Churchill Capital Corp IV (CCIV) Stock Price and News: Shares drop again on elusive SPAC merger

- NYSE: CCIV shares continue higher, up 16% on Friday.

- Lucid Motors CEO Peter Rawlinson spoke earlier on CNBC.

- Investors looking for news of a merger between CCIV and Lucid.

Update February 9: CCIV shares have been trending lower on Tuesday, slipping below $31 – a drop of around 6% at the time of writing. The Special Purpose Acquisition Company (SPAC) is still expected to merge with Lucid Motors, the luxury electric vehicle maker founded Tesla alumni. However, that has yet to materialize. Some investors probably prefer to "buy the rumor, sell the fact" even before anything happens, or in fear that the deal does not come through. Nevertheless, it is essential to note that Churchill Capital Corp IV is already worth more than double its price early in the year.

Update: February 8: Churchill Capital Corp IV (NYSE: CCIV) has been edging lower at the beginning of a new trading week, moving down below $34, but holding most of its gains. Is there a buy opportunity on shares of the blank check company? While the merger with Lucid Motors remains elusive, it remains on the cards. President Joe Biden is set to pass a large stimulus plan supporting the economy. If it includes any provisions for green technologies – or opens the door to such initiatives – electric vehicle firms could benefit.

Update 2 Friday, February 5: Shares in CCIV continued to rally as Friday progressed. CCIV shares are trading above $35 at the time of writing, a gain of 16% for the day. Volume remains high in CCIV. Investors hoped that the rumoured merger between Lucid Motors and CCIV may be back on the cards.

Update Friday, February 5: CCIV powered higher in early trading on Friday as investors pondered over the rumoured Lucid Motors merger. Lucid CEO Peter Rawlinson speaking to CNBC says he "cannot confirm nor deny" if the merger is going ahead. Investors took that as a positive after the Wall Street Journal had reported on Wednesday that the merger "isn't imminent". CCIV shares are up 8% at the time of writing at $32.75.

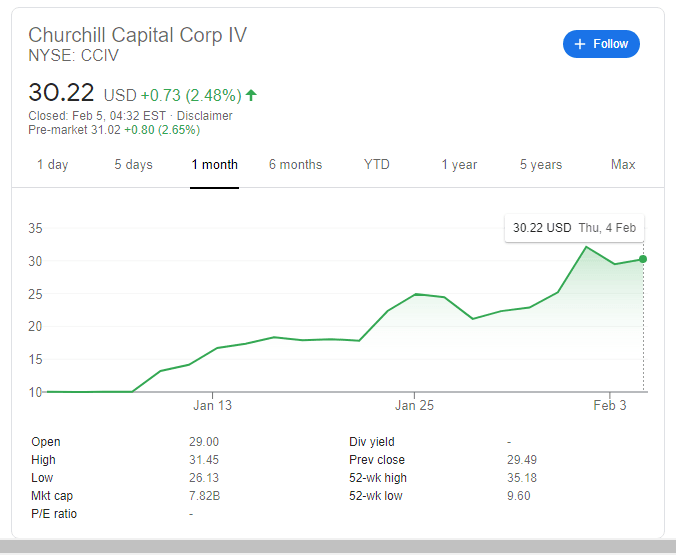

Update: Churchill Capital Corp IV (NYSE: CCIV) has been changing hands at around $31 early on Friday, indicating another gain of 2.58% on the last day of a bullish week. That would follow up on Friday's increase of 2.48% that allowed shares of the blank-check company to top $30. Investors are still awaiting news about a potential SPAC merger with Lucid Motors. Some are awaiting news to come out early next week, perhaps on "Merger Monday" as some Wall Street insiders call such events. At current levels, CCIV shares are worth more than triple their value early in 2021.More: Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Update February 4, GMT 19:30: While investors await an announcement on an illusive merger deal, CCIV bulls had taken the price to fresh highs on Wall Street.

The price was recovering to a 61.8% Fibonacci retracement of the prior day's sell-off from $34.50 to today's low of $26.13.

Trading at $29.79 at the time of writing, the stock is over 1% higher having found demand in the vicinity of the 25th Jan highs.

Meanwhile, for the day traders, the price is now breaking a key support in the 15 min chart, below $30, testing $29.40 support with eyes on a break to $28.76 structure which meets a 61.8% Fibonacci confluence of the latest bullish impulse.

Update February 4: Shares in CCIV continue to suffer in early trade on Thursday. Shares are currently trading at $27.87 down nearly 6%. CCIV investors were left disappointed on Wednesday as the Wall Street Journal had dashed hopes of a quick merger with Lucid Motors.

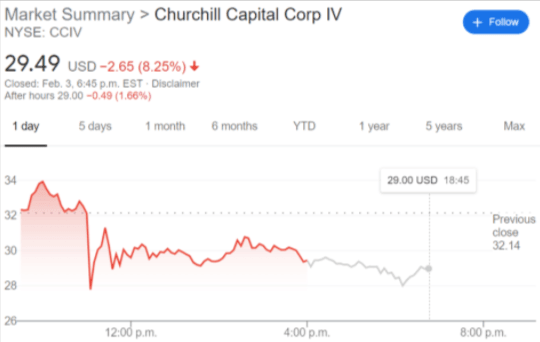

NYSE:CCIV has finally slowed down after being one of the most popular SPAC targets for investors looking to get in on the ground floor of the up and coming Lucid Motors. That momentum came to a screeching halt on Wednesday as the stock dropped by 8.25% to close the trading session at $29.49. Shares made a slight recovery near the closing bell after dropping to $27.58 before some investors jumped in at the discounted price.

The catalyst for the drop in price was a Wall Street Journal report that the highly anticipated merger between Churchill Capital and upstart electric vehicle maker Lucid Motors is not at all imminent. Investors have been piling into the SPAC stock since early January, where the initial rumors of a merger with Lucid were reported. Lucid is widely viewed as a luxury electric vehicle brand that has a chance to disrupt industry leader Tesla’s (NASDAQ:TSLA) stranglehold on the market. With a manufacturing plant in Arizona nearly ready to start production of its Lucid Air sedan, many investors believed that CCIV would be a chance to get the next parabolic electric vehicle stock at a discount.

CCIV stock forecast

But is CCIV trading at a discount? It is currently one of the highest price SPAC stocks on the market – higher even than Chamath Palihapitiya’s IPOD, IPOE, and IPOF companies. The proposed Lucid merger has already been baked into the high price, so investors who want to get in may want to wait, as the stock should continue to decline the longer it goes without an announcement for a merger.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet