Amazon stock twists 8% lower following startling $200 billion capex guidance

- AMZN sinks 8% to $204 as Street is surprised by $200 billion capex.

- AWS grows 24% to over $35 billion in Q4 revenue.

- AMZN loses 200-day moving average and could be in for prolonged bear market.

- Free cash flow craters from $38 billion to $11 billion in Q4.

Amazon (AMZN) stock is holding onto an 8% loss late into Friday's morning session, the first regular session since CEO Andy Jassy released the company's fourth-quarter results. Despite a beat on the revenue side, the market was startled by a $0.01 miss on adjusted earnings per share (EPS) and Jassy's guidance for $200 billion in capex this year, the highest level among all Magnificent 7 stocks.

The Lion's share of that capex figure is going toward the buildout of AI-focused data centers for Amazon Web Services' (AWS) cloud business, but the guidance was $44 billion ahead of where the Street had been guessing. Overtaking Alphabet's (GOOGL) $180 billion guidance, analysts worry it will push Amazon into negative free cash flow by year-end.

The wider equity market has gained ground on Friday following a stark three-day sell-off. All three major US indices (S&P 500, NASDAQ Composite and Dow Jones Industrial Average) have risen more than 1% at the time of writing as the Dow takes the lead, up 1.77%.

Amazon's $200 billion AI spending spree clouds decent quarter

In the fourth quarter, Amazon earned $1.95 in adjusted EPS, up 5% YoY, on $213.4 billion in net sales, up 14% YoY. While the income figure was just under consensus and the net revenue figure was $2.2 billion above it, the market found neither impressive.

AWS grew revenue 24% YoY to $35.6 billion, but margins contracted in the cloud business.

What's more, free cash flow cratered to $11.2 billion from $38.2 billion one year ago. This is mostly blamed on the $125 billion that Amazon spent on capex last year. With the outlook calling for another $200 billion this year, Wall Street expects that figure to go negative.

For his part, CEO Jassy suggested the company would see improving Return on Invested Capital (ROIC) from Amazon's massive data center onslaught in the years to come. He pointed to new contracts with "OpenAI, Visa, the NBA, BlackRock, Perplexity, Lyft, United Airlines, DoorDash, Salesforce, U.S. Air Force, Adobe, Thomson Reuters, AT&T, S&P Global, National Bank of Canada, London Stock Exchange Group, Choice Hotels, Accenture, Indeed, HSBC and CrowdStrike."

Of course, Amazon's proximity to OpenAI is something of a liability since Google's Gemini platform has begun growing faster than it. Over the past week, Nvidia scaled down its $100 billion investment in OpenAI to $20 billion as the latter has lost its aura as the large language model (LLM) leader.

Additionally, Jassy expects to see heavier demand due to the hyperscaler's offering of proprietary chip platforms, including the Trainium2, Trainium3 and Gravitron5 products. Looking ahead, Jassy pointed to the Trainium4 offering arriving online in 2027 "with 6 times the FP4 compute performance, 4 times more memory bandwidth, and 2 times more high memory bandwidth capacity than Trainium3."

RBC Capital analyst Brad Erickson was not dismayed by the quarterly result. "It remains the most underappreciated mega-cap in our space, where we maintain high conviction in AI leadership materializing over time amidst rising ROIC justification." RBC reiterated its Outperform rating on AMZN and $300 price target.

Morgan Stanley and Wedbush Securities also have $300 price targets on AMZN, while Bank of America lowered its price target slightly to $275.

Amazon stock technical analysis

Amazon stock has left the 200-day Simple Moving Average (SMA) far behind with Friday's 8% plunge. The stock has clearly entered bear market status, and traders will expect this sell-off to continue before consolidation emerges.

The closest area of historical support is the May 23, 2025, low at $197.85, which lies just a few percentage points lower from the $204 area it treads on Friday. That price level is almost a given.

But any break of $197.85 could send AMZN hurtling toward 2024 supports at $176.92 and $166.32. Either way, bulls should expect this bear market to last at least a quarter and maybe longer, particularly if OpenAI's standing deteriorates any more.

