AUD/NZD Technical Analysis: Aussie trapped in tight congestion with Kiwi near 1.0725

- AUD/NZD pulls back on Monday from 1.0750, but is still primed for further topside.

- 1.0650 continues to hold as a firm technical floor for the pair.

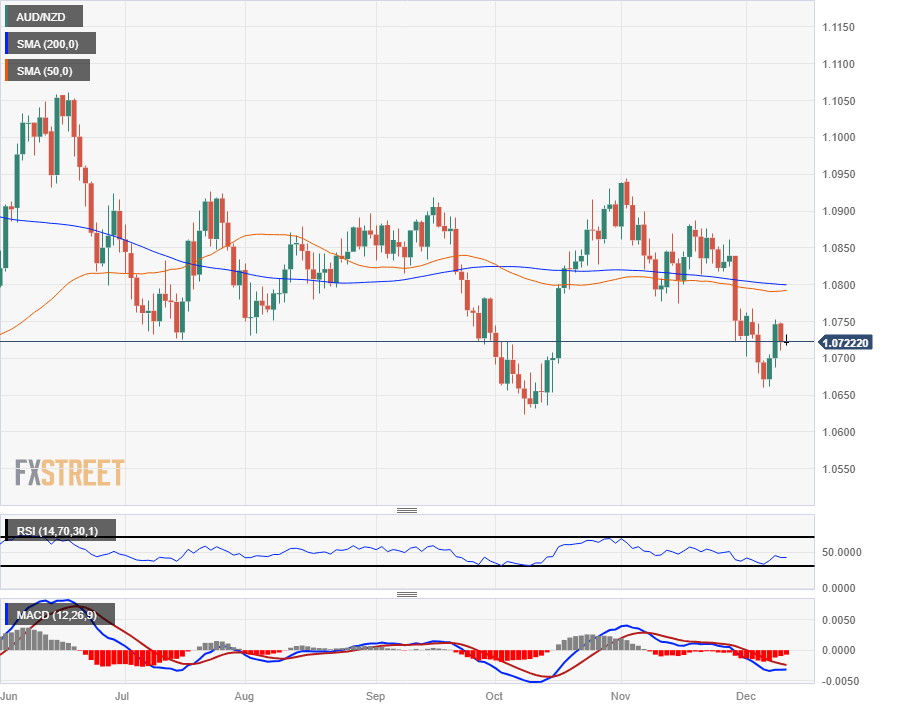

The AUD/NZD is getting hamstrung in the midrange as intraday price action gets caught in the negative space between the 50-hour and 200-hour Simple Moving Averages (SMA) after a near-term bullish crossover of the intraday moving averages.

The Aussie (AUD) saw a bullish rebound last week, taking the AUD/NZD back into the 1.0740 level after waffling to a seven-week low near 1.0650. Sideways momentum has been the overall trend for the AUD/NZD through most of 2023, but the pair remains down from late November’s last swing high into 1.0860, leaving the door open for near-term bullish plays.

Australian Dollar price this week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.01% | -0.02% | -0.05% | 0.24% | 0.78% | 0.01% | -0.15% | |

| EUR | 0.01% | -0.02% | -0.04% | 0.24% | 0.77% | 0.01% | -0.14% | |

| GBP | 0.03% | 0.02% | -0.02% | 0.26% | 0.80% | 0.03% | -0.12% | |

| CAD | 0.05% | 0.04% | 0.02% | 0.28% | 0.83% | 0.05% | -0.10% | |

| AUD | -0.24% | -0.24% | -0.26% | -0.28% | 0.53% | -0.23% | -0.38% | |

| JPY | -0.78% | -0.79% | -0.90% | -0.84% | -0.54% | -0.78% | -0.94% | |

| NZD | -0.01% | -0.01% | -0.03% | -0.05% | 0.22% | 0.76% | -0.14% | |

| CHF | 0.15% | 0.14% | 0.12% | 0.10% | 0.38% | 0.93% | 0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Daily candlesticks look notably sideways for the AUD/NZD, with the pair channeling around the 200-day SMA near the 1.0800 handle. 1.0650 represents a notable technical support region for the pair with multiple rebound zones baked into the price level, and a bullish extension will see the pair taking a fresh run at a long-running technical resistance zone near 1.0900 that has vexed long-term Aussie bulls for most of the year.

Moving averages and technical indicators are mechanically breaking with long-term midrange chart action limiting data series, and the 50-day and 200-day SMAs are drifting in parallel near the 1.0800 handle.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.