AUD/USD could get let off if the US dollar breaks near term market structure

- AUD/USD is finding solace in firmer stocks and in the weakness of the US dollar and prospects of lower levels in DXY to come.

- Analysts eye 102 for DXY near term, and this leaves AUD in limbo.

At 0.6896, AUD/USD is down some 0.4% on the day although the US dollar remains under pressure on Thursday as it looked set to extend declines against major peers to a fourth day. Nevertheless, the Aussie struggles across the board and vs the greenback, it has fallen from a high of 0.6927 to a low of 0.6869 so far as the Wall Street close approaches.

The greenback has been dented by Treasury yields wallowing near two-week lows amid rising concerns of a recession following two days of testimony from the Federal Reserves Chairman, Jerome Powell.

Powell said in testimony to Congress on Wednesday that the central bank is fully committed to bringing prices under control even if doing so risks an economic downturn. He said a recession was "certainly a possibility," reflecting fears in financial markets that the Fed's tightening pace will throttle growth.

On his second day of testifying before Congress, Powell said the Fed's commitment to reining in 40-year-high inflation is "unconditional" but also comes with the risk of higher unemployment. However, there has been less of an impact on Thursday from his comments as the narrative moved over from inflation and towards the rising likelihood of a recession following alarmingly poor US data.

Markit’s flash composite PMI cooled from 53.6 in May to a 5-month low of 51.2 in June. While still above the 50-point mark separating expansion from contraction, this result was the second weakest since July 2020, when the economy was emerging from a pandemic-induced lockdown. The manufacturing sector tracker fell from 57.0 to a 23-month low of 52.4, marking one of the largest monthly declines in data going back to 2007. The services sub-index, for its part, decreased from 53.4 to a 5-month low of 51.6.

After falling 8.6% in February, 3.0% in March and 2.6% in April, existing-home sales dropped another 3.4% in the US in May to 5,410K (seasonally adjusted and annualized), bringing the total drawback over four months to 16.6%. This was also the lowest level of sales observed in nearly two years.

Nevertheless, Wall Street's main indexes were mixed in choppy trading on Thursday and the benchmark S&P 500 is headed for a positive close as gains in defensive shares countered declines for economically sensitive groups amid growing worries about a recession. Benchmark U.S. Treasury yields fell to two-week lows, supporting tech and other growth stocks and keeping the Nasdaq in positive territory.

However, trading is set to remain volatile in the wake of the S&P 500 last week logging its biggest weekly percentage drop since March 2020. Investors are weighing how far stocks could fall after the index earlier this month fell over 20% from its January all-time high, confirming the common definition of a bear market, which is not going to be favourable for the high better currencies such as the Aussie.

US dollar bulls throwing in their towels

In the meantime, it can take refuge in the softness of the greenback and the prospects of lower levels to follow, as per the following technical analysis:

