AUD/USD looking for a rebound from 0.6300

- The AUD/USD is struggling to find support as the US Dollar movers higher across the broader market.

- The Aussie is facing multiple bearish pressures as the RBA keeps rates unchanged as markets expected.

- The rest of the week still sees key data points for both the Aussie and the Greenback.

The AUD/USD is pinned into the 0.6300 level after the Reserve Bank of Australia (RBA) kept its benchmark rate at 4.1% early Tuesday. The RBA was broadly forecast to stand pat on interest rates for their fourth straight meeting as inflation expectations ease, though the RBA Governor Michele Bullock noted that inflation is likely to remain on the high side until sometime in 2025.

RBA keeps interest rate steady at 4.10% for fourth straight meeting

Diverging talking points from different officials from the US Federal Reserve (Fed) leaves rate cycle expectations hung in the middle. The Fed's Mester and Bostic both hit the newswires on Tuesday, leaving investors twisted around as Bostic cooled rate expectations going forward but Mester appearing notably hawkish.

Fed's Mester: Likely to favor hike at next meeting if current economic situation holds

Fed's Bostic: No urgency for the Fed to do anything more

The rest of the week sees plenty of data for both the Aussie (AUD) and the Greenback (USD); late Tuesday sees the Australian S&P Purchasing Managers Index (PMI) figures, followed by the US' own Services PMIs on Wednesday.

Thursday will see Australian Trade Balance figures early on, followed by US Challenger Job Cuts and Initial Jobless Claims, and market participants will be bristling ahead of Friday's US Non-Farm Payrolls (NFP).

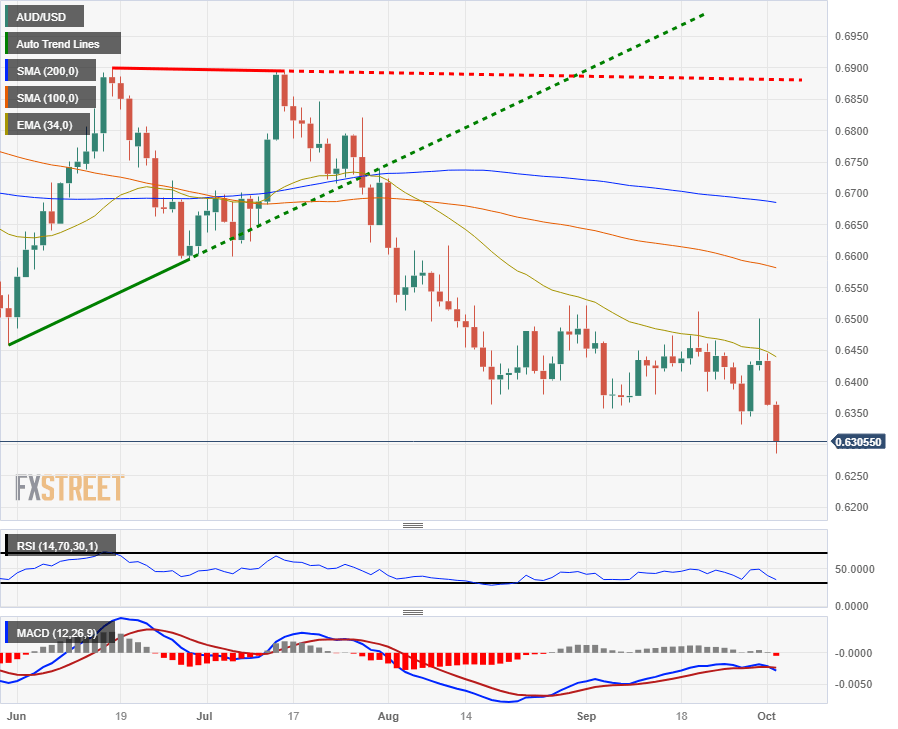

AUD/USD technical outlook

The AUD/USD extended declines for Tuesday, tumbling into the 0.6300 handle and is struggling to find bid support as broad-market risk appetite favors the US Dollar.

The pair is down over 3% from last week's swing high, falling over 210 pips over three trading days after getting rejected from the 0.6500 handle.

Intraday chart action is capped off by the 200-hour Simple Moving Average (SMA) currently building a resistance zone near 0.6400.

On the daily candlesticks, the AUD/USD has slipped out of recent consolidation, and is extending a downside move after seeing a clean rejection from the 34-day Exponential Moving Average (EMA).

The pair is now set for a challenge of 12-month lows below 0.6200 if bearish momentum continues unchallenged.

AUD/USD daily chart

AUD/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.