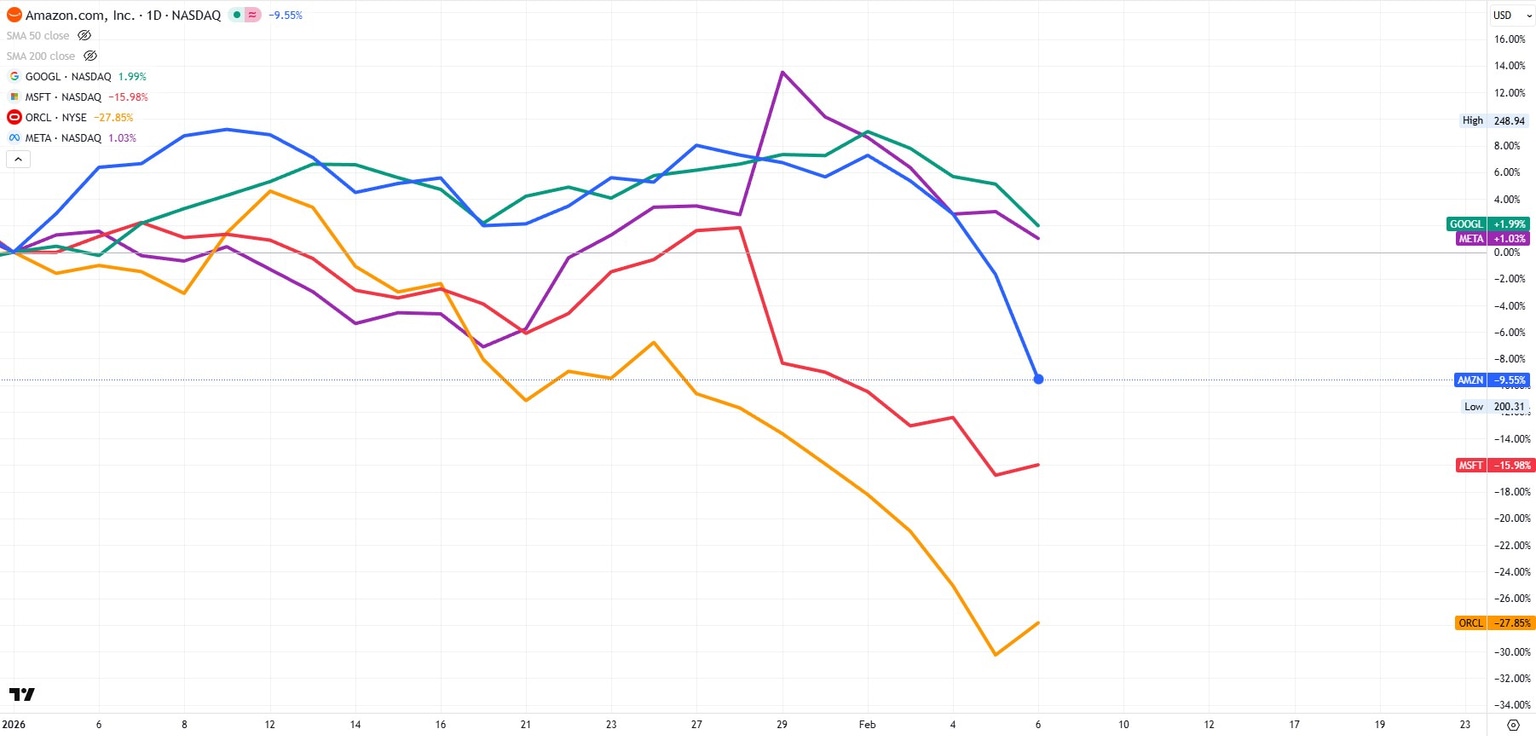

Year to date, however, Amazon stock's -9% loss is still performing better than Microsoft (MSFT), which features an enormous backlog from OpenAI projects, as well as Oracle (ORCL), which has been suffering for months.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.