AMC Stock News: Amc Entertainment Holdings falls on proposed stock offering, sales drop off

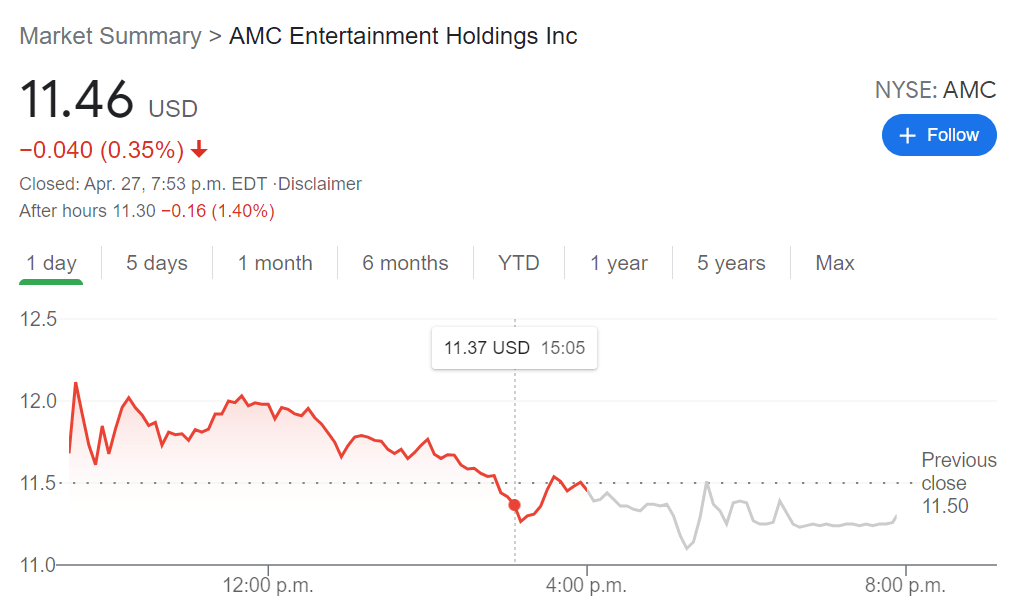

- NYSE:AMC dipped by 0.35% on Tuesday as the broader markets traded flat throughout the day.

- AMC CEO Adam Aron reveals stock offering plan to shareholders.

- AMC is still a social media darling after the recent effort on #AMCDay.

NYSE:AMC has actually been holding steady as it tries to distance itself from the Reddit short squeeze event in January, and reopen its business in a post-pandemic world. On Tuesday, AMC traded mostly flat, as it fell 0.35% to close the day at $11.46, just one day after a 10% surge sent shares over the 50-day moving average. The stock has been slowly trending up as the vaccination efforts in the United States has allowed for movie theaters to reopen fully, albeit at limited capacity.

Stay up to speed with hot stocks' news!

In a potential attempt to take advantage of the elevated share price, AMC CEO Adam Aron revealed that the company still has an option to offer 43 million outstanding shares to raise capital. While Aron has denied that AMC will not be asking shareholders to authorize an offering for 500 million shares, although Aron went on to say if he did and they approved it, AMC still would not make the offering in 2021. Stock offerings are often utilized by companies to raise capital to pay off debts or fund operations, but a direct impact is that shareholder equity is diluted.

AMC Stock chart

As mentioned earlier, AMC’s stock chart is heading in the right direction as the stock is currently trading above its 50-day moving average and well above its 200-day moving average. Part of this is the brand’s continued appeal with retail investors, which was evident during the social media event #AMCday on April 22nd, where there was a coordinated effort across FinTwit and Reddit to buy more shares of the cinema chain.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet