Breaking: FOMC minutes showed a few participants favored raising rates by 50 basis points

The first FOMC Minutes of 2023 has been released with investors searching for further insights into the near-term path for policy and any comments regarding the possibility of the Federal Reserve going back to 50 bps hikes.

Key notes from FOMC minutes

A few participants favoured raising rates by 50 basis points.

All participants agreed more rate hikes needed to achieve Federal Open Market Committee's job, inflation objectives.

Participants said restrictive monetary policy needed until Fed confident inflation falling to 2%; added that process likely to take 'some time'.

All participants favored further fed balance sheet reductions under current plan.

Participants said uncertainty associated with outlooks for economy, job market and inflation was 'high'.

Participants saw upside risks for inflation, including china's economic reopening and Russia's war in Ukraine.

Participants said risks to economic outlook weighted to downside.

A number of participants said drawn-out US debt limit process could pose 'significant risks' to the financial system, economy.

Participants said job market 'very tight,' labor demand outstripping available supply.

Participants said continued tight job market would contribute upward pressure to inflation.

Participants said inflation in last three months has eased, but they need to see more progress.

Some participants saw elevated prospect of recession in 2023.

US Dollar and Treasury Yields update

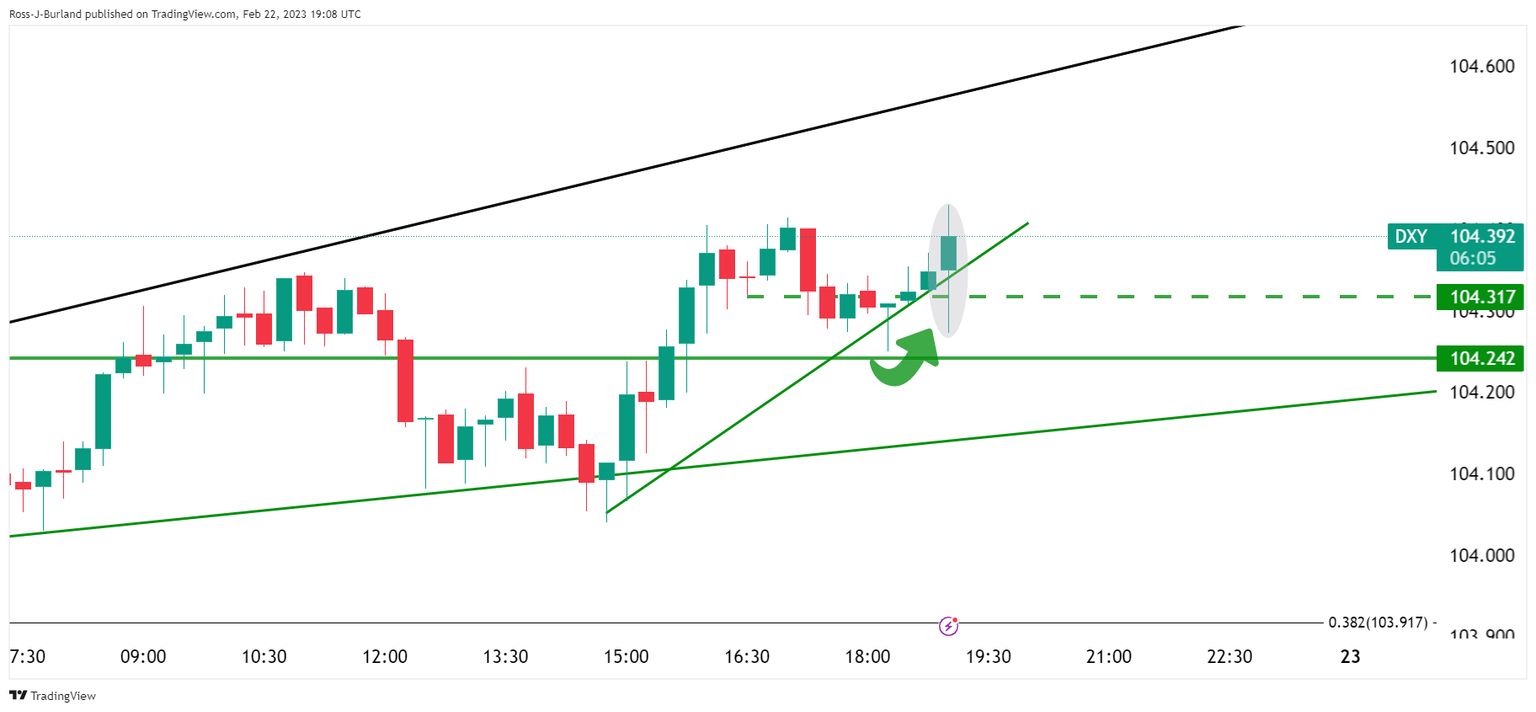

The US Dollar ran higher from a new low at 104.25 in the NY session in anticipation of a hawkish outcome ad sat at 104.35 moments ahead of the release.

DXY is moving up to fresh highs on the prospects of a 50bp rate hike next time around. However, the price action is volatile and bears are fading bullish attempts within the first 15 min candle:

US Treasury yields have seen the 10-year stay in familiar territories at 3.929% the post FOMC high.

About the FOMC minutes

FOMC stands for The Federal Open Market Committee which organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Author

FXStreet Team

FXStreet