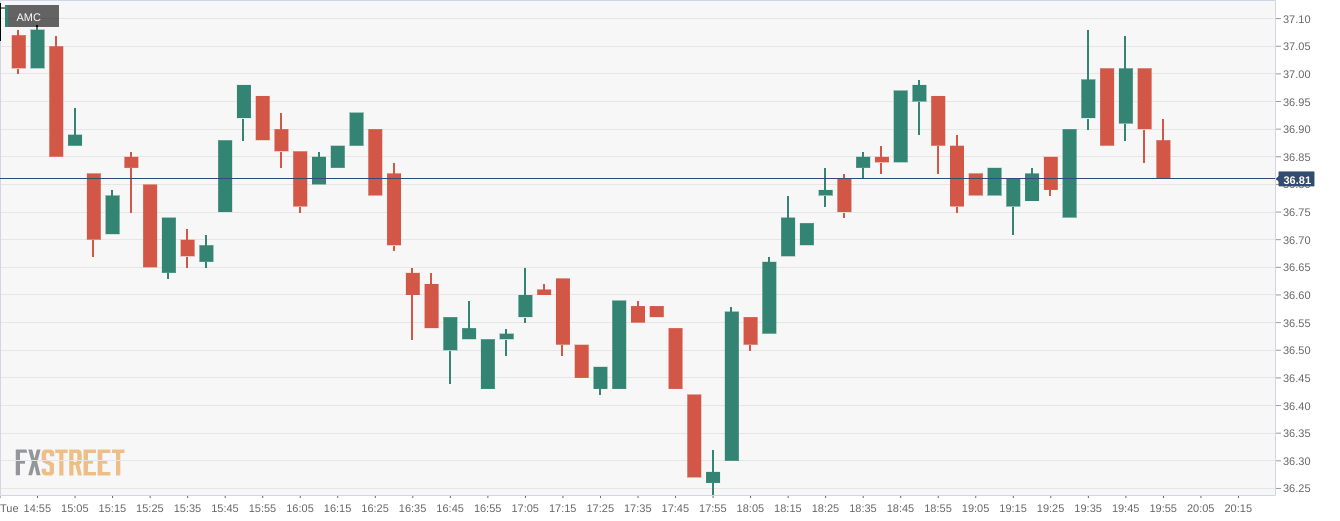

AMC Stock Price: AMC Entertainment dips as a noted short seller closes its position

- NYSE:AMC fell by 1.15% during Tuesday’s trading session.

- Iceberg Research closes its short position at a 30% profit.

- Some big swings for meme stocks on Tuesday as smaller names prevail.

NYSE:AMC dipped alongside the broader markets on Tuesday, even as some smaller meme stocks took some giant steps higher. Shares of AMC fell by 1.15% and closed Tuesday’s trading session at $36.82. The legacy meme stock has shown some positive movement over the past week, signalling that the stock may finally be approaching a bottom. The move lower comes during the third consecutive negative session for the major U.S. indices. Wall Street will be watching for the September inflation report due out on Wednesday, to see how the economic recovery fared following a disappointing jobs report that came out last week.

Stay up to speed with hot stocks' news!

Another short seller has publicly stated that they have closed out their short position in AMC. Iceberg Research took to Twitter on Monday to disclose that its short position was now down 30%, which equates to a nice profit for a short seller. Iceberg Research did not give much detail as to why it chose to close the position now, although in a follow up tweet it did mention that it could potentially reopen another short position in the future. The company did mention that market markers and short sellers should not be confused as the same group of investors, and that payment for order flow like the system used at Robinhood (NASDAQ:HOOD) generates conflicts of interest.

AMC stock forecast

Some less prominent meme names were making some big moves during Tuesday’s session. Koss Corporation (NASDAQ:KOSS) led the way, gaining 24.95%, while Vinco Ventures (NASDAQ:BBIG) surged by 19.89%, and ContextLogic (NASDAQ:WISH) was also up 3.25%. AMC was joined by stocks like GameStop (NYSE:GME), Camber Energy (NYSEAMERICAN:CEI), and Meta Materials (NASDAQ:MMAT), which were all trading lower on Tuesday.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet