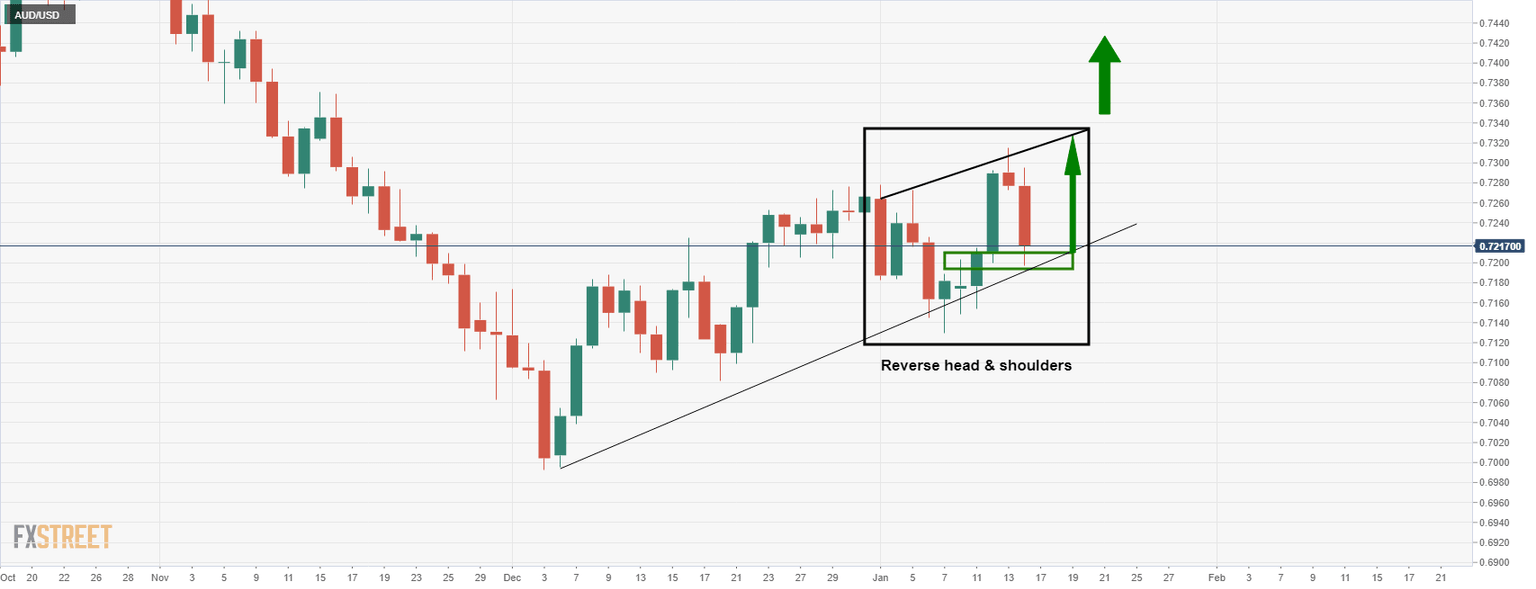

AUD/USD Price Analysis: Inverse H&S in the making from 0.7200 support

- AUD/USD bulls are guarding 0.7200 areas which could lead to a bullish surge.

- A break of trendline support opens risk to 0.7000 which guards 0.6920 and then 0.6780.

As per the analysis at the start of the week, AUD/USD Price Analysis: Bears pressure 0.72 the figure, eyes on key employment data, the price is stabilising near 0.7200. There has been a low of 0.7195 so far, but this area is expected to be a strong location of support.

If the bulls commit to here in a significant way, a thrust to the upside could come as a consequence and lead to prospects of a bullish continuation towards 0.7400 and beyond channel resistance:

The bulls have committed to around 0.7200 since the prior analysis (above) illustrated in the up to date price action chart as follows:

In doing so, there are prospects of a right-hand shoulder (RHS) being formed. Should this development play out, then the price would be expected to break out from the neckline resistance and move in to challenge the channel resistance thereafter. This could leave the 0.74 figure exposed for a test and the potential for a subsequent break thereof.

On the other hand, should the bears break this current area of support, the dynamic trendline support would be exposed and vulnerable. 0.7150 and 0.7130 recent lows would guard prospects of a weighty breakout to the downside:

0.7000 guards 0.6920 and then much lower towards 0.6780 thereafter.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.