AUD/USD Price Analysis: Bears step in after big volatility

- AUD/USD bulls start to move out ahead of CPI data today.

- Big moves in the forex space keep prospects of volatility alive.

Aussie Consumer Price Index is on the cards for the day ahead and the market structure is showing the data could make or break for the pair after a series of whipsaw in recent sessions.

The sentiment around the Federal Reserve monetary tightening and the policy direction of top trading partner China after President Xi Jinping have seen a lot of volatility in the price with the ATR picking up to over 100 pips for any given day.

if the data comes in hot, given that the Reserve Bank of Australia only delivered a smaller-than-expected 25 basis point rate hike earlier this month, then there could be [prospects of stronger action next time around that will only feed into the bullish AUD playbook.

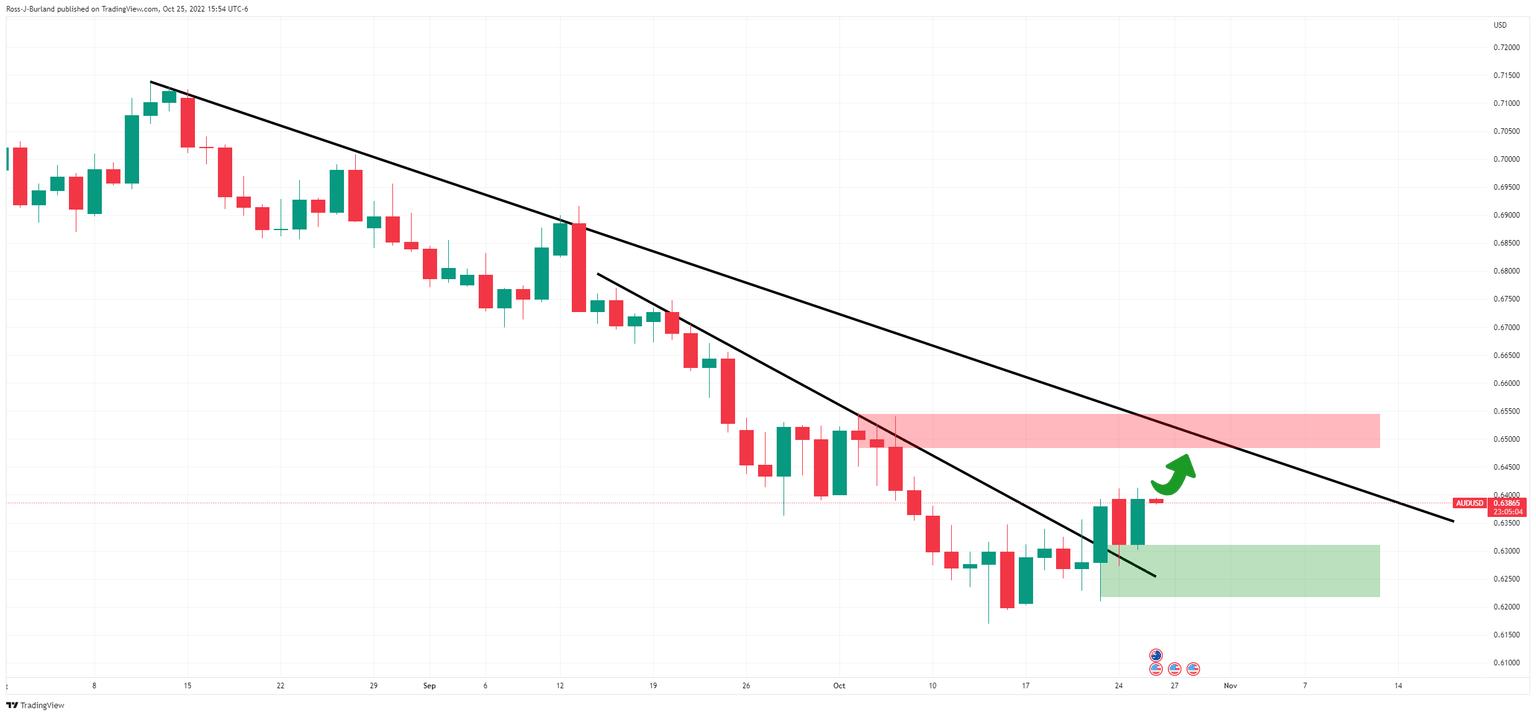

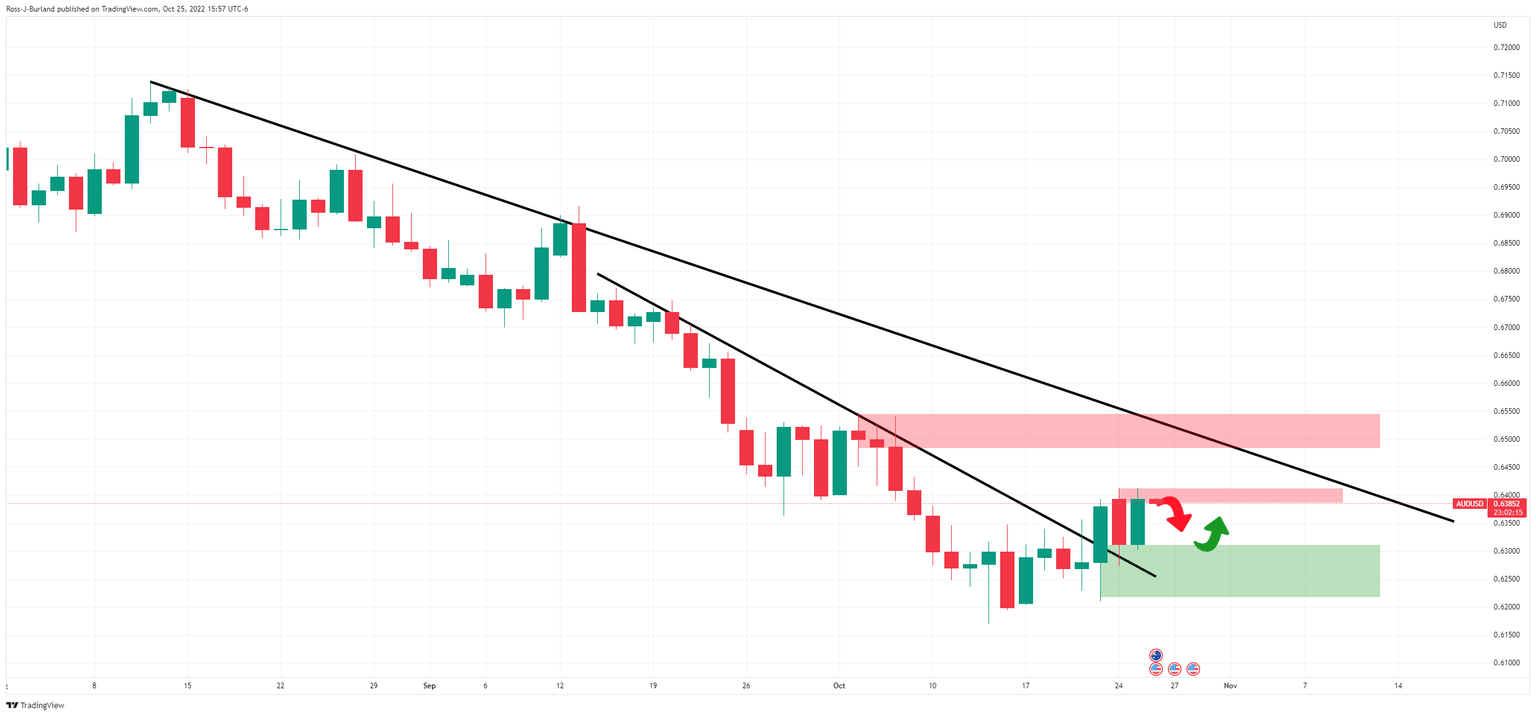

AUD/USD daily chart

The daily charts are neutral with both the upside and downside to play for at this juncture. However, the double top on the hourly chart shows the price under pressure:

