Alibaba Stock Price and Forecast: Why is BABA up? $180 support holds strong

- BABA shares rally sharply on Wednesday after a tough week on China news.

- Alibaba shares closed Wednesday at $19.01 for a gain of 5.3%.

- BABA shares and other Chinese names suffered heavy falls early in the week.

Alibaba (BABA) shares staged a strong recovery on Wednesday as most Chinese names bounced from heavy losses suffered early in the week. It was a case of third time not being a charm for Alibaba as the stock was caught firmly in the headlights of a Chinese onslaught with nearly all Chinese names taking a big hammering in the US on Monday and Tuesday. Alibaba was of course the original name that caught the attention of Chinese authorities when it was due to spin off its subsidiary ANT Group via an initial public offering (IPO) in late 2020. The IPO was pulled at the last minute as China cracked down on regulatory concerns. The fact that Jack Ma of Alibaba had appeared to criticize the Chinese leadership certainly did not help. BABA shares suffered in the aftermath and never really got going in 2021.

The situation then reared its head again as DIDI suffered increased Chinese scrutiny not long after its own IPO in the US. This hit Chinese stocks again, and BABA suffered deja vu. Just when investors hoped things were calming down, it all came to a head this week as China hit education stocks with for-profit tutoring rumoured to no longer be allowed in certain key subjects. WeChat, part of Tencent Holdings (TCEHY), stopped new user registrations, and Tencent Music (TME) had to give up exclusive rights to online music. All this was too much for investors, who rushed for the exit across all Chinese names. Most notable of the large investors was Cathie Wood's ARK funds selling many Chinese names.

Adding to all this negative news was the geopolitical situation. China and the US staged a high-level diplomatic meeting on Monday, and it is safe to say the outcome was less than stellar, with both sides disappointed with the meeting as China said the relationship was at a "stalemate." The US talked tough, with Defence Secretary Austin saying, "The US does not desire confrontation with China, but it will not back down."

Wednesday though has seen a strong recovery, but is this just a dead cat bounce? A lot of these Chinese names are retail interest stocks, so it may have been retail investors bargain hunting as institutional investors leave the field.

BABA shares closed up 5% at $196.01 on Wednesday.

Alibaba (BABA) key statistics

| Market Cap | $510 billion |

| Price/Earnings | 23 |

| Price/Sales | 4.8 |

| Price/Book | 3.5 |

| Enterprise Value | $579 billion |

| Gross Margin | 44% |

| Net Margin |

21% |

| Average Wall Street Rating and Price Target | Buy $286 |

Alibaba (BABA) stock forecast

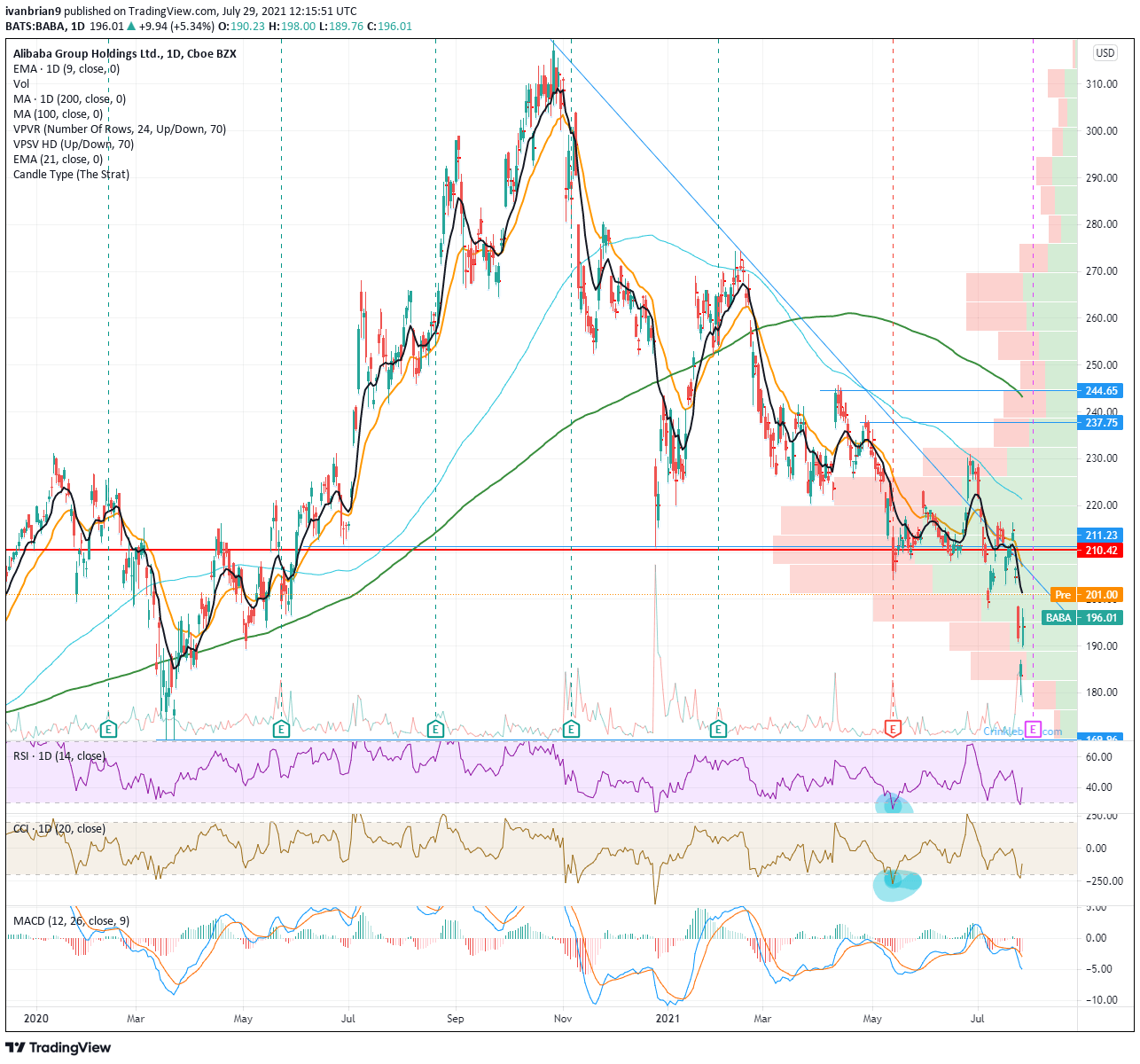

Our call from Tuesday when everything was dropping was certainly a brave one: "The chart looks bleak, but on the weekly we can see one potential staging area for some longs. The area around $180 is a nice volume staging point with plenty of volume to support the price. The point of control is at $180.93, this is the price with the highest level of volume since 2017."

That worked well, considering the low was $179.67. Buyers got a 10% return in a few days, but where to now?

There is a gap at $198-207 and markets love to fill gaps, this would also take us to the 9-day moving average. This would be the first resistance, above that $210 is an area with a lot of volume that will be tough to get through.

BABA is in a classic bearish downtrend with a series of lower lows and lower highs, the Moving Average Convergence Divergence (MACD) is crossed into sell territory. To end this, Alibaba stock would need to break $216 as this would make a higher high. If this is not taken out, the downside support/target is at $170 in the short term.

Note that Alibaba releases earnings next week on August 3.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.