- NYSE: AMC kept advancing on Thursday on the Wall Street rebound.

- Meme stocks surge on no particular news during Wednesday’s trading.

- The box office prepares for this year’s next blockbuster: Top Gun: Maverick.

Update: The return of risk appetite on Wall Street on Thursday, courtesy of the better-than-expected earnings at Chinese technology companies. Additionally, downbeat US Q1 GDP and Pending Home Sales data cooled off aggressive Fed tightening bets, cheering investors’ sentiment further. AMC stocks capitalized on the Wall Street rebound and jumped nearly 3% to recapture the $12 mark, extending its recovery into the second straight trading day. The AMC share price rallied as high as $12.86 before easing to settle the day at $12.23.

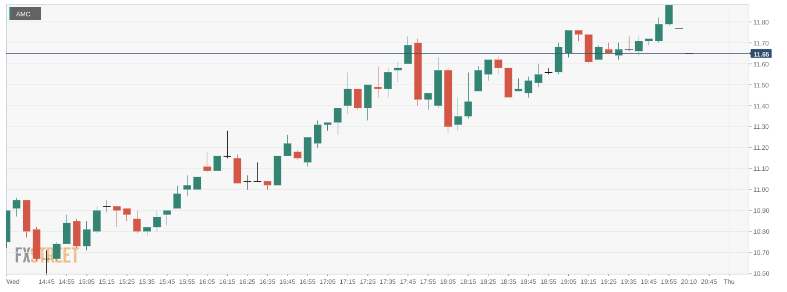

NYSE: AMC had a nice rebound on Wednesday, just when it looked like the stock would be falling back to the single digits and its 52-week lows. Shares of AMC skyrocketed by 14.34% and closed the trading session at $11.88. It was the largest single gain AMC had seen in recent weeks, and is a clear example of the day to day volatility involved with meme stocks. Part of the momentum was likely due to broader buying pressure that spread across all three major averages following the release of the May FOMC minutes. The Dow Jones gained 191 basis points, while the S&P 500 and NASDAQ rose by 0.95% and 1.51% respectively during the session.

Stay up to speed with hot stocks' news!

AMC wasn’t the only meme stock that was seeing unusual behavior on Wednesday, as GameStop (NYSE: GME) saw its shares jump by 29.19%. There wasn’t any particular news from either company, although both ticker symbols were trending on social media, and as a result saw higher trading volume than usual. GameStop’s recent release of its non-custodial crypto and NFT wallet had little effect on the stock, so Wednesday’s surge is a peculiar one.

AMC stock forecast

Perhaps in AMC’s case, investors were also getting bullish on the next Hollywood blockbuster to hit the silver screen this weekend. The long-awaited sequel to Top Gun which was released in 1986 will hit US theaters and it is already anticipated to knock off this year’s largest grossing film so far, Doctor Strange in the Multiverse of Madness. Top Gun: Maverick is anticipated to gross between $98 million and $125 million domestically during this opening weekend.

Previous updates

Update: AMC stocks added roughly 3% on Thursday, trimming part of its early gains but still closing in the red at $12.23 per share. Wall Street posted substantial gains, extending its post-FOMC Minutes rally. The Dow Jones Industrial Average added 516 points or 1.61%, while the Nasdaq Composite gained 2.68%. Finally, the S&P 500 added 92 points or 2.31%. The rally took place despite disappointing US growth-related data. According to the official report, the Gross Domestic Product contracted at an annualised pace of 1.5% in the first quarter of the year, worse than the 1.4% contraction expected.

Update: AMC stock has advanced 6.4% to $12.64 on Thursday. The S&P 500 has moved up by 1.5%, while the Nasdaq gains 1.9%. Nothing much has happened to AMC since it took a 6.8% state in National Cinemedia one week ago. Other than the news that Switzerland's central bank had recently purchased AMC shares, of course.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.