Every year, the Jackson Hole Symposium is one of the most closely watched events on the financial markets.

This year was no exception, as Federal Reserve (Fed) Chair Jerome Powell's speech marked a turning point in monetary expectations, with immediate repercussions for Commodities, particularly Gold.

A more conciliatory Fed, relieved markets

By confirming that the US central bank was considering a first interest rate cut as early as September, Jerome Powell gave investors the signal they had been waiting for.

The Fed Chair's comments highlighted the fact that inflation is now better contained, but also a worrying slowdown in employment.

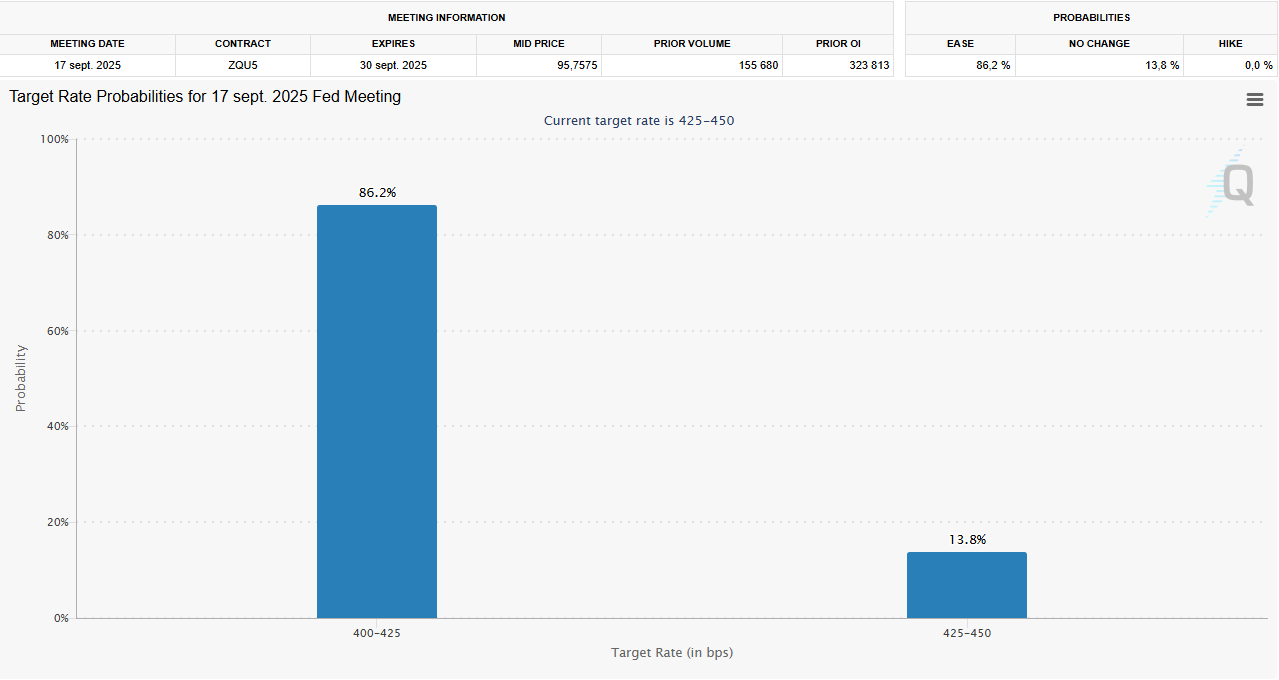

As a result, markets are now betting massively on rapid monetary easing, with over 86% probability of a 25 basis points (bps) cut as early as September, according to the CME FedWatch tool.

Fed Watch Tool. Source: CME Group.

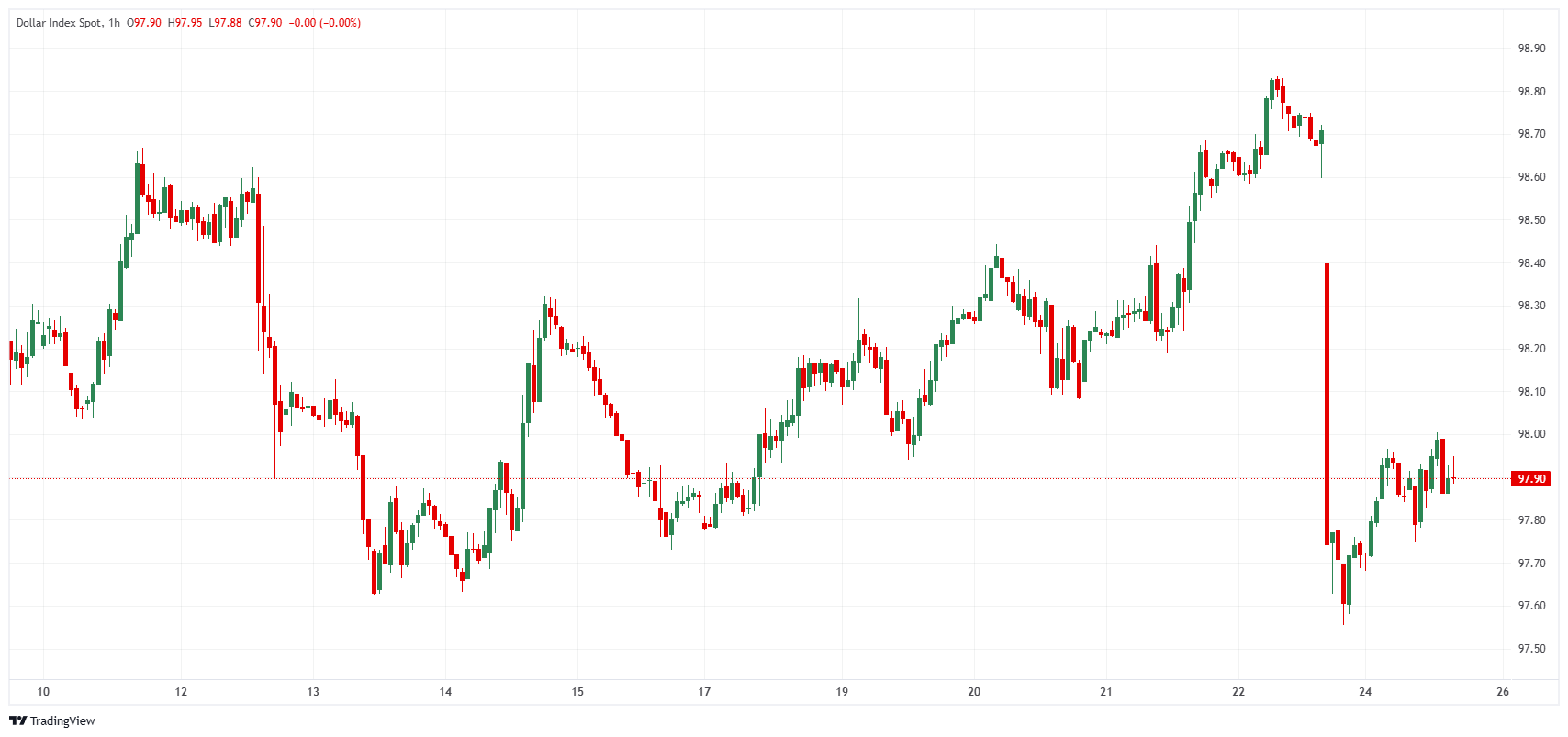

This more dovish tone immediately weakened the US Dollar (USD) as an immediate reaction, creating a favorable context for the entire Commodities complex, whose prices often move inversely to the US currency.

US Dollar Index (DXY) 1-hour chart. Source: FXStreet.

Gold in the spotlight, boosted by the prospect of lower interest rates

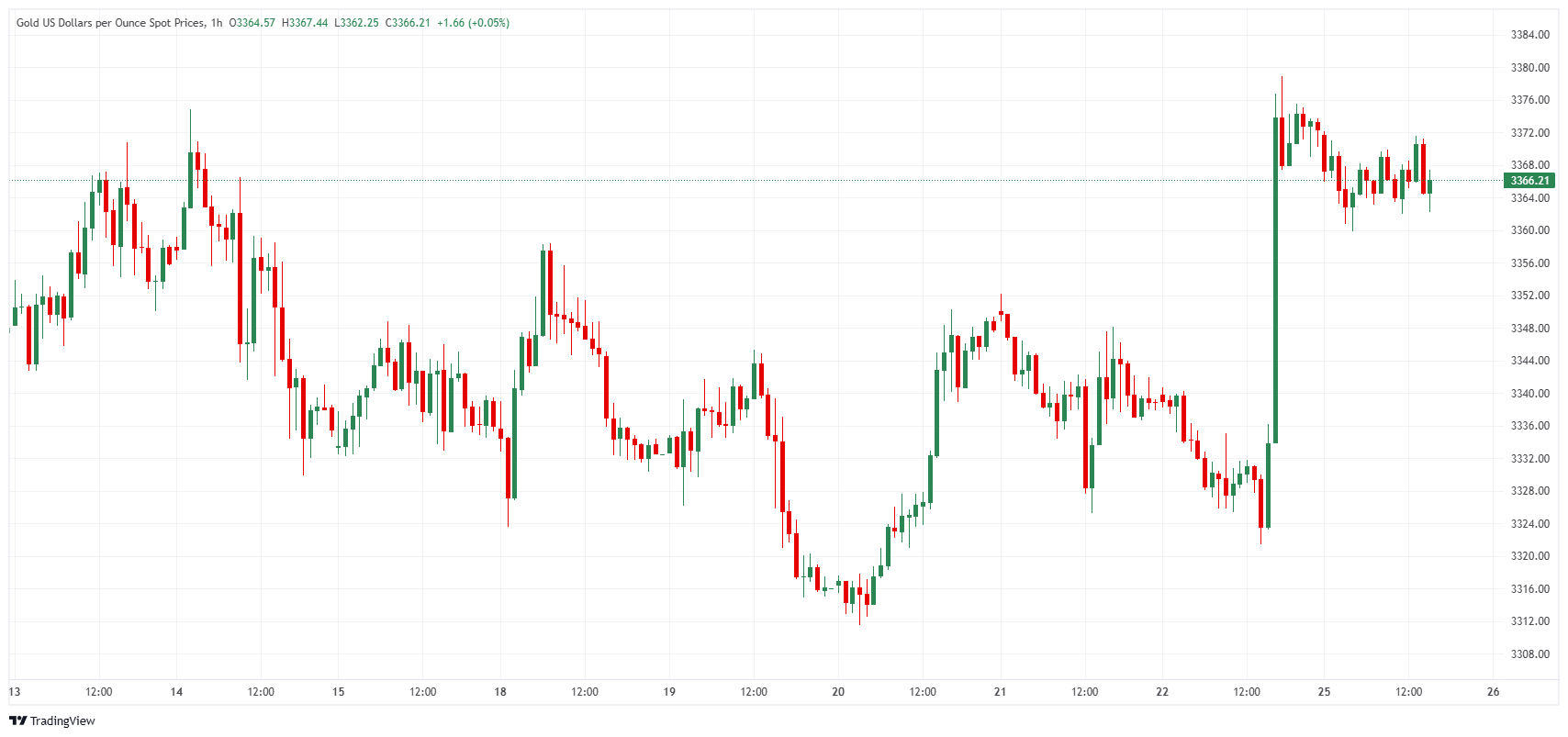

Gold, the safe-haven par excellence, was the first to benefit from this change in tone from Chair Powell. The yellow metal surged by almost 1% after the speech, breaking through new technical thresholds and resuming the upward momentum interrupted in recent weeks.

Gold price 1-hour chart. Source: FXStreet.

Investors see a double opportunity. On the one hand, Bond yields are set to fall with lower interest rates; on the other, a weaker US Dollar makes Gold more attractive to international buyers.

Physical demand also helped to sustain the movement: Swiss exports in July showed a notable increase to the United States and India, where the festive season traditionally stimulates jewelry buying, noted Kedia Advisory.

For its part, China maintained solid premiums on its imports, a sign that consumption remains robust despite economic uncertainties.

Silver, Oil and other Commodities follow suit

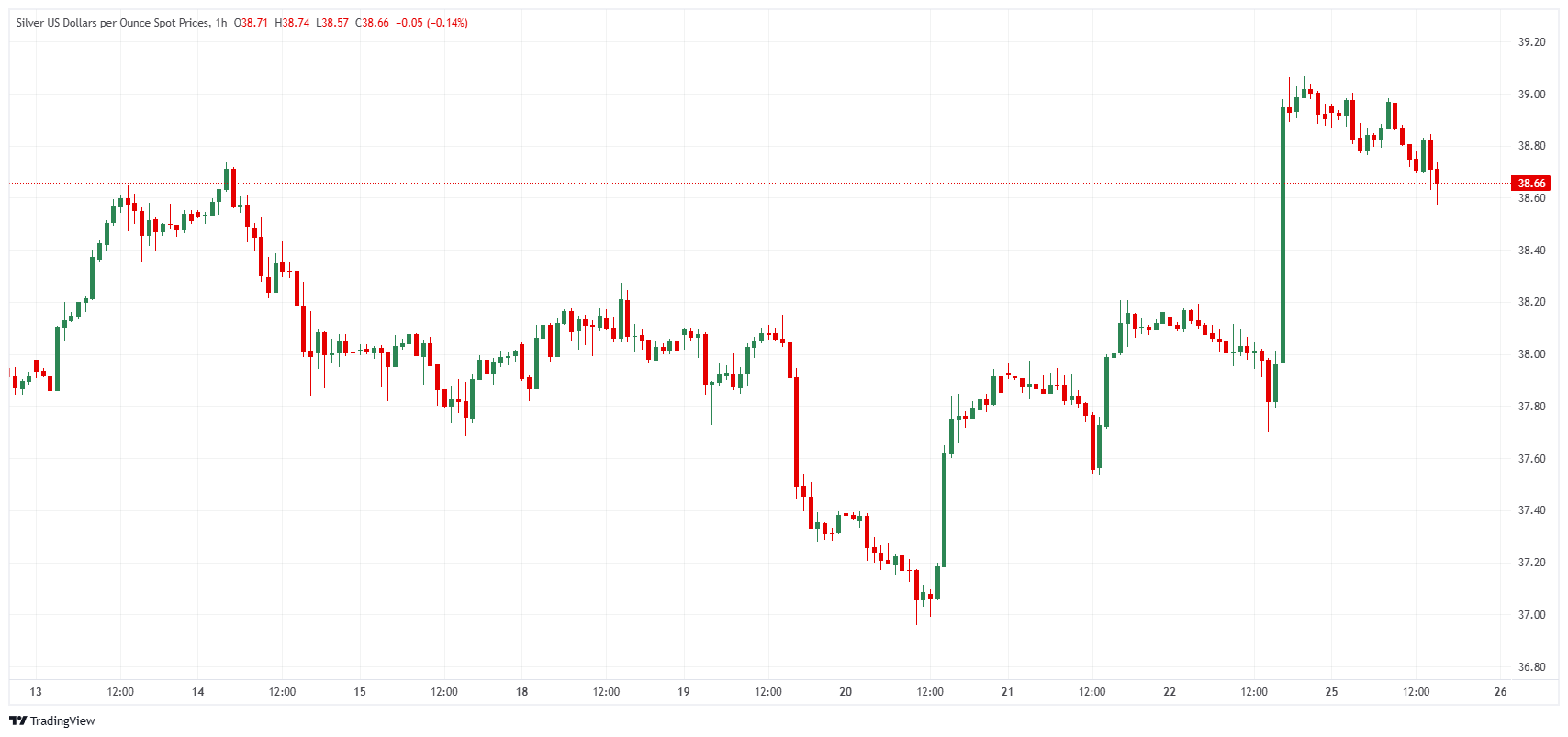

While Gold caught the eye, the Powell effect was also felt in Silver, which advanced even more strongly, benefiting from its hybrid role between safe-haven asset and industrial metal.

Silver price 1-hour chart. Source: FXStreet.

Analysts are puzzled by the performance gap between Silver and Gold, some seeing it as a sign of Silver's own dynamic, often more volatile but capable of outperforming when precious metals recover.

On the Energy front, the Fed's accommodating message offset a more complex context. Oil prices, already buoyed by uncertainties linked to the Russia-Ukraine conflict and US sanctions, found the prospect of lower interest rates an additional factor of short-term support.

Nevertheless, the fundamentals remain fragile. Supply remains abundant, and global demand could suffer if the economic slowdown worsens.

Fragile but revealing support

Jerome Powell's speech at Jackson Hole confirms the extent to which US monetary policy remains a major catalyst for Commodities.

The expected cut in key interest rates acts as a powerful psychological and technical driver for dollar-denominated assets, starting with Gold.

But this impetus rests on a precarious balance. If inflation were to rise again, and the Fed needs to pause cutting interest rates, the dynamic could quickly reverse.

For the time being, Gold has emerged stronger from the Jackson Hole Symposium and remains in the spotlight. As a barometer of investor confidence in the Federal Reserve, it could soon test new all-time highs if the central bank confirms its accommodative stance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD hits fresh three-year highs above 0.7100 on hawkish RBA-speak

AUD/USD has refreshed three-year highs to regain 0.7100 and beyond in Wednesday's Asian trading. The pair remains undeterred by the mixed Chinese inflation data for January, which showed the growth in the Consumer Price Index slowing more than expected, while the Producer Price Index beat estimates. RBA official Hauser's hawkish commentary provides an extra boost to Aussie bulls.

USD/JPY extends three-day rout below 154.00, NFP eyed

USD/JPY is extending its three-day rout below 154.00 in the Asian session on Wednesday, awaiting the release of the closely-watched US NFP report. In the meantime, rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance underpin the Japanese Yen, weighing on the pair amid intervention fears.

Gold awaits US Nonfarm Payrolls data for a sustained upside

Gold remains capped below $5,100 early Wednesday, gathering pace for the US labor data. The US Dollar licks its wounds amid persistent Japanese Yen strength and potential downside risks to the US jobs report. Gold holds above $5,000 amid bullish daily RSI, with eyes on 61.8% Fibo resistance at $5,141.

Bitcoin, Ethereum and Ripple show no sign of recovery

Bitcoin, Ethereum, and Ripple show signs of cautious stabilization on Wednesday after failing to close above their key resistance levels earlier this week. BTC trades below $69,000, while ETH and XRP also encountered rejection near major resistance levels. With no immediate bullish catalyst, the top three cryptocurrencies continue to show no clear signs of a sustained recovery.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

Elliott Wave analysis: Apple set to complete impulsive rally from January 21 low

The cycle from the January 21, 2026 low in Apple (AAPL) is unfolding as a five‑wave Elliott Wave impulse. From that low, wave 1 advanced to $268.34, followed by a corrective pullback in wave 2 that terminated at $252.12. The stock then resumed its upward trajectory in wave 3.