- Blink Charging Company shares trade 4.72% lower on Friday.

- The price is now in a consolidation mode and the next resistance is at USD 13 per share.

BLNK Stock

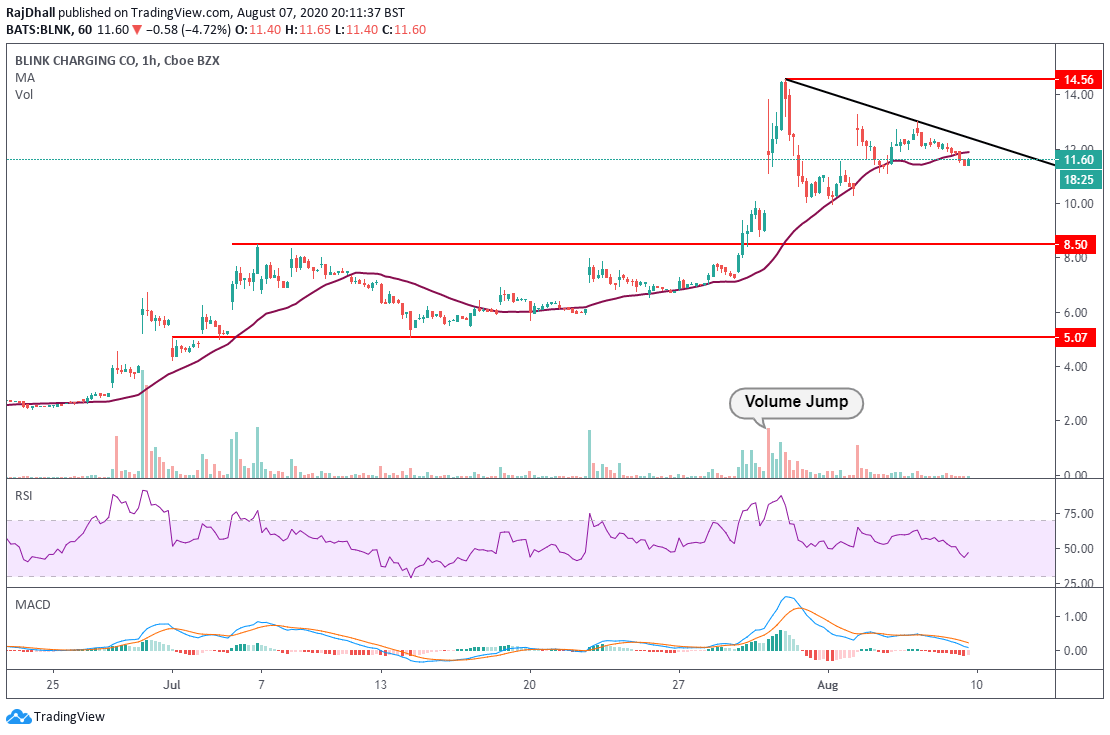

Blink Charging Company (NASDAQ:BLNK) shares are struggling at the end of the week. After the companies great run of late rising 361% since 25th June and now it seems the bulls have stalled. The firm has been winning contracts all over the US and also received a grant to deploy 200 Blink Fast Level 2 charging stations across the mid-Atlantic region, including Virginia, Maryland, West Virginia, and Washington D.C.

Looking closer at the chart, the price has now stalled into a consolidation pattern between USD 14.56 and USD 10 per share. The top of the pattern is marked by the black downward sloping trendline. If this level breaks then the bulls could look to target the high of USD 14.56 per share and maybe keep the trend going. On the bearish side, the price has now broken below the 55 Exponential Moving Average. This is not the end of the world as the price has done this before and moved back higher but it is not a bullish sign.

If USD 10 per share breaks then it could be safe to assume the market is moving lower. There is another resistance zone underneath that at 8.50 and this could be considered the main support on the chart. The indicators are looking mixed. The Relative Strength Index is above the 50 area but only just. The MACD histogram is red but more importantly, the signal lines are hanging on above the zero line. All in all, the price is still in an uptrend but next week it would be important to see if the psychological USD 10 per share level holds if it does it could be a positive step for the company.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.