AUD/USD arrests backslide post-dovish RBA, struggling to reclaim 0.6450

- The AUD/USD fell after a dovish RBA hiked rates but talked down expectations at the same time.

- The Aussie shed 1.5% post-RBA 25 basis point rate hike.

- Coming up in the mid-week: Fed Chair Powell speech, Aussie Consumer Inflation Expectations.

The AUD/USD tumbled 1.5% on Tuesday, falling to 0.6404 after the Reserve Bank of Australia (RBA) delivered a broadly expected 25 basis point rate hike and wrapped it in a dovish statement, sending the Aussie (AUD) skidding against the US Dollar (USD). The Aussie recovered to head into Wednesday trading near 0.6440.

RBA hikes interest rate to a 12-year high of 4.35% in November

Despite the 25 basis point rate hike, the RBA remains concerned about a slowdown impacting the Australian economy as consumer spending remains tepid, even as inflation risks continue to remain high. The RBA's pace of rate hikes may have been too little, too early to eat away at inflation expectations at the street level after the Aussie central bank stood pat on rates for four consecutive meetings.

Wednesday will see an appearance from Federal Reserve (Fed) Chairman Jerome Powell will be delivering speaking notes at a conference at the Division of Research and Statistics in Washington, DC. After last Friday's Nonfarm Payrolls (NFP) disappointment that sparked broad-market hopes of a decisive end to Fed rate hikes, investors will be watching the Fed head carefully.

Early Thursday sees November's Australian Consumer Inflation Expectations, which last came in at 4.8% for October.

AUD/USD Technical Outlook

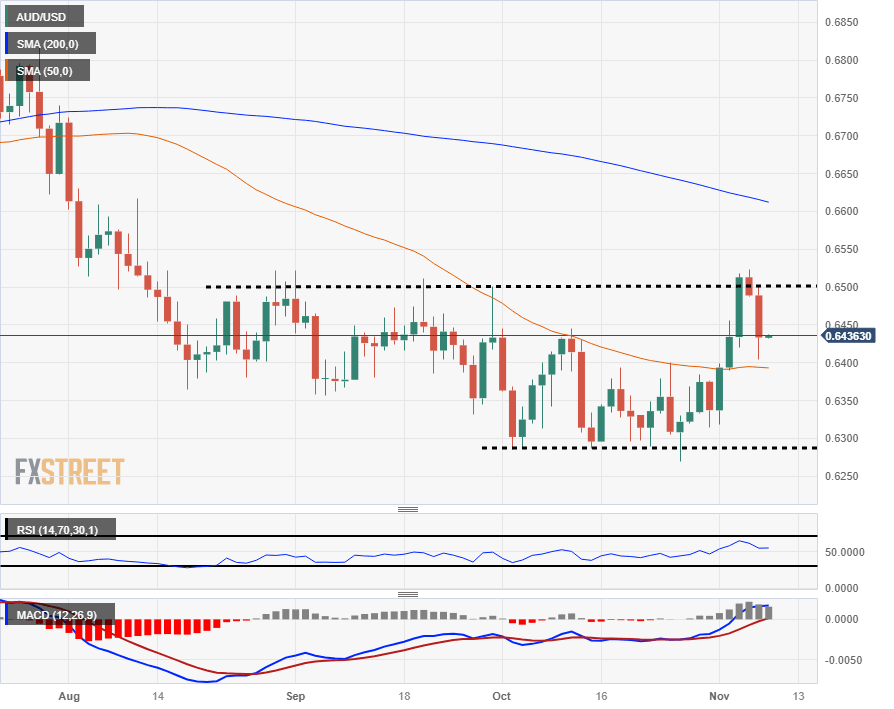

Tuesday's topside rejection following the dovish RBA showing is seeing the Aussie head back towards the 0.6400 handle, where the 50-day Simple Moving Average (SMA) currently sits, and bulls will be looking to springboard off the moving average in order to make a second bid for clearing technical resistance at the 0.6500 handle.

Near-term technical bookends are capping price moves to the downside near the 0.6300 handle, while bull side momentum will see technical resistance from a descending 200-day Simple Moving Average (SMA) near 0.6600.

AUD/USD Daily Chart

AUD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.