Breaking: Australian Q2 GDP beats estimates, lifts AUD towards highs

Australian second quarter Gross Domestic Product has been released as follows.

It was set for a modest gain, so it comes as no surprise but beating estimates are positive for the Aussie:

Australian GDP SA (QoQ) Q2: 0.7% (exp 0.4%; prev 1.8%) - GDP (YoY) Q2: 9.6% (exp 9.1%; prev 1.1%)

There was more than the usual level of uncertainty around these estimates, with conflicting signals from the partial data released over the last week.

However, the economy is set to see Delta lockdown-led contraction in Q3 so the data is less significant this time around.

Nevertheless, it is passive for the Aussie as the nation avoids a double-dip recession.

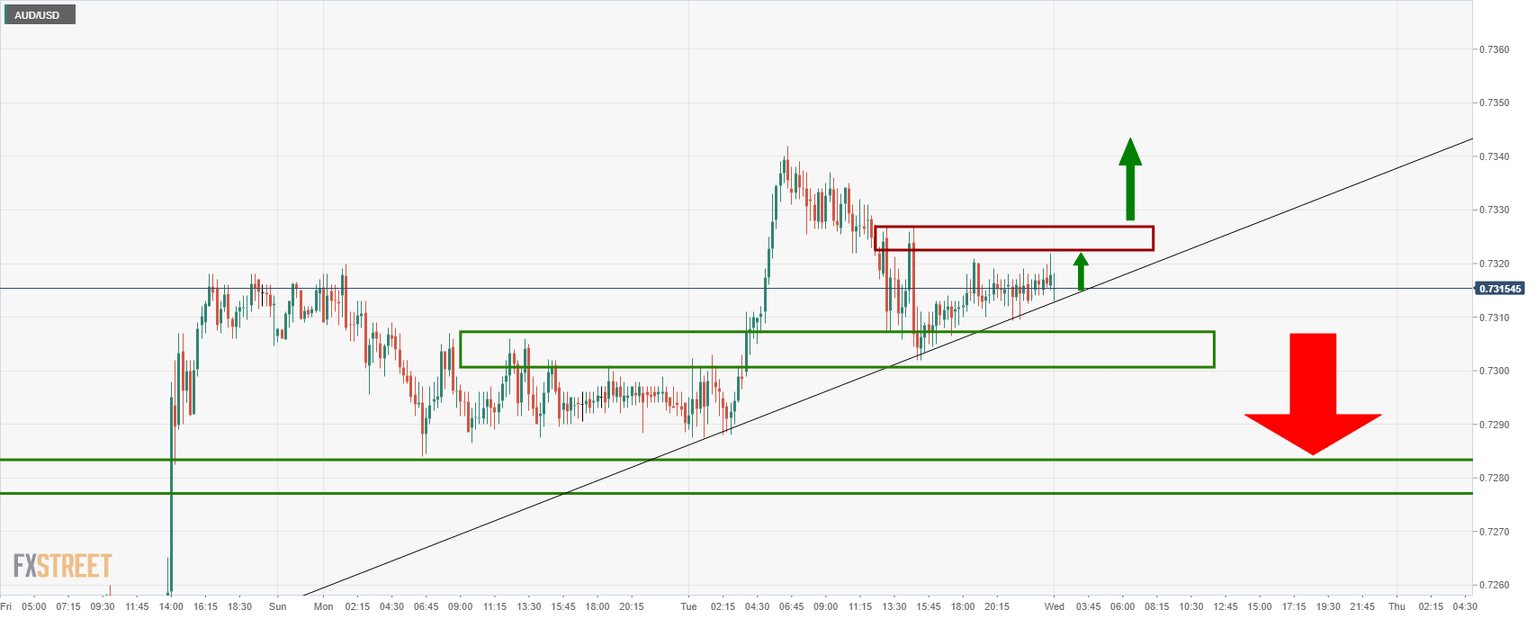

The daily technical setup shows more room for the upside for AUD/USD.

AUD/USD has risen around 10 pips on the data to 0.7318 so far.

The price is supported from the dynamic support and the bulls eye a break of horizontal resistance as illustrated above.

About the GDP

The Gross Domestic Product released by the Australian Bureau of Statistics is a measure of the total value of all goods and services produced by Australia.

The GDP is considered as a broad measure of the economic activity and health. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative (or bearish) for the AUD.

Author

FXStreet Team

FXStreet