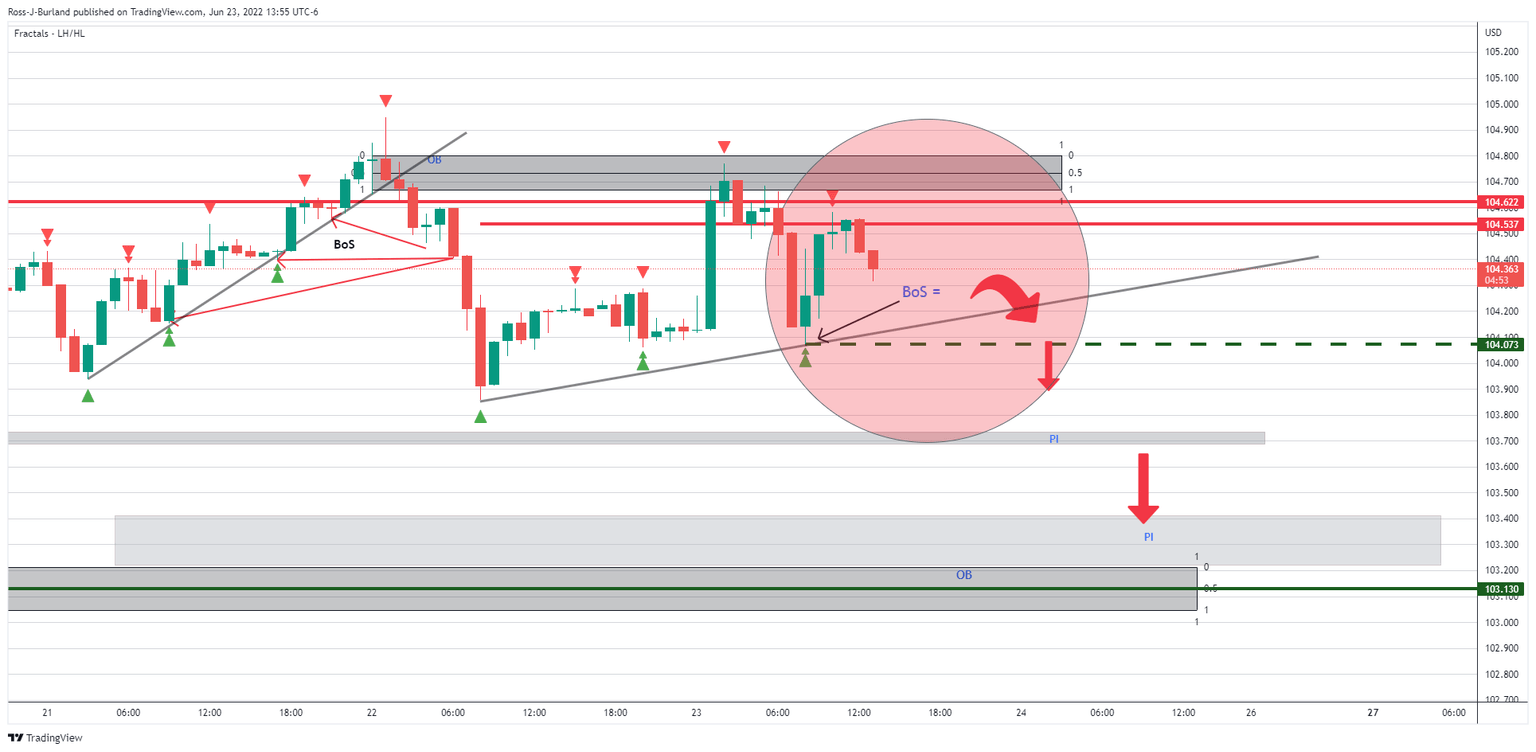

The dollar index (DXY), which measures the currency against six key rivals, slipped 0.14% to 104.06 in recent trade which is leaving an hourly H&S on the chart, taking it towards a test of the neckline at the time of writing:

A break of structure, BoS, will open risk to run on the price imbalances, PI, below and that will leave 103.13 (a mid-point of an important bullish order block, OB) and below exposed.

The DXY is already down to a decline since Friday to 0.5%. It has fallen 1.57% from the two-decade peak of 105.79 reached on June 15, when the Federal Reserve raised rates by 75 basis points, which was the biggest hike since 1994.

This is due to the concerns that the Fed's commitment to quelling red-hot inflation will spur a recession that has sent the 10-year Treasury yields sliding to an almost two-week low.

"Powell's semi-annual testimony has taken some steam out of the USD, his comments regarding elevated recession risk evidently weighing more than his unconditional commitment to restore price stability," Westpac analysts recently said.

"But with 75bp still on the table for July and Fed Funds set to rise above 3% by year’s end, USD interest rate support should ultimately continue to build."

The analysts at Westpac have observed the risks and forecast that the DXY will drop to as far as the 102 level in the near term.

As for the Aussie, analysts at Rabobank said, ''we expect AUD/USD to hold close to current levels on a 1-month view and rise moderately to the 0.73 area by year-end. ''

''The AUD is likely to be sensitive to risks regarding Chinese economic output and broader concerns regarding slowing global growth.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.