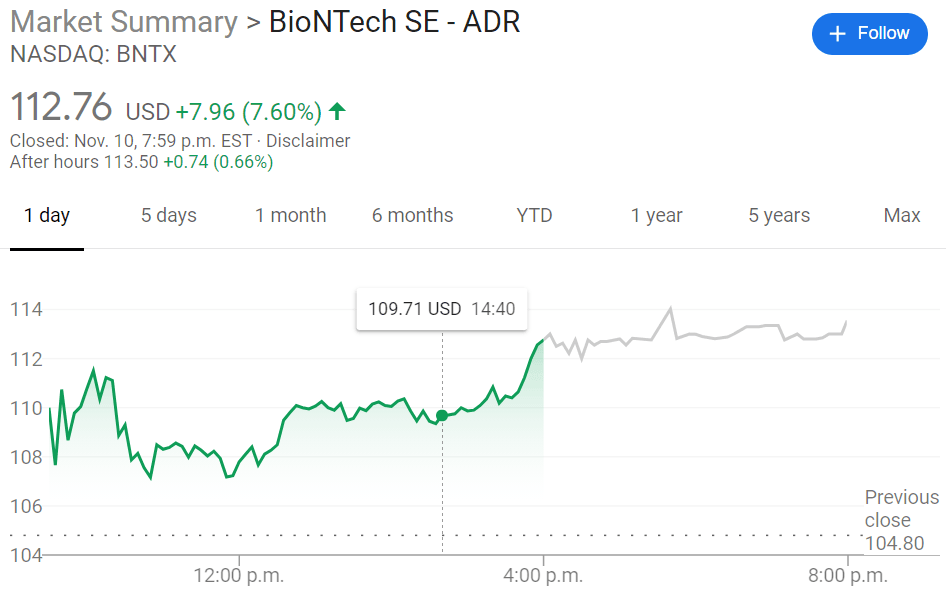

BNTX Stock Price and Quote: BioNTech SE extends surge from its COVID-19 vaccine results

- NASDAQ:BNTX continues its surge as it gains 7.60% on Tuesday.

- BioNTech and Pfizer announced a 90% efficacy for their COVID-19 vaccine candidate trials.

- With up to 1.3 billion doses being produced for 2021, BNTX is a long-term pay in the biotech field.

NASDAQ:BNTX did well to partner with American pharmaceutical giant Pfizer (NYSE:PFE) as the two firms have produced one of the most historic vaccines of our lifetime. BioNTech’s stock continued its gains on Tuesday, adding a further 7.60% as investors piled into the German company, a day after its game-changing announcement. Shares of BNTX are now up nearly 500% for the year and investors who took a chance on the little known biotech company back in March when the partnership with Pfizer was first announced are celebrating the successes of the vaccine candidate BNT162b2.

It seems like great timing as the global financial markets were already rallying around the likelihood of a Joe Biden administration in the White House, when the Pfizer and BioNTech announcement sent the markets through the roof. Democratic president-elect Biden himself has supported the wearing of masks and pledged that the first thing he will do when taking the office is to tackle the coronavirus pandemic in America. Having 1.3 billion doses of BNT162b2 ready for distribution in 2021 will definitely help with that.

BNTX Stock Forecast

While having an FDA approved vaccine on the horizon has provided investors and the world with optimism, the world is still months away from having widespread access. BioNTech also has a series of oncology treatments, with twelve different candidates currently at some stage of clinical testing. Despite all of these, BioNTech reported a nice jump in third quarter revenues that are clearly connected to its work with Pfizer, and this could spike even more next quarter, as the companies announced they would be seeking FDA approvals as early as next week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet