- BioHiTech Global Inc. benefits from its AP-4 Disinfection Tech.

- Upbeat earnings projections are raising interest in NASDAQ: BHTG

- The appointment of Nicholaus Rohleder to its board also provides a boost.

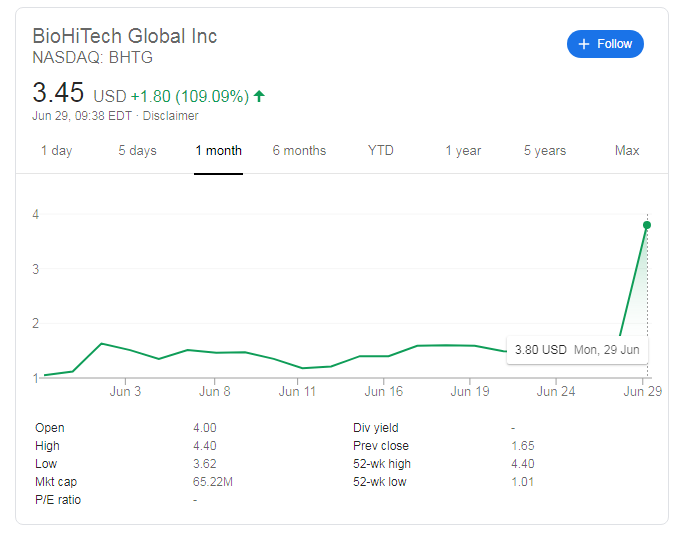

BioHiTech Global Inc (NASDAQ: BHTG) is surging toward $4, up over 100% in volatile trading. Investors have a healthy appetite for the Chestnut Ridge, New York-based firm.

Why BHTG, a waste-management company, rising? Here are three reasons:

1) Disinfection tech: BIoHiTech has collaborated with Altapure to offer the AP-4 disinfectant which kills any virus both in the air and on a surface by using vapor and its aerosol system. Can it outperform its competitors? Frank E. Celli, BHTG's CEO, seems optimistic about the new venture. Demand for disinfectants has soared amid the coronavirus crisis.

Materials that allow safe usage of touchable objects – and cleaning the air in closed spaces that may be exposed to COVID-19 – are in growing demand. The current second wave of coronavirus in the US Sun Belt could raise demand for the BIoHiTech's products.

2) Upbeat earnings expectations: Steve Mayer, writing for NewsDaemon – and republished on Yahoo Finance – said that NASDAQ: BHTG is "ticking every box for top investors." The prediction of an Earnings Per Share ratio of -0.13 is relatively upbeat in comparison to the BioHiTech's past. Mayer notes that the firm as only 39 employees. A low earnings-per-worker ratio may help the company's bottom line.

3) Top appointment: BioHiTech announced that Nicholaus Rohleder, previously of New American Energy, to its board of directors. The new independent member provides clout to the company. He has been quoted by several reputable publications such as Forbes, Hedge Fund Monthly, and Energy Trend. That may help the firm gain ground.

BHTG stock price

At the time of writing, NASDAQ: BHTG is trading around $3.50, up some 112%. Similar to its price action on Friday, the volume is elevated and shares are exchanging hands at a rapid pace. Can it continue higher?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.