AUD/USD rallies despite a firm US Dollar, on risk-on mood and falling US yields

- AUD/USD is up 0.51%, benefiting from the overall weakness of US Dollar.

- Despite hawkish remarks from various Fed officials, the US Dollar remains subdued, with the DXY showing modest gains at 105.55.

- Solid PMIs in Australia and considerations of rate hikes by the RBA support the AUD.

- Key economic data scheduled for release next week, including Consumer Price Index and Retail Sales for Australia, and Consumer Confidence and Durable Goods Orders for the US.

The Australian Dollar (AUD) stages a comeback versus the Greenback (USD) on Friday, and it remains set to finish the week with decent gains. Overall US Dollar weakness, along with investors seeking risk, and dropping US Treasury bond yields, are the reasons behind the buck’s reaction. Hence, the AUD/USD is posting gains of 0.51%, trading at 0.6448 once the pair bounced off the 0.6403 low.

Aussie Dollar gains traction as business activity in the US takes a hit, US bond yields retreat

S&P Global revealed that business activity in the United States (US) remains subdued, failing to gather momentum, instead decelerating. Manufacturing PMI, despite improvement, remained below the 50 threshold that divides expansion from contraction, while the Services and Composite PMIs, clung to expansionary territory, despite printing lower readings compared to August.

Aside from this, Federal Reserve officials remained hawkish, led by Fed Governor Michell Bowman saying more rate hikes are needed, while Susan Collins called for patience. Recently, San Francisco Fed President Mary Daly noted that the gradual rebalancing of labor market data is good news, but more is needed to determine further policy tightening. She echoed Collins's words that “Patience is a good strategy.”

That said, the Greenback continues to print modest gains as shown by the US Dollar Index (DXY) at 105.55, gains 0.16%. Nevertheless, traders booking profits seem the reason behind the AUD/USD’s strength, alongside the recent economic data revealed on the Aussie’s side.

PMIs in Australia were solid, showing a slight improvement compared to August PPMIs, particularly the Composite one. The Index rose by 50.2, crushing estimates of 47, boosted by the jump in the Services segment, while manufacturing activity continued to deteriorate. That alongside the Reserve Bank of Australia’s (RBA) monetary policy minutes showed the central bank considered hiking rates in September, cushioned the AUD/USD pair's fall, past the current week’s low of 0.6385.

For the next week, tier 1 data would feature on the Australia side the Consumer Price Index (CPI) monthly, Retail Sales, and Housing Credit. On the US front, Consumer Confidence, Durable Goods Orders, Initial Jobless Claims, and the Fed’s preferred gauge for inflation, the core PCE.

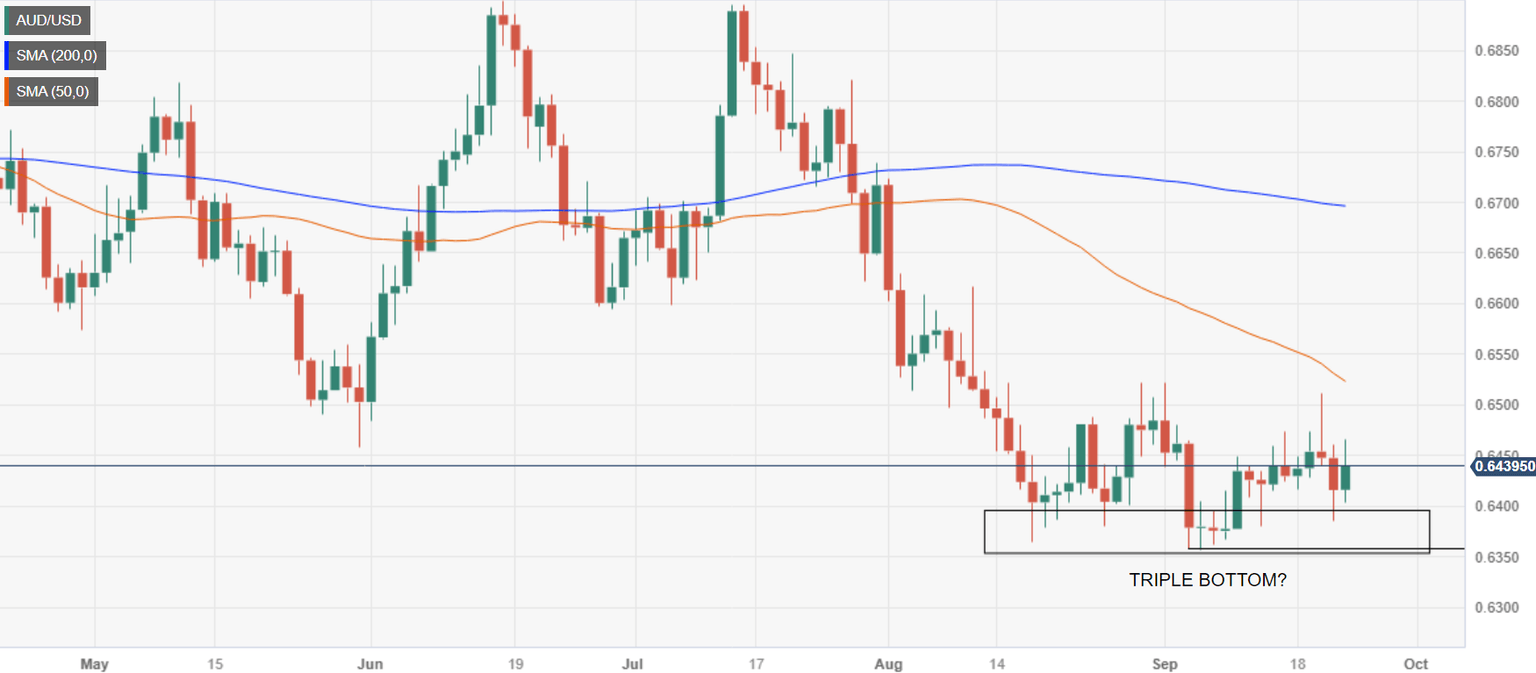

AUD/USD Price Analysis: Technical outlook

The AUD/USD remains consolidated at around the year's lows, unable to record a new cycle high, which could trigger a rally. However, a triple-bottom chart pattern is emerging, suggesting that further upside is expected. If the pair crosses the confluence of the 50-day moving average (DMA) and the latest swing high of August 30 at 0.6522, that could confirm its validity. The next resistance would be the 0.6600 figure, followed by the 200-DMA and the triple-top objective at 0.6695. Conversely, if price action remains subdued and drops below 0.6400, a re-test of the YTD low at 0.6357 is on the cards.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.