When it comes to retirement planning, few tools offer as much versatility and stability as Bonds, especially when held in an Individual Retirement Account (IRA).

In a world where market volatility and economic uncertainty can derail the best-laid investment plans, US Bonds remain a cornerstone for long-term savers looking to preserve capital and generate predictable income.

This article explores how and why Bonds, particularly US government Bonds, can offer retirement stability when strategically included in an IRA.

Why do Bonds belong in an IRA?

Bonds are debt instruments that pay regular interest over a given period and return principal at maturity.

While stocks often attract attention for their growth potential, Bonds bring an equally crucial element to a retirement portfolio: consistency.

For many investors approaching or entering retirement, this consistency becomes a central pillar of financial security.

When placed in an IRA, be it a Traditional IRA or Roth IRA, Bonds benefit from the account's tax advantages.

Bond interest income, which is generally taxed as ordinary income outside of a retirement account, grows tax-deferred (in a traditional IRA) or even tax-free (in a Roth IRA), dramatically improving after-tax returns over time.

The obligations and objectives of retirement planning

Retirement planning is fundamentally about managing two key objectives: preserving capital and generating income. Bonds effectively meet both these objectives.

- Preservation of capital: Unlike equities, high-quality US Bonds, particularly Treasury securities, have a very low risk of default. When held to maturity, they return the initial investment.

- Income generation: Bonds offer a predictable stream of interest payments. At retirement, this regular income can supplement social security benefits and help cover essential expenses.

In the distribution phase of retirement, stability becomes just as important as growth.

Unlike stocks in an IRA, which can fluctuate wildly during economic downturns, US Bonds offer steadier, more predictable performance, allowing retirees to sleep better at night.

The appeal of US Bonds for IRA investors

US Bonds, including Treasury Bonds, Treasury Inflation Protected Securities (TIPS) and short-term to medium-term government Bonds, are particularly well suited to IRAs.

Backed by the confidence and credit of the US government, they offer peace of mind in an unstable world. The United States has never defaulted on its Bond obligations, reinforcing its reputation as one of the safest investments available.

Treasury Bonds pay a fixed rate and are exempt from State and local taxes.

TIPS adjust for inflation, preserving purchasing power, an essential feature for retirees with long life expectancies.

Bond Funds or Exchange Traded Funds (ETFs) based on US Bonds can provide broad diversification and liquidity within an IRA, without the need to purchase individual Bonds.

