At first glance, Individual Retirement Accounts (IRAs) may seem like simple savings products for retirement. However, behind this administrative label lies an extremely flexible and powerful investment tool.

Whether you want to buy stocks, diversify with Exchange-Traded Funds (ETFs) or build a balanced portfolio via Mutual Funds, IRAs enable you to put the financial markets to work for your long-term goals, while benefiting from a favorable tax framework.

But it's important to understand what an IRA really allows you to do, how to choose the right assets, and how to structure your portfolio to reconcile growth, security and diversification.

IRA account as an investment portfolio

One of the great advantages of Individual Retirement Accounts is their investment flexibility. Unlike many company retirement plans, IRAs provide access to a wide range of financial assets: stocks, bonds, Mutual Funds, ETFs, real estate, precious metals and more.

Once your account is open, you're free to build a customized strategy aligned with your personal goals.

So it's possible to do more than just save passively. An IRA can become a genuine long-term investment portfolio, managed according to your own rules.

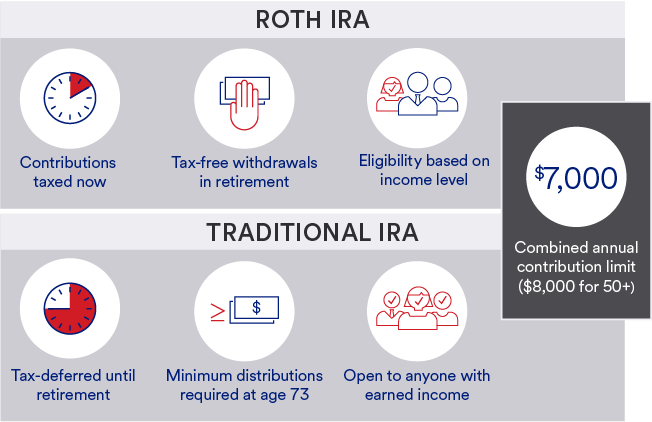

Choosing the right type of IRA: Traditional or Roth?

Before choosing your assets, you need to select the right type of IRA, Traditional or Roth.

Traditional IRAs allow you to deduct your contributions from your taxable income, but withdrawals will be taxed at retirement.

The Roth IRA, on the other hand, taxes you on entry, but allows you to withdraw your earnings tax-free after age 59 and half, provided you've held the account for at least five years.

This tax detail is not insignificant. For assets with high growth potential, such as equities or ETFs exposed to stock markets, many experts believe that the Roth IRA offers better long-term efficiency, thanks to the total exemption of capital gains.

For example, if you invest $1,000 in a stock ETF today, and your investment climbs to $5,000 in retirement thanks to the gains, with a Traditional IRA, you'll pay taxes on the $5,000 at the time of withdrawal, whereas with a Roth IRA, you'll be taxed on the $1,000 at the time of investment.

Of course, other considerations may come into play, such as your tax rate at the time of investment and at the time of retirement, which may be different. But also the risk of losses on your equity investments, making taxation on exit more advantageous.

Which stock market instruments should you choose for your IRA?

The choice of assets in an IRA should not be left to chance. Each instrument has its own advantages, risks and role to play in building a portfolio tailored to your retirement goals.

Individual stocks: Growth but volatility

Investing in equities via an IRA allows you to bet on the success of major listed companies. This can offer the potential for substantial capital gains, as well as regular income via dividends.

But it also means direct exposure to market risk. A bad surprise on a stock, even an iconic one, can weigh heavily on the account's overall performance.

The key is prudence. Unless you have a very dynamic, expert profile, it is rarely advisable to concentrate more than 2% of your IRA portfolio on a single stock.

ETFs: Diversification, simplicity and low costs

Exchange-Traded Funds (ETFs) have become the most popular instruments in IRAs. They enable you to invest in a single transaction in entire indices, specific sectors or various geographical zones. The most widely used in retirement accounts include :

- The Vanguard S&P 500 ETF (VOO) replicates the performance of the 500 largest U.S. companies.

- The Schwab US Dividend Equity ETF (SCHD) primarily invests in stocks with stable dividend yields.

- The iShares Core MSCI World (IWDA) offers global exposure.

ETFs combine several decisive advantages for a long-term portfolio, including instant diversification, very low management fees and daily liquidity.

Mutual Funds: Active management and long-term discipline

Mutual Funds are also still widely used in IRAs, especially for investors who prefer to delegate stock selection to professionals.

Some well-known funds, such as Vanguard Wellesley Income Fund Investor Shares (VWINX), combine stocks and bonds, offering balanced management suited to retirement accounts.

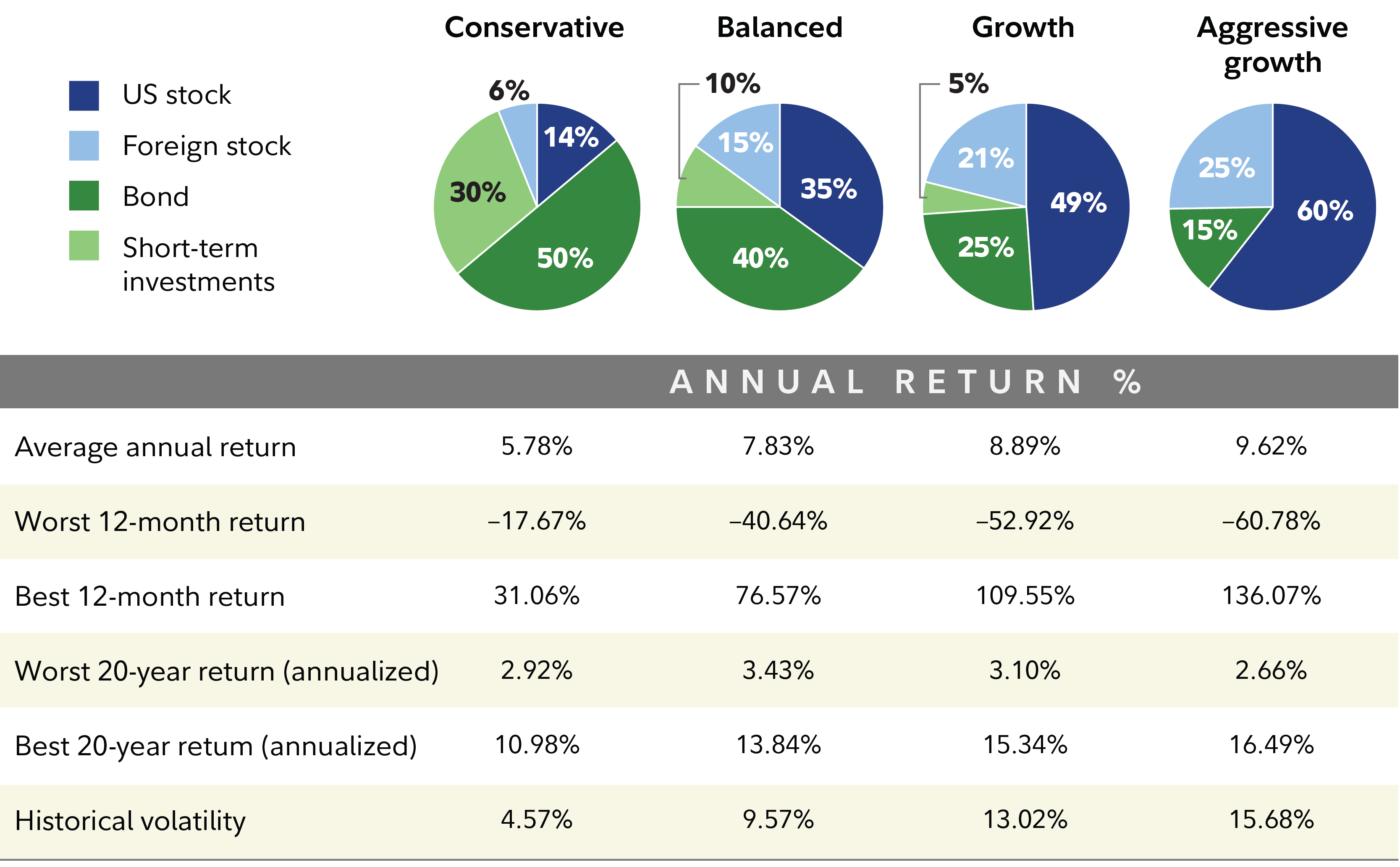

Among the most popular funds in IRA accounts is a special category: Target Date Funds, which are funds with a retirement horizon. These funds are designed to evolve automatically according to the time you have left before retirement.

The principle is simple. You choose a fund whose target year corresponds to your planned departure date (for example, Target Retirement 2050), and the manager gradually adjusts the allocation between equities and bonds.

The closer you get to the target date, the more the fund adopts a defensive strategy, reducing exposure to equities in favor of more stable assets. This makes it a particularly suitable solution for investors wishing to outsource their portfolio management while respecting a long-term investment rationale consistent with their age.

Data source: Fidelity Investments and Morningstar Inc, 2025 (1926-2024). Past performance is no guarantee of future results. Returns include the reinvestment of dividends and other earnings. This chart is for illustrative purposes only.

Companies such as Vanguard, Fidelity and T. Rowe Price offer comprehensive ranges of Target Date Funds, suitable for "autopilot" management in an IRA.

However, Mutual Funds often charge higher fees than ETFs, and are less flexible, as they only trade at the end of the day.

Is it possible to trade stocks in an IRA? A false good idea

The absence of immediate taxation on capital gains in an IRA could encourage some to multiply their transactions. However, the overly active approach has several limitations in this context.

It is forbidden to use leverage, sell short or engage in traditional day trading.

In addition, the free-riding rule prevents the use of unsettled funds to buy or sell a stock too quickly.

Finally, the accumulation of brokerage fees or timing errors can significantly reduce gains.

In a retirement account, a more passive, structured strategy is often more effective. It allows you to benefit fully from compounding over the long term, while reducing the risks associated with volatility.

Diversifying your IRA: More than just common sense

Diversification remains the foundation of a robust portfolio. In an IRA, diversification can take several forms.

Geographic diversification

Most American investors overweight domestic equities. Yet international markets – Europe, Asia, emerging markets – often offer more attractive valuations and complementary growth potential.

ETFs such as the Vanguard Total International Stock Index Fund ETF (VXUS) for non-US markets, or the iShares MSCI Emerging Markets ETF (EEM) for emerging markets, can meet this objective.

A word of caution, however. Dividends received on foreign securities are often subject to a withholding tax, which is not recoverable in an IRA.

Sector diversification

It's risky to concentrate your portfolio on a single sector, even a buoyant one. Adding sector-based ETFs (healthcare, energy, financials, industry and others) smoothes overall performance and helps to absorb shocks.

Diversification by asset type

It can be a good idea to add asset classes to your portfolio that are less volatile than equities.

Bonds provide stable income, notably via funds such as the iShares Core U.S. Aggregate Bond ETF (AGG).

Precious metals, via ETFs such as SPDR Gold Trust (GLD) on Gold, play a hedging role in the event of economic or inflationary tensions.

Listed real estate, via REITs or real estate ETFs such as the Vanguard Real Estate Index Fund ETF (VNQ), can also offer a steady source of return.

Common pitfalls in managing an IRA

Despite its advantages, an IRA is not without its pitfalls. Certain behaviors can hinder your performance or generate tax penalties:

- Forgetting to make compulsory withdrawals from age 73 in a Traditional IRA.

- Investing only in fashionable stocks, with no regard for valuation or diversification.

- Leaving your portfolio abandoned, without periodic rebalancing.

- Neglecting account liquidity, especially as retirement approaches.

It's crucial to adapt your strategy over time. At age 30, a 100% equity portfolio may make sense. At age 60, a more conservative allocation, taking into account less volatile assets, often becomes necessary to protect accumulated capital.

Adding equities to an IRA implies greater rigor

Investing in equities and funds via an IRA can transform a simple tax wrapper into a genuine engine of wealth growth.

By combining management flexibility, intelligent diversification and a long-term horizon, this type of account offers a good framework for building future income, as a complement to Social Security.

But this opportunity requires a certain amount of rigor. Making the right asset choices, limiting fees, regularly rebalancing your portfolio, and adapting your risk exposure to your age and objectives.

In a context of increasing longevity and potential retirement reforms, a well-managed IRA can make all the difference. And while everyone is free to manage their own account, we also recommend consulting a professional for optimal, personalized retirement planning.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remains capped by 0.7100, focus on inflation data

AUD/USD shrugs off Monday’s pullback and regains composure on Tuesday, coming close to the 0.7070 region despite the Greenback trading with modest gains ahead of the opening bell in Asia. In the meantime, the Aussie Dollar should remain under scrutiny in light of the publication of critical inflation data in Oz early on Wednesday.

EUR/USD risks a deeper drop below 1.1750

EUR/USD keeps its vacillating mood in place as the the NA session drwas to a close on Tuesday, hovering below the 1.1800 hurdle amid acceptable gains in the US Dollar. In the meantime, market participants and the FX galaxy are expected to closely follow President Trump’s SOTU speech around 2AM GMT.

Gold appears offered around $5,150

Gold is giving back a good portion of the recent multi-day rally, receding to the $5,150 zone per troy ounce amid the decent bounce in the US Dollar and mixed US Treasuty yields. In the meantime, markets’ attention remain on upcoming comments from Fed speakers.

Ripple’s DeFi shift in focus: Navigating XRPL EVM sidechain growth, XRPFi migration and liquidity

The Citrini report: How a debatable AI narrative can shake Wall Street Premium

That AI-related headline alone was enough to rattle investors.US stocks slid sharply on Monday after a widely circulated Citrini Research memo outlined a hypothetical “2028 Global Intelligence Crisis”, warning that rapid AI adoption could push US unemployment into double digits as early as by mid-2028.

NVDA earnings preview: NVIDIA presses key resistance as Nasdaq watches

NVIDIA (NVDA) heads into Wednesday’s February 25 earnings release at a key technical decision zone, with price once again testing the 191–193 resistance band that has capped multiple recovery attempts since late December 2025.