AUD/USD Price Forecast: Posts fresh yearly high above 0.6700

- AUD/USD refreshes yearly high at 0.6717 as the Australian Dollar outperforms across the board.

- The RBA minutes showed that officials discussed tightening monetary conditions in 2026.

- The US Dollar underperforms amid firm Fed dovish expectations.

The AUD/USD pair jumps to near 0.6717 during the European trading session on Wednesday, the highest level seen in over a year. The Aussie pair strengthens as the Australian Dollar (AUD) outperforms its peers amid expectations that the Reserve Bank of Australia (RBA) could raise interest rates in 2026 to contain accelerating inflationary pressures.

RBA hawkish expectations have been prompted after the release of the minutes of the monetary policy on Tuesday, which was announced on December 9, where they discussed raising interest rates next year. “Discussed whether a rate increase might be needed at some point in 2026, as recent data indicated risks to inflation have increased to the upside,” RBA minutes showed.

According to a report from Reuters, swaps now imply just a 27% probability of a rate hike from the RBA in February, but a move has been fully priced by June next year. There is a 56% probability of a follow-up move by the end of 2026.

Meanwhile, a sharp decline in the US Dollar (USD) due to firm expectations that the Federal Reserve (Fed) will cut interest rates by at least 50 basis points (bps) in 2026 has also strengthened the Aussie pair. During the day, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh 11-week low at 97.75.

AUD/USD technical analysis

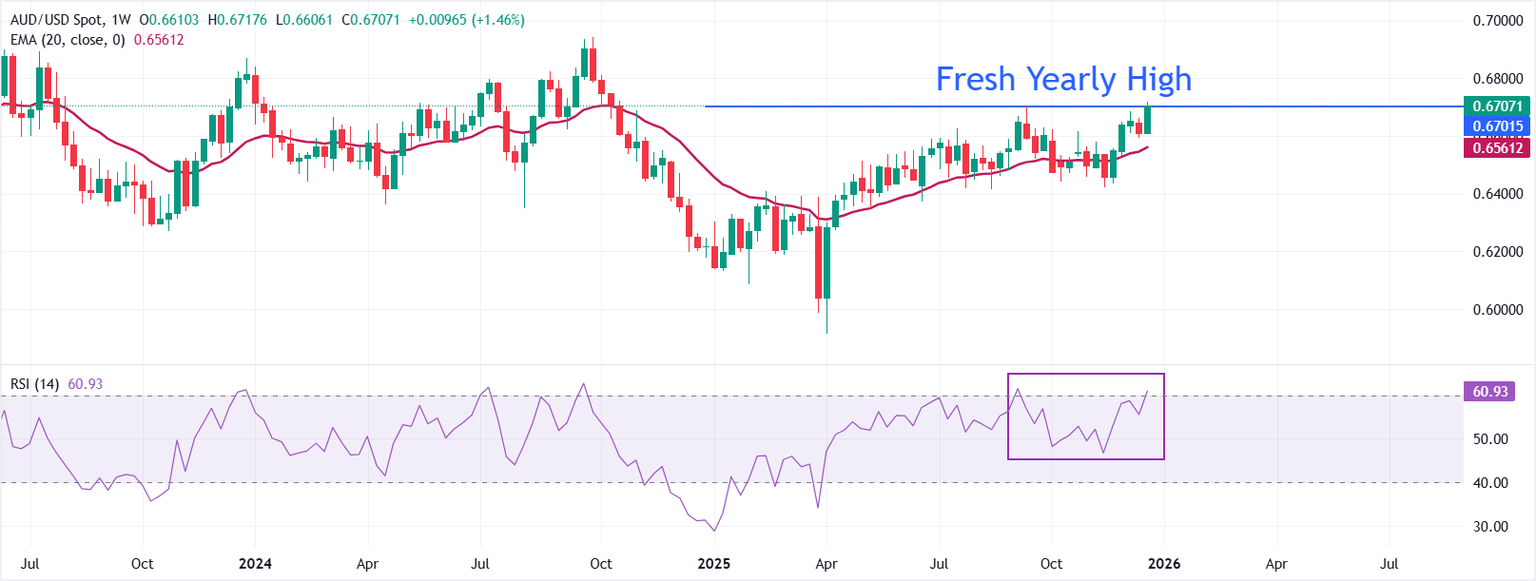

AUD/USD trades significantly higher above 0.6700 on Wednesday. The pair holds above the rising 20-week Exponential Moving Average (EMA) at 0.6561, keeping the short-term uptrend intact and favoring higher lows.

The 14-day Relative Strength Index (RSI) at 60.93 (above midline) confirms positive momentum. While price stays over the average, pullbacks would remain contained, and the bias would stay bullish.

Trend conditions remain firm as the 20-week EMA continues to slope upward, with support aligned in an EMA band at 0.6561–0.6546. RSI is yet to reach overbought, leaving room for extension before 70. A weekly close above the round level of 0.6700 would open the door for further upside towards the October 7 high of 0.6810.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

RBA Meeting Minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

Read more.Last release: Tue Dec 23, 2025 00:30

Frequency: Weekly

Actual: -

Consensus: -

Previous: -

Source: Reserve Bank of Australia

The Reserve Bank of Australia (RBA) publishes the minutes of its monetary policy meeting two weeks after the interest rate decision is announced. It provides a detailed record of the discussions held between the RBA’s board members on monetary policy and economic conditions that influenced their decision on adjusting interest rates and/or bond buys, significantly impacting the AUD. The minutes also reveal considerations on international economic developments and the exchange rate value.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.