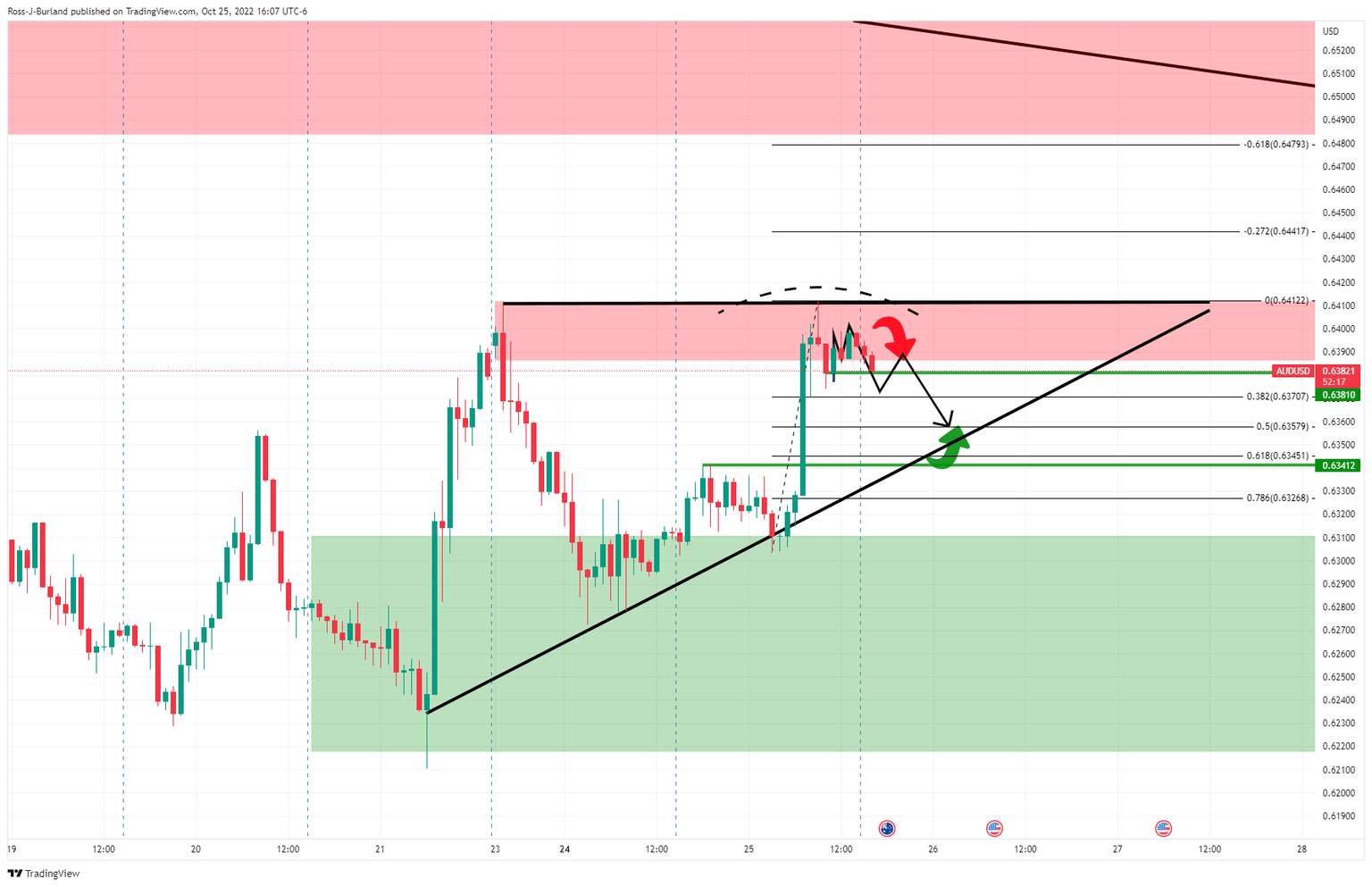

AUD/USD H1 chart

The price is coiling within a geometrical pattern and is forming an M-top with prospects of a move into mitigating the price imbalance of the hourly impulse towards trendline support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.