Using Bonds to balance risk

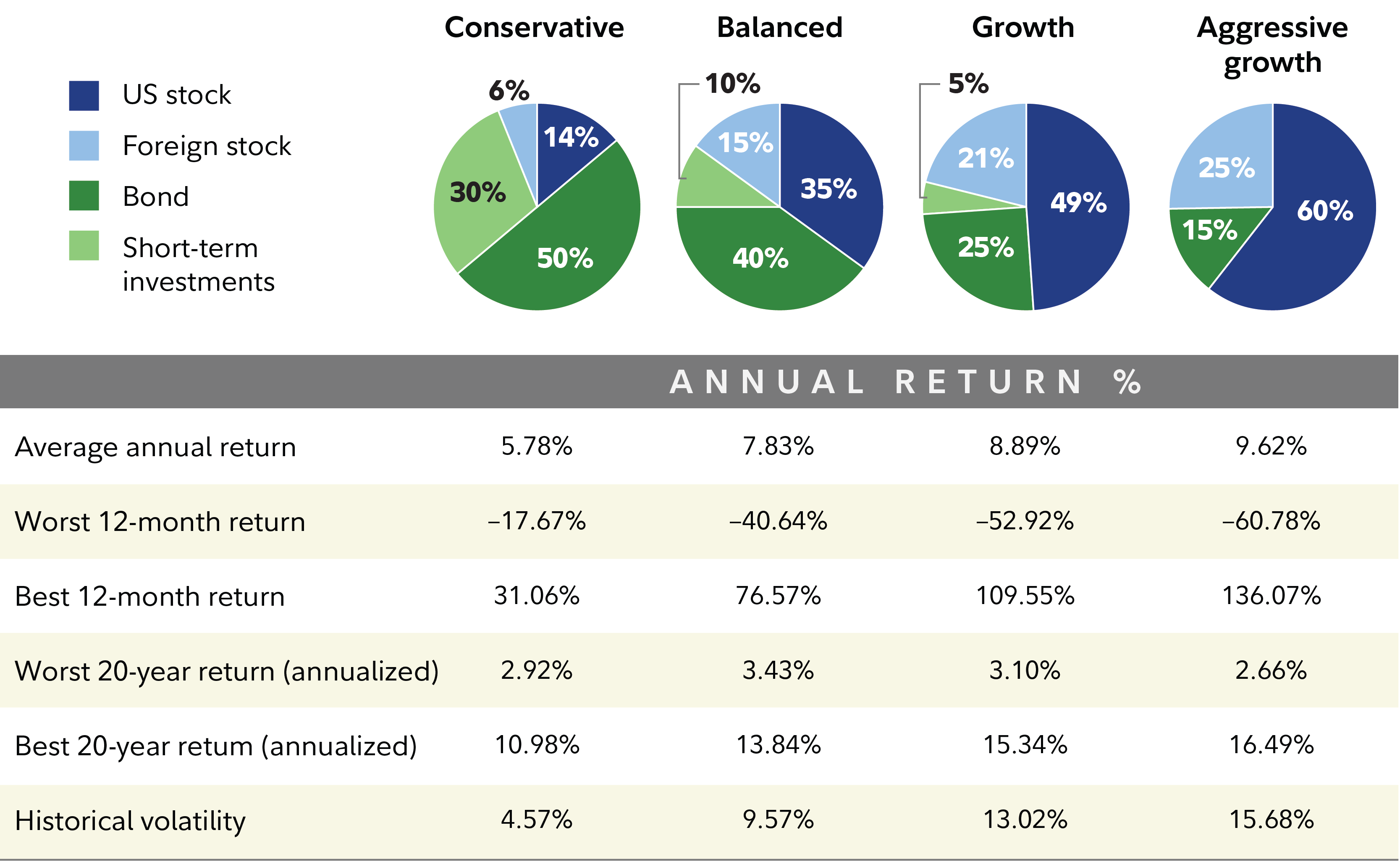

The appropriate mix of Bonds in an IRA depends on personal factors such as age, risk tolerance and retirement timetable.

A common rule of thumb suggests allocating a percentage of the portfolio to Bonds equal to the person's age, e.g., 65% Bonds for a 65-year-old retiree.

However, the principle is more important than the formulas: Bonds reduce portfolio volatility and smooth returns.

Source: Fidelity

Diversifying the IRA is another key role of Bonds. Because they tend to perform differently from equities, including Bonds in your IRA can help protect your retirement savings in the event of a stock market downturn.

This makes them particularly valuable in the years before and after retirement, when losses can be most damaging.

Types of Bonds in an IRA: What works and what doesn't

Not all Bonds are created equal in an IRA. Some are more tax-efficient than others, making account investing an essential strategy:

- Taxable Bonds (e.g., US Treasuries, corporate Bonds) are ideal for IRAs because their interest income is sheltered from immediate taxation.

- Municipal Bonds, on the other hand, offer tax-free income, which is superfluous in an IRA and better suited to taxable brokerage accounts.

- Corporate Bonds offer higher yields, but carry greater credit risk. In the context of an IRA, they can be interesting, especially when incorporating varieties of different quality that balance yield and security.

For hands-off investors or those seeking diversification, mutual funds or Bond ETFs can be an effective way of gaining exposure to hundreds of Bonds at a time, while benefiting from professional management.

Risks associated with Bond duration, inflation and interest rates

Even the safest Bonds carry risks, especially in the current context of fluctuating interest rates. The main ones are as follows:

- Interest rate risk: Bond prices fall when interest rates rise. Retirees holding long-dated Bonds may see the value of their portfolio decline.

- Inflation risk: Fixed coupon payments may not keep pace with rising prices, eroding purchasing power.

- Reinvestment risk: As older Bonds mature, it may be difficult to find new Bonds offering similar yields, especially when interest rates are low.

One way to manage these risks is through Bond ladders, a strategy that spreads Bond maturities over time, offering regular income and reinvestment opportunities.

Bonds as an anchor for your retirement

In the grand architecture of retirement planning, Bonds aren't the flashy horizon, they're the solid foundation.

Held in an IRA, they're even more powerful, tax-protected and aligned with your long-term savings goals.

Whether you're five years away from retirement or already enjoying it, including US Bonds in your IRA is a strategy based on prudence, not prediction.

They offer predictable income and a counterweight to market volatility, which are essential for anyone wishing to retire with peace of mind.

When reviewing your retirement portfolio, ask yourself: Do your current investments reflect your needs for income, stability and protection? If not, it may be time to reconsider the role of Bonds as a core element of your IRA strategy.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

A tale of two earnings reports: Rolls Royce beats Nvidia, because its European

The last 24 hours has seen a plethora of earnings reports, but two stand out: Nvidia and Rolls Royce. The contrasting investor response to both earnings reports is stark, and tells us something important about this market.