AUD/JPY Price Analysis: Struggles at daily highs, and finishes flat around the weekly open

- AUD/JPY seesawed within 94.00-94.70s but finished Monday’s session around 94.11.

- Fears about a recession reignited by Apple’s company saying that it would halt hiring.

- AUD/JPY Price Analysis: Neutral-to-upwards, though failure around 94.70s, might open the door for further losses.

On Monday, the AUD/JPY finished almost flat, on a thin liquidity trading session, as Japan was in observance of Marina day, resuming activities on Tuesday, which would see an improvement in Japanese yen crosses, including the AUD/JPY.

The AUD/JPY is trading at 94.13 after opening near the day’s lows, witnessing some selling pressure entering the market at the weekly open, sending the cross towards a daily low below 94.00, followed by a bounce towards its daily highs at around 94.64. However, late news in the US session, stating that the tech giant Apple will halt hiring, fueled recession fears amongst investors.

Also read: Forex Today: Optimism proved ephemeral

AUD/JPY Price Analysis: Technical outlook

AUD/JPY Daily chart

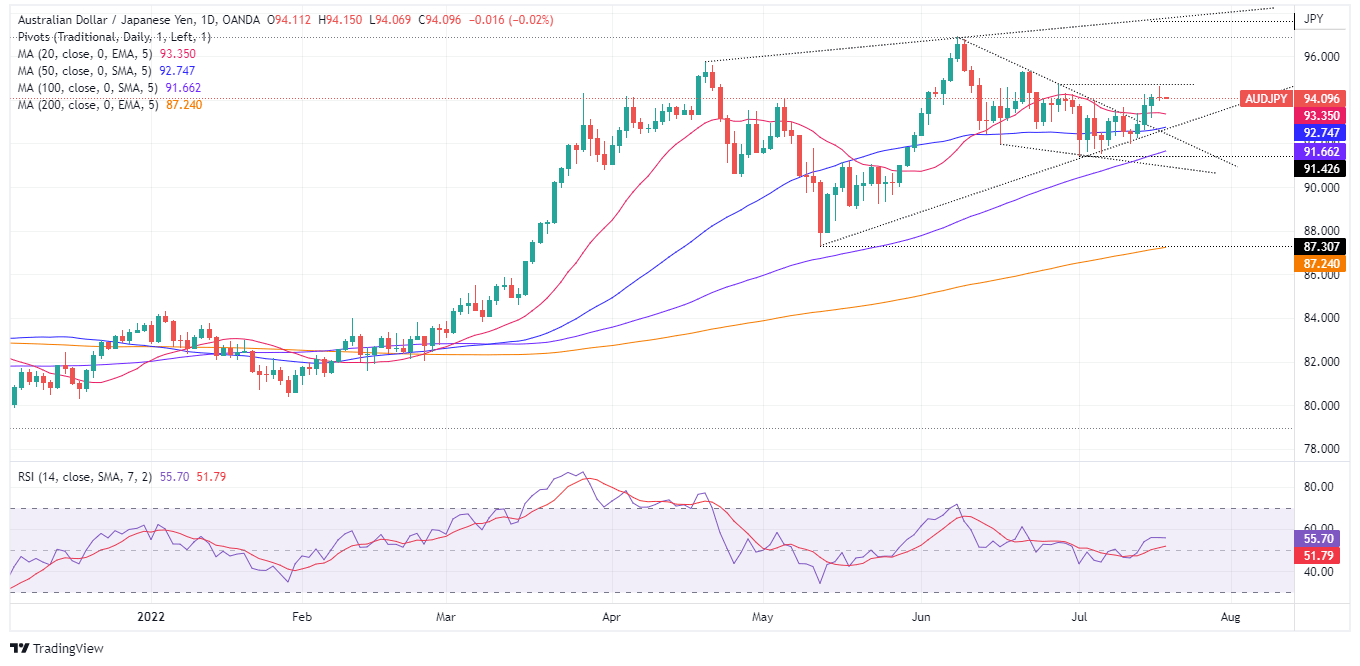

The AUD/JPY depicts the pair as neutral-to-upward biased due to the location of the daily EMAs below the exchange rate. However, its neutral status is derived by price action in consolidation, alongside the Relative Strength Index (RSI), which tumbled from overbought territory towards the 50-midline, faltering to aim higher.

Therefore, the AUD/JPY’s first resistance would be July 18, high at 94.68. Break above will expose the 95.00 mark, followed by the June 21 high at 95.32, which once cleared will expose the YTD high at 96.88

Conversely, the AUD/JPY first support would be 94.00. A breach of the latter will send the cross sliding towards the 20-day EMA at 93.35, followed by the confluence of an upslope trendline and the 50-day EMA near 92.74.

AUD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.