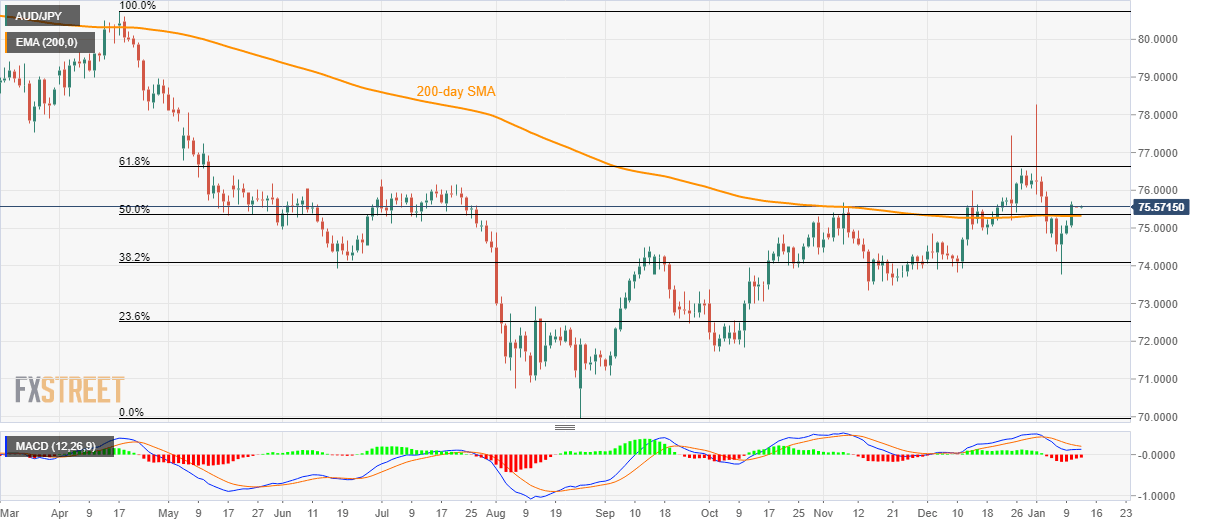

AUD/JPY Technical Analysis: Regains its place above 200-day EMA, 50% Fibonacci

- AUD/JPY looks for fresh clues to extend the latest rise above key resistance confluence (now support).

- July 2019 high, 61.8% Fibonacci retracement cap immediate upside.

- December low will regain market attention on the break of immediate support.

AUD/JPY awaits fresh direction as it trades near 75.57 during the initial Asian session on Monday. The pair recently recovered back beyond a confluence of 200-day EMA and 50% Fibonacci retracement of April-August 2019 fall. However, bearish MACD levels and nearness to the key upside resistances keep buyers in check.

In doing so, July 2019 month top of 75.75 will be the immediate upside barrier, a break of which could push prices further north to 61.8% Fibonacci retracement level of 76.63.

It should, however, be noted that the pair’s run-up beyond 76.63 might not refrain from challenging 77.00.

On the downside, 75.35/30 area, comprising 200-day EMA and 50% Fibonacci retracement, limit the pair’s immediate declines.

A daily closing below 75.30 will fetch the quote back to the sub-75.00 area with the December month low near 73.82 being a follow-on level on the Bear’s radar.

AUD/JPY daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.