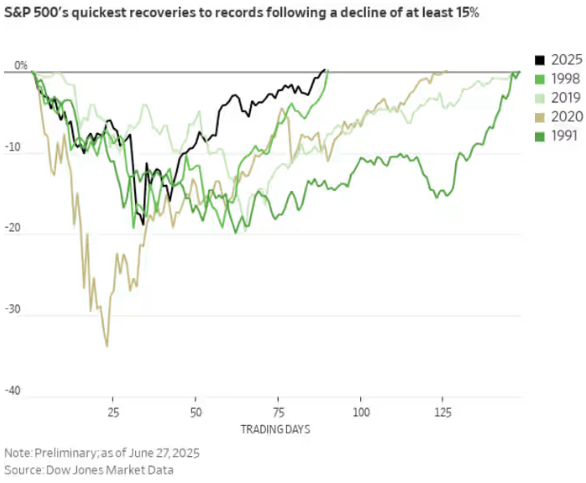

The US stock market has just set new all-time highs, buoyed by a technology wave dominated by artificial intelligence (AI). The Nasdaq and S&P 500 have erased a violent spring correction in a matter of weeks, and this spectacular recovery owes much to a clearly identified group: tech giants and AI stocks.

But is this euphoria solid... or does it rest on foundations that are more fragile than they appear?

The return of AI stocks

Since mid-April, US indices have rallied with remarkable strength. The Nasdaq has rebounded by over 33%, the S&P 500 by 24%, and even reached all-time highs at the end of June. At the heart of this recovery, Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Meta (META), Amazon (AMZN) and other artificial intelligence stars.

Already a market driver in 2023 and 2024, AI stocks are more than ever a catalyst this year. The Roundhill Magnificent Seven ETF, which includes the technology giants, has surged 31% since the beginning of April. The iShares Semiconductor ETF, which covers chip manufacturers, jumped 44% over the same period.

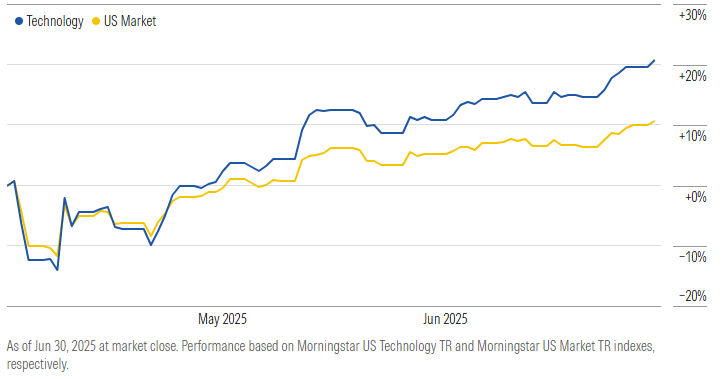

In addition, the Technology sector’s performance has doubled the US market over the past three months, according to Morningstar indicators.

These figures testify to investors' renewed enthusiasm for AI stocks despite an uncertain geopolitical context.

Nvidia leads the stock market

Nvidia best embodies this dynamic. After briefly overtaking Apple in market capitalization, the company headed by Jensen Huang is now on par with the peaks, with a valuation of $3,850 billion at the end of June.

Nvidia stock price chart. Source: TradingView.

According to Loop Capital forecasts, Nvidia could be the first company to break through the symbolic $4,000 billion barrier, and reach $6,000 billion in the medium term.

Its success is based on the explosive demand for GPUs (Graphics Processing Units) for AI data centers.

The new Blackwell chips, successors to the H100, are being sold at record prices and remain in short supply, such is the demand from companies, governments and start-ups.

According to Loop Capital, Nvidia could ship 6.5 million GPUs this year and 7.5 million next year, with an average price of around $40,000 per unit.

Microsoft, Meta, Apple: the other side of AI stocks

The winners of the AI revolution are not just to be found in semiconductors. Microsoft, for example, is leveraging its strategic partnership with OpenAI. The company has exceeded 10 billion in AI-related revenues, notably via Azure and Copilot, according to Investor’s Business Daily.

Meta, for its part, has just created a laboratory dedicated to "superintelligent" artificial intelligence by massively recruiting renowned researchers, sometimes poached from OpenAI.

Even Apple, long criticized for lagging behind in the field, seems to be changing its strategy, as Bloomberg has just revealed ongoing discussions to integrate OpenAI or Anthropic models into Siri, in what could become a turning point for the company.

Other big names are taking part in this AI rush. Amazon is investing in cloud services optimized for generative models, Alphabet (GOOG) is multiplying AI integrations in its products, while IBM (IBM), Oracle (ORCL), Dell (DELL) and Super Micro Computer (SMCI) are taking advantage of the growing demand for infrastructure and computing power. The ecosystem is expanding rapidly, far beyond the tech giants alone.

A macroeconomy that supports the stock market

Beyond AI, several favorable winds are blowing through the markets: de-escalation in the Middle East, trade agreements – albeit sometimes partial – with China and the UK, for example, and the prospect of interest rate cuts by the US Federal Reserve (Fed) in the months ahead.

The US economy remains solid, with GDP growth close to 4% in the second quarter, according to the Atlanta Fed GDPNow estimate..

Corporate earnings are supporting this momentum. The S&P 500 has enjoyed eight consecutive quarters of earnings growth, with a 4.9% gain expected for the second quarter, according to FactSet data picked up by CNBC.

What's more, AI spending remains a priority for large companies, despite fears of overinvestment.

Towards an AI-driven second half of the year?

The enthusiasm surrounding artificial intelligence remains the main driver of this market phase. The construction of data centers, the explosion in computing power requirements, massive investment in infrastructure and the global AI race continue to fuel investor appetite.

But this growing dependence on a small group of companies also raises questions. The market is expensive, with the S&P 500 trading at nearly 23 times expected earnings, according to Barrons, and an underperformance by a leader could weigh heavily.

AI still seems far from its ceiling. But if it is the essence of this rally, it is also its main risk. The month of July, with its key deadlines (trade tariffs, employment, inflation, earnings season), will tell whether this engine can continue to propel the markets... or whether it is starting to run hot.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trims losses, back to 1.1830

EUR/USD manages to regain some composure, leaving behind part of the earlier losses and reclaim the 1.1830 region on Tuesday. In the meantime, the US Dollar’s upside impulse loses some momentum while investors remain cautious ahead of upcoming US data releases, including the FOMC Minutes.

GBP/USD bounces off lows, retargets 1.3550

After bottoming out just below the 1.3500 yardstick, GBP/USD now gathers some fresh bids and advances to the 1.3530-1.3540 band in the latter part of Tuesday’s session. Cable’s recovery comes as the Greenback surrenders part of its advance, although it keeps the bullish bias well in place for the day.

Gold remains offered below $5,000

Gold stays on the defensive on Tuesday, receding to the sub-$5,000 region per troy ounce on the back of the persistent move higher in the Greenback. The precious metal’s decline is also underpinned by the modest uptick in US Treasury yields across the spectrum.

Crypto Today: Bitcoin, Ethereum, XRP upside looks limited amid deteriorating retail demand

The cryptocurrency market extends weakness with major coins including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) trading in sideways price action at the time of writing on Tuesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

FedEx (FDX) outpaces stock market gains: What you should know

FedEx (FDX) ended the recent trading session at $374.72, demonstrating a +1.42% change from the preceding day's closing price. The stock outpaced the S&P 500's daily gain of 0.05%. On the other hand, the Dow registered a gain of 0.1%, and the technology-centric Nasdaq decreased by 0.22%.