The US Dollar (USD), long considered the world's safest asset, is experiencing unusual turbulence. The cause is US President Donald Trump's repeated attacks on the Federal Reserve (Fed), the independent institution responsible for steering US monetary policy.

The attempt to sack Fed Governor Lisa Cook, despite her appointment until 2038, marks a turning point in the ongoing tug-of-war between the White House and the central bank. An offensive which, according to many analysts, is likely to have a lasting impact on the Fed's credibility, and therefore on the trajectory of the US Dollar.

An unprecedented attack on the Fed's independence

Since his return to the White House, Donald Trump has stepped up his criticism of the Fed, which he deems too cautious in its rate cuts.

The American president took things a step further by announcing the dismissal of Lisa Cook on the pretext of financial irregularities.

Cook immediately contested the decision, pointing out that the President does not have the legal authority to dismiss a Fed governor.

This confrontation paved the way for an unprecedented legal tug-of-war, undermining the central bank's image of independence.

Historically, the Fed has been shielded from political pressure to guarantee financial stability and contain inflation.

By directly attacking its members, Trump is calling this principle into question, at the risk of bringing the world's leading power closer to less reassuring models, such as that of Turkey, where political interference led to the collapse of the national currency.

Immediate market reactions

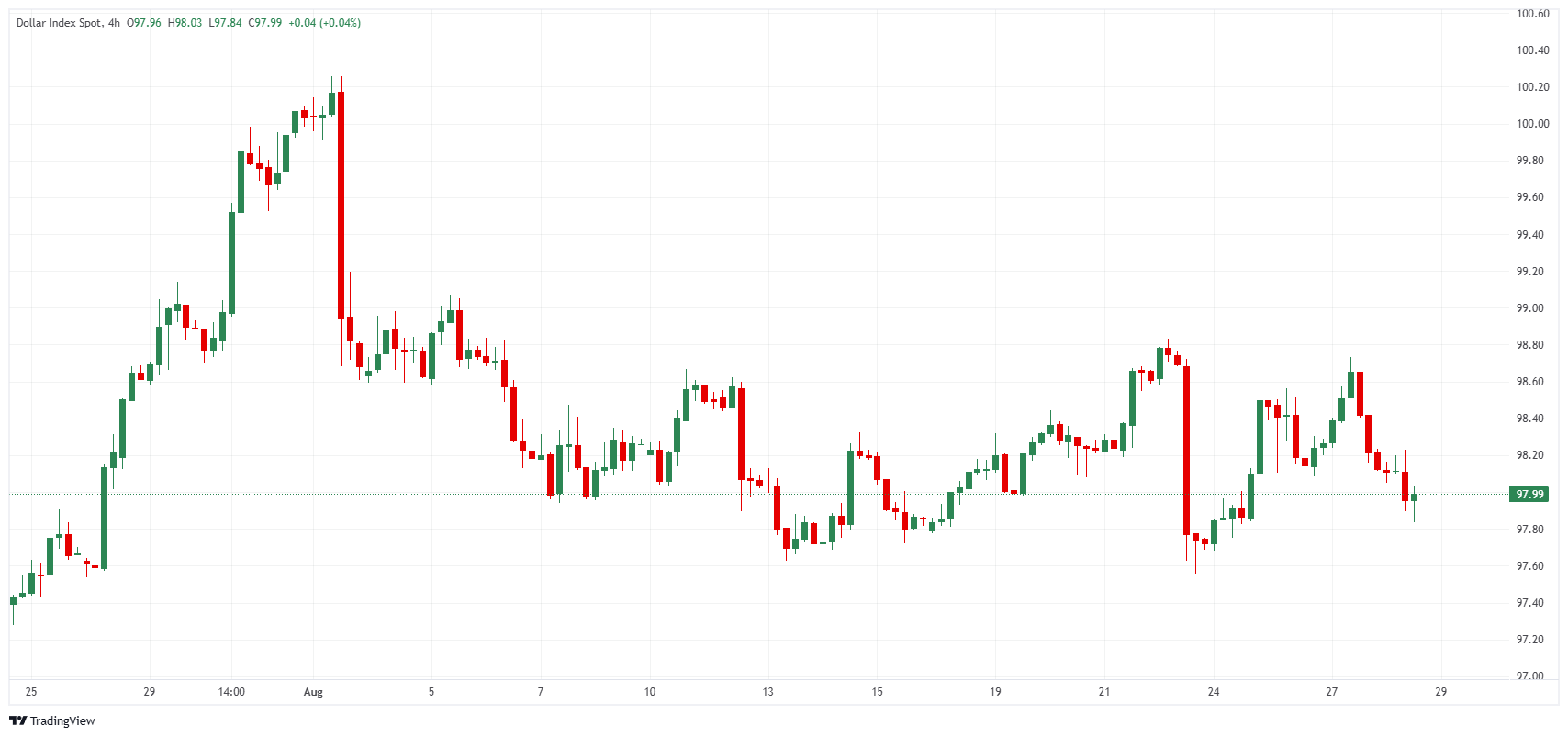

Investors were quick to react. The US Dollar lost ground against the Euro (EUR) and the Japanese Yen (JPY) after the announcement targeting Lisa Cook.

US Dollar Index (DXY) 4-hour chart. Source: FXStreet.

At the same time, yields on short-term Treasury Bonds fell, reflecting expectations of a more accommodating Fed that would likely yield to political pressure. Long-term yields, on the other hand, showed the opposite trend, a sign that markets fear renewed inflation and a loss of confidence in US debt on the part of foreign investors.

The result is a steeper yield curve, symptomatic of growing tensions.

"The Fed's credibility is now at the heart of the problem," said Brian Jacobsen, chief economist at Annex Wealth Management, quoted by Reuters. "If independence is compromised, the risk premium demanded by investors on the dollar and Treasuries will rise."

What future for the US Dollar?

In the short term, the trajectory of the USD will largely depend on the Fed's decisions at its forthcoming meetings.

The market is already anticipating several rate cuts between now and the end of the year, encouraged by Donald Trump, but also by signs of a slowdown in the US economy.

Should these rate cuts materialize, they could accentuate the downward pressure on the Greenback against other major currencies.

