The foreign exchange market, also known as Forex, is the world's largest financial market, with several trillion dollars traded daily. Unlike Equity markets, which are influenced by corporate results, Forex is particularly sensitive to political decisions and institutional stability.

Elections, geopolitical tensions, trade policies and central bank decisions directly shape currency values.

In a world where politics and economics are intertwined, understanding this link becomes essential for investors, companies and individuals exposed to currency variations.

Central banks at the heart of the link between policy and currencies

Central banks, such as the US Federal Reserve (Fed) and the European Central Bank (ECB), play a decisive role in currency trends.

Their interest rate and liquidity decisions immediately influence currency values. And while these institutions are supposed to be independent, they are never totally cut off from political pressures.

In the United States, the President appoints the members of the Fed's Board of Governors. US President Donald Trump, for example, has often publicly criticized Fed Chair Jerome Powell when he believed that monetary policy was not sufficiently supportive of growth.

In Europe, the ECB faces a complex equation, defending price stability while taking into account the political tensions between countries in the north and south of the Eurozone.

A signal of monetary loosening is perceived as downward pressure on the currency concerned, while a tightening of interest rates tends to reinforce it.

Political decisions influencing the trajectory of central banks are, therefore, becoming a key factor for Forex traders.

Elections and changes in leadership: Uncertainty as a driver of volatility

Election periods are highly volatile times for currencies. Uncertainty over the future government's economic program, or the stability of its institutions, pushes investors to quickly adjust their positions.

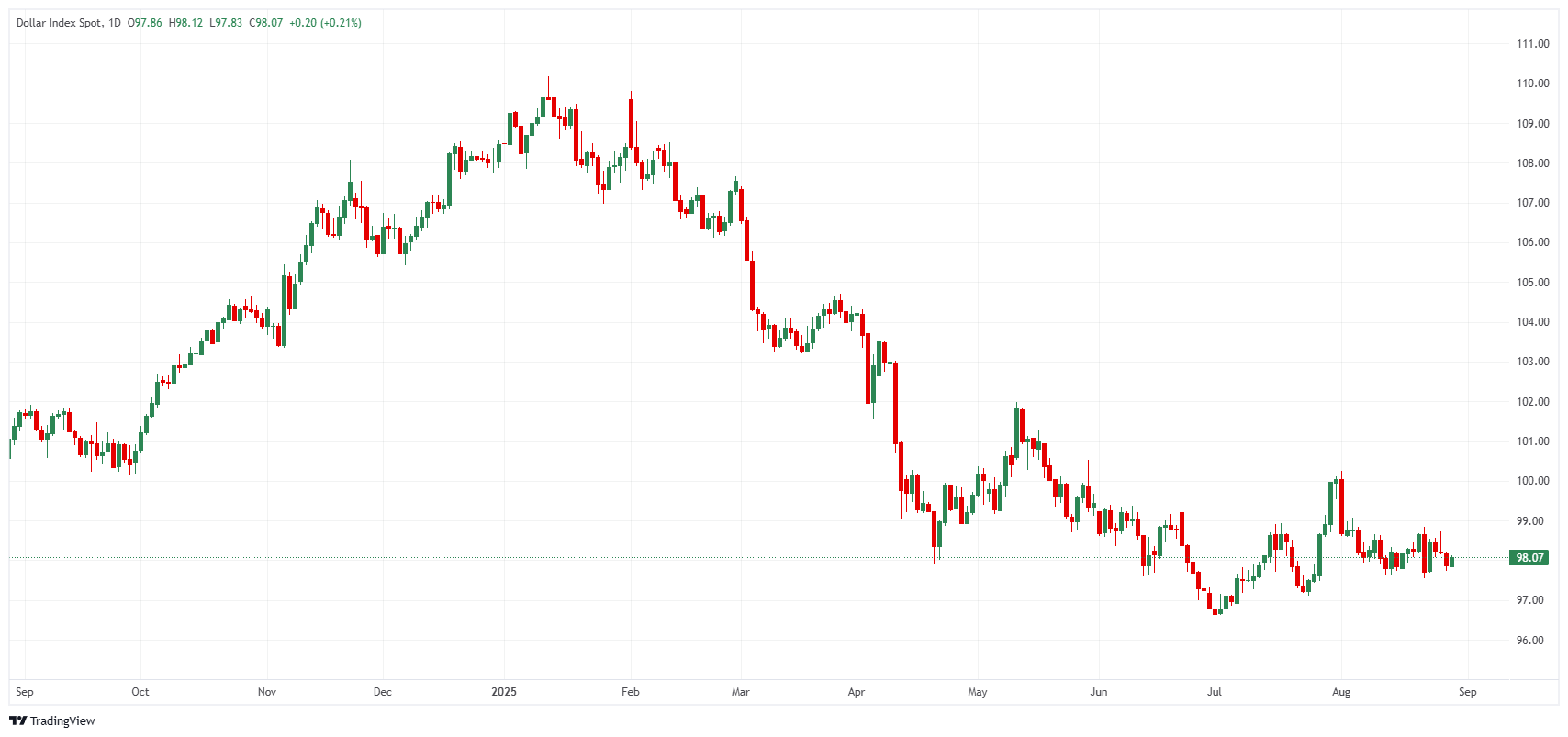

In the United States, since his return to the White House in 2025, Donald Trump has reintroduced an aggressive protectionist trade policy, massively raising tariffs on many imported products.

Far from supporting the US Dollar (USD), these measures have, on the contrary, weighed on the Greenback, as investors fear the impact of new trade wars. Growing uncertainty thus undermined confidence in the US currency, despite its traditional status as a safe-haven asset.

US Dollar Index daily chart. Source: FXStreet.

In Europe, national elections in countries such as Germany, France, Italy and Spain often weighed on the Euro, especially when populist or Eurosceptic parties were in a strong position.

Brexit is the most striking example of this. The announcement of the referendum in 2016 had plunged the Pound (GBP) to historic lows, and its price remains sensitive to British political developments to this day.

More recently, the multiple political crises in France have also regularly had a negative impact on the Euro, due to growing uncertainty.

Geopolitical tensions and the role of sanctions

Economic sanctions have become a political tool that immediately impacts currencies. Russia, hit by sanctions after its invasion of Ukraine, saw its Ruble (RUB) collapse before rebounding thanks to capital controls.

Iran, Venezuela and Turkey also suffered massive currency depreciations as a result of Western measures.

Geopolitical conflicts, for their part, direct flows towards "safe-haven currencies" such as the Swiss Franc (CHF), the Japanese Yen (JPY) or the US Dollar, accentuating market movements.

Populism, nationalism and the political use of currencies

The rise of populist and nationalist parties in many parts of the world is also having a lasting impact on Forex. These governments tend to favor protectionist policies and direct currency intervention.

Some economies do not hesitate to practice competitive devaluation to boost their exports, as China has often been accused of doing with the Yuan (CNY).

Turkey illustrates another scenario. President Recep Tayyip Erdoğan's determination to impose low interest rates despite galloping inflation has caused the Turkish Lira (TRY) to plummet, eroding international confidence in the country's monetary policy.

How investors can navigate this landscape

For foreign exchange traders, politics is an inescapable risk factor. There are several strategies for dealing with this volatility:

- Follow political news in real time: A speech by the Fed, a statement by US President Donald Trump or an unexpected vote in the European Parliament can trigger instantaneous movements on Forex.

- Diversify positions to avoid dependence on a single geographic zone.

- Turn to safe-haven assets such as the US Dollar, Japanese Yen, Swiss Franc or Gold during periods of great uncertainty.

- Use hedging instruments, such as options or futures, to protect against sudden movements.

The Forex market is a reflection of global political tensions. The decisions of leaders, whether Donald Trump in the United States, European institutions such as the ECB, or nationalist parties in Europe or Latin America, directly shape currency values.

Against a backdrop of fragile globalization and heightened trade rivalries, politics is increasingly influencing capital flows and therefore currencies.

For traders and investors, keeping a close eye on political developments is not just an option; it's a prerequisite for anticipating trends and protecting positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds losses below 1.1850 ahead of FOMC Minutes

EUR/USD stays on the back foot below 1.1850 in the European session on Wednesday, pressured by renewed US Dollar demand and reports that ECB President Lagarde will step down before the end of her term. Traders now look forward to the Minutes of the Fed's January monetary policy meeting for fresh signals on future rate cuts.

GBP/USD defends 1.3550 after UK inflation data

GBP/USD is holding above 1.3550 in Wednesday's European morning, little changed following the UK Consumer Price Index (CPI) data release. The UK inflation eased as expected in January, reaffirming bets for a March BoE interest rate cut, especially after Tuesday's weak employment report.

Gold retains bullish bias amid Fed rate cut bets, ahead of Fed Minutes

Gold sticks to modest intraday gains through the early European session, reversing a major part of the previous day's heavy losses of more than 2%, to the $4,843-4,842 region or a nearly two-week low. That said, the fundamental backdrop warrants caution for bulls ahead of the FOMC Minutes, which will look for more cues about the US Federal Reserve's rate-cut path.

Pi Network rally defies market pressure ahead of its first anniversary

Pi Network is trading above $0.1900 at press time on Wednesday, extending the weekly gains by nearly 8% so far. The steady recovery is supported by a short-term pause in mainnet migration, which reduces pressure on the PI token supply for Centralized Exchanges. The technical outlook focuses on the $0.1919 resistance as bullish momentum increases.

Mixed UK inflation data no gamechanger for the Bank of England

Food inflation plunged in January, but service sector price pressure is proving stickier. We continue to expect Bank of England rate cuts in March and June. The latest UK inflation read is a mixed bag for the Bank of England, but we doubt it drastically changes the odds of a March rate cut.

NVIDIA trend shift again? The battle to reclaim the parallel channel

For much of the past year, NVIDIA Corporation (NVDA) has largely been contained in an inclining parallel channel. However, the price action on Thursday and Friday of last week marked a significant departure from this trend.