January 26: The Governor of the Saudi Wealth Fund appears on CNBC saying it is time for Lucid Motors to take the next step. No further elaboration but investors move the stock up to $24!

February 2: Jim Cramer of CNBC tweets "we have liked and spoken many times on CCIV because we like Lucid". Shares in CCIV break $35!

February 3: Finally a bear! The Wall Street Journal reports that a deal between CCIV and Lucid “isn’t imminent”. Shares in CCIV retreat below $30.

February 5: Lucid Motors CEO Peter Rawlinson appears on CNBC, saying he can “neither confirm nor deny” talks between the parties. Investors take this as a positive and push the stock back up to $36.

Shares have since retreated slightly to sit at $32 at the time of writing.

Should I Buy shares in CCIV now?

Electric Vehicle manufactures are in play and SPACs have been snapping them up. Hyzon Motors announced a merger with Decarbonization Plus (DCRB) SPAC on Tuesday and last year Nikola (NKLA) merged with VectoIQ SPAC. It should be noted that while share prices in both cases rallied strongly, none came close to matching the near 300% gain that CCIV shares have already returned!

A CCIV share price of over $30 values Lucid Motors at somewhere in the $30-40 billion range, so investors must decide if a start-up electric vehicle manufacturer, that has yet to produce a vehicle, justifies such a valuation. Most would say no but then just look at Tesla. A bigger market cap than any other auto manufacturer in the world despite producing a fraction of sales units. Also, such a high price and such speculation may have pushed the price of CCIV too high to make the Lucid merger happen. Although the news on Feb 10 that another EV maker, Amazon backed Rivian, is to seek an IPO this year with a $50 billion valuation shows that maybe the price is right?

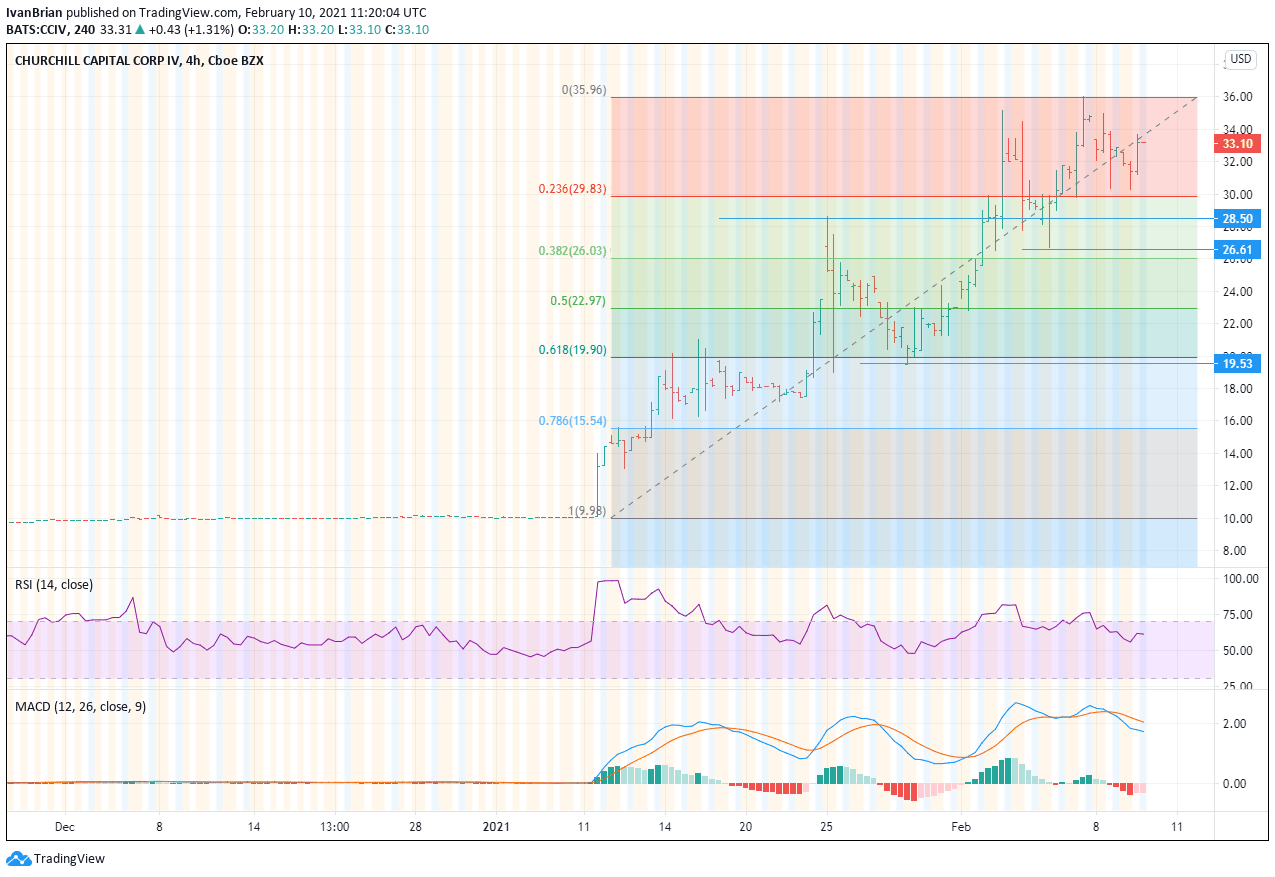

CCIV Technical analysis

As a newly launched vehicle and so-called “black cheque stock” there is not a lot of history for CCIV share price. However, clearly, we have a strong bullish trend in place.

Churchill Capital IV (CCIV) has $10 in cash if nothing comes of any potential merger. So this is the downside. Prices are highly elevated right now but so are all prices in the EV sector (see Amazon and Rivian'ss $50 billion valuation) and Lucid is seen as a high growth stock. A preferred entry point would be at support at $19.53 giving a more reasonable valuation for Lucid Motors but that may be too low now so support at $26.61 is key to the bullish trend.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.