AUD/USD Price Analysis: Bears taking charge and testing critical support

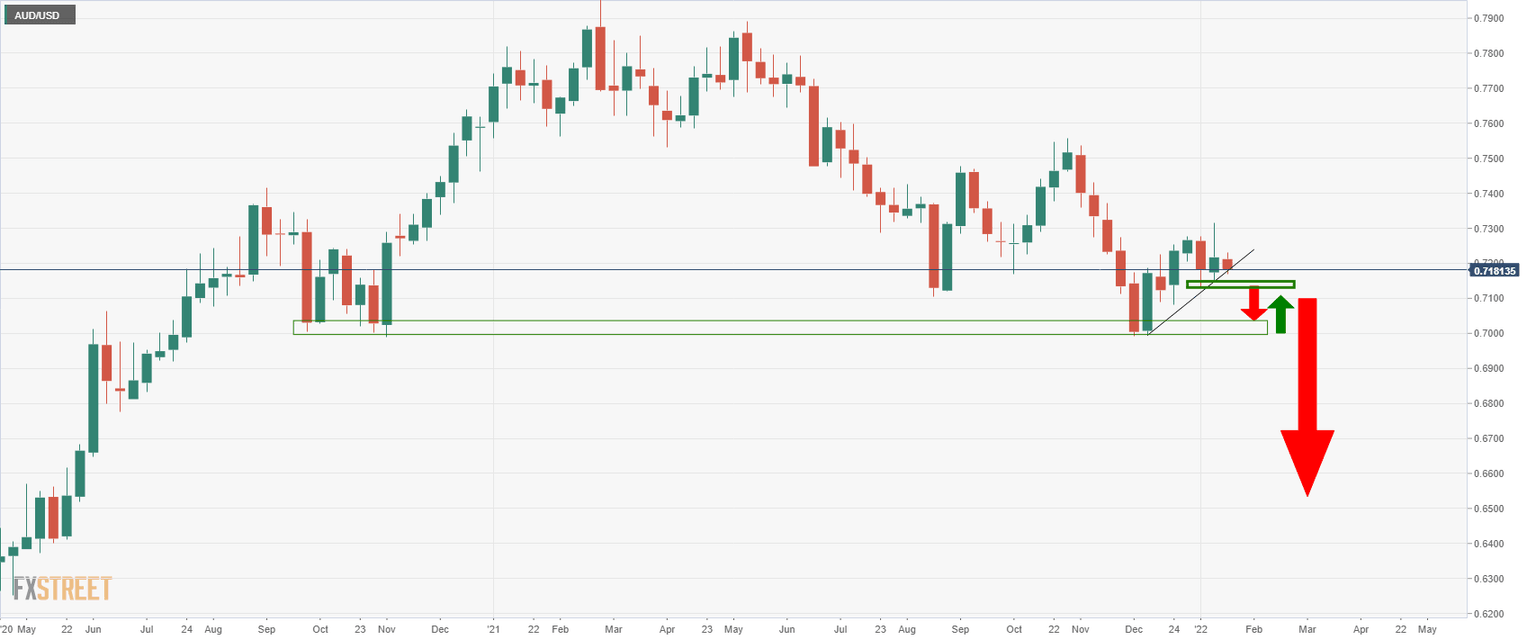

- AUD/USD is breaking into key support and the focus is on 0.7150.

- Bears will be looking for a significant breakout below trendline support.

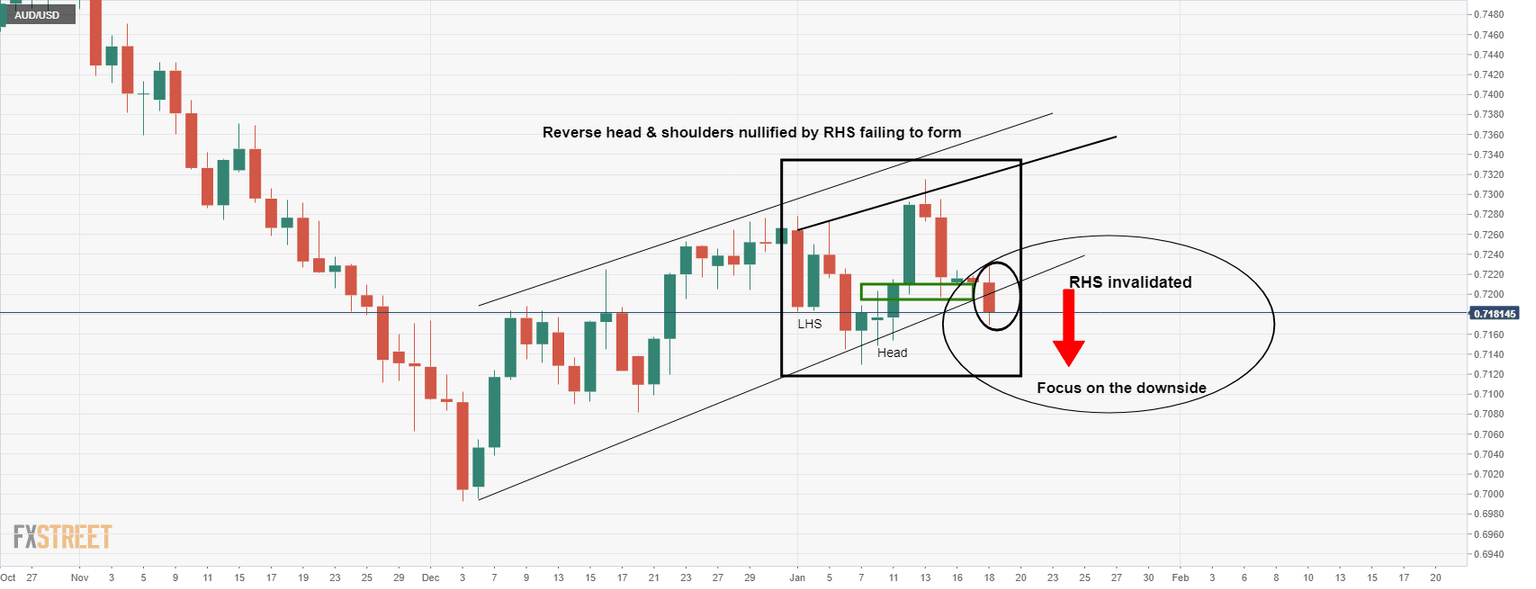

As per the prior analysis, AUD/USD Price Analysis: Consolidation in play, 0.7150 eyed while below 0.7230, daily support is key, the bears took over and now the bullish outlook based on the inverse head & shoulders is invalidated.

AUD/USD prior analysis

AUD/USD Price Analysis: Inverse H&S in the making from 0.7200 support

The above was an article that had identified the prospects of a bullish inverse head & shoulders taking shape on the daily chart.

AUD/USD was on the verge of either a break to the upside of a run below critical daily support, as follows:

However, due to the surge in US yields and the greenback following suit, the bears have taken over and broken a critical daily support structure.

AUD/USD inverse H&S invalidated

In turn, this has invalidated the bullish inverse head & shoulders pattern leaves 0.7150 exposed for the session ahead. 0.7150 could be the last stop before a significant sell-off below daily trendline support:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.