Canadian Dollar plunged this week, with investors paring back Fed easing expectations

- Canadian Dollar dives further with the USD rallying across the board.

- The CAD has depreciated about 1.23% this week, on its worst weekly performance in almost a year.

- USD/CAD is on a steady bullish trend, focusing on 1.3770 and 1.3845

The Canadian Dollar (CAD) is selling off for the third day in a row on Friday, on track to post its worst weekly performance in almost a year. The US Dollar is marching higher, fueled by higher US yields, as the market reassesses the timing and the size of the US Federal Reserve’s (Fed) easing cycle.

The Michigan Consumer Sentiment Index deteriorated beyond expectations, although the Consumer Inflation Expectations have ticked up. These data have failed to weigh on the US Dollar, which has received additional support from the European Central Bank’s (ECB) dovish monetary policy statement.

Somewhat earlier, on Friday, Boston Fed President Susan Collins anticipated a delay on the monetary easing kick-off, hinting at September, and pointed to just two cuts in 2024.

Daily digest market movers: USD/CAD remains firm with investors reassessing Fed easing expectations

- Canadian Dollar keeps heading south and is on track to a 1.25% sell-off this week, its worst weekly performance since May 2023.

- US Michigan Consumer Sentiment Index declined to 77.9 in April from 79.4 in March. The market had anticipated a 79.0 reading.

- University of Michigan Consumer 5-year Inflation Expectations have ticked up to 3% from 2.8% in April.

- US 10-year yields have pulled back from highs, although they remain above the key 4.5% level, their highest levels since last November.

- Investors have trimmed their Fed easing expectations to 60 basis points in 2024 from the 150 basis points foreseen in January. The first rate cut is expected only in September. This is acting as a tailwind for the US Dollar.

- Chicago Fed President Austan Goldsbee affirms that the bank might have more to do to tame inflation and that the trade-off between prices and employment will be heightened in 2024.

- Later today Fed’s Bostic, and Daly, all in the hawkish side of the committee are meeting the press. They might provide further support for the USD.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.73% | 0.76% | 0.58% | 1.13% | -0.04% | 0.99% | 0.31% | |

| EUR | -0.74% | 0.03% | -0.16% | 0.40% | -0.78% | 0.24% | -0.42% | |

| GBP | -0.76% | -0.03% | -0.19% | 0.36% | -0.80% | 0.21% | -0.45% | |

| CAD | -0.58% | 0.16% | 0.21% | 0.56% | -0.62% | 0.41% | -0.26% | |

| AUD | -1.15% | -0.41% | -0.38% | -0.56% | -1.18% | -0.15% | -0.83% | |

| JPY | 0.04% | 0.77% | 0.79% | 0.61% | 1.16% | 1.02% | 0.35% | |

| NZD | -0.99% | -0.23% | -0.22% | -0.41% | 0.16% | -1.02% | -0.67% | |

| CHF | -0.31% | 0.43% | 0.45% | 0.26% | 0.82% | -0.35% | 0.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

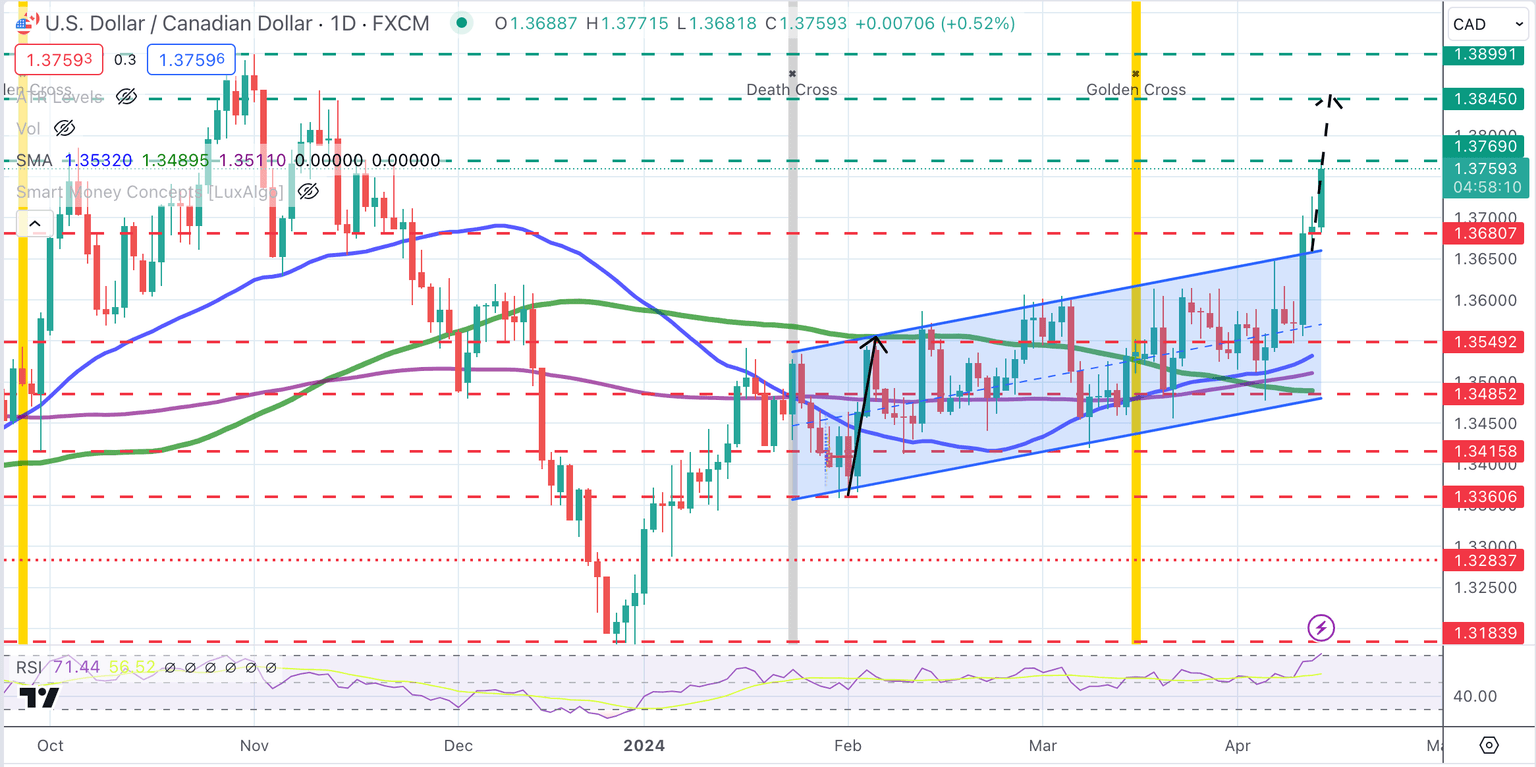

Technical analysis: USD/CAD keeps marching higher, with 1.3770 and 1.3845 in the bulls’ focus

The US Dollar is under a strong bullish momentum after confirming above the last two months’ channel top with no sight of a trend shift.

The reverse trendline has provided support, triggering another bull run to the 1.3770 resistance area, which has been tested on Friday. The USD/CAD pair is at overbought levels but not at extremes, with the measured target of the broken channel at the mid-November high of 1.3845. On the downside, supports are 1.3680-1.3660 and below here, at 1.3545.

USD/CAD Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.