However, its status as the world's reserve currency remains a considerable asset. As long as global markets seek refuge in times of uncertainty, the US Dollar will retain a solid base of support.

The question is whether Trump's repeated attacks, combined with concerns about public debt and the quality of economic statistics, will eventually erode this long-term confidence.

A decisive test for America

The confrontation between President Trump and the Fed goes far beyond a simple technical disagreement over interest rates.

It calls into question the institutional solidity of the United States and its ability to preserve a balance between executive power and monetary independence.

For the markets, the stakes are clear. If the Fed is perceived as a political instrument, the value of the US Dollar and American financial stability could be permanently weakened.

In this sense, the future of the Greenback is as much at stake in Washington as it is on Wall Street. The behavior of Donald Trump, the resistance of Lisa Cook and Fed Chair Jerome Powell, and the reaction of investors will determine whether the US Dollar remains the essential currency of the global financial system, or whether it begins a slow erosion of its credibility.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD challenges 1.1800, two-week lows

EUR/USD remains on the defensive, extending its leg lower to the vicinity of the 1.1800 region, or two-week lows, on Tuesday. The move lower comes as the US Dollar gathers further traction ahead of key US data releases, inclusing the FOMC Minutes, on Wednesday.

GBP/USD falls below 1.3550, pressured by weak UK jobs report

GBP/USD remains under heavy bearish pressure and falls toward 1.3500 on Tuesday. The UK employment data highlighted worsening labor market conditions, bolstering bets for a BoE interest rate cut next month and making it difficult for Pound Sterling to stay resilient against its peers.

Gold recovers modestly, stays deep in red below $4,950

Gold (XAU/USD) stages a rebound but remains deep in negative territory below $4,950 after touching its weakest level in over a week near $4,850 earlier in the day. Renewed US Dollar strength makes it difficult for XAU/USD to gather recovery momentum despite the risk-averse market atmosphere.

Crypto Today: Bitcoin, Ethereum, XRP upside looks limited amid deteriorating retail demand

The cryptocurrency market extends weakness with major coins including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) trading in sideways price action at the time of writing on Tuesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

FedEx (FDX) outpaces stock market gains: What you should know

FedEx (FDX) ended the recent trading session at $374.72, demonstrating a +1.42% change from the preceding day's closing price. The stock outpaced the S&P 500's daily gain of 0.05%. On the other hand, the Dow registered a gain of 0.1%, and the technology-centric Nasdaq decreased by 0.22%.