Successful forex trading isn't just about reading charts; it's about understanding the powerful economic forces that drive currency movements. This enhanced analysis blends technical insights with crucial economic drivers to provide a more comprehensive outlook on key currency pairs.

Important economic factors influencing forex

Understanding these fundamental factors is essential for any forex trader:

- Interest rates: Central bank policies (Federal Reserve, Bank of Japan, Reserve Bank of New Zealand, Bank of England, European Central Bank, Reserve Bank of Australia) and their interest rate decisions are paramount. Generally, higher interest rates attract foreign investment, increasing demand for a currency and causing it to appreciate.

- Inflation: Inflation rates significantly influence central bank policy. High inflation often leads to interest rate hikes to control prices, directly affecting currency values.

- Economic growth: Key indicators like GDP growth, employment levels, manufacturing output, and retail sales reflect a country's economic health. Stronger economies tend to have stronger currencies.

- Geopolitical events: Political instability, wars, trade disputes, and global crises can inject uncertainty and volatility into the Forex market.

- Commodity prices: For commodity-exporting nations (like Australia and New Zealand), fluctuations in commodity prices (e.g., oil, metals, agricultural products) can significantly impact their currencies.

- Market sentiment: Overall investor confidence or fear can drive capital flows and influence currency valuations.

Enhanced pair-specific analysis with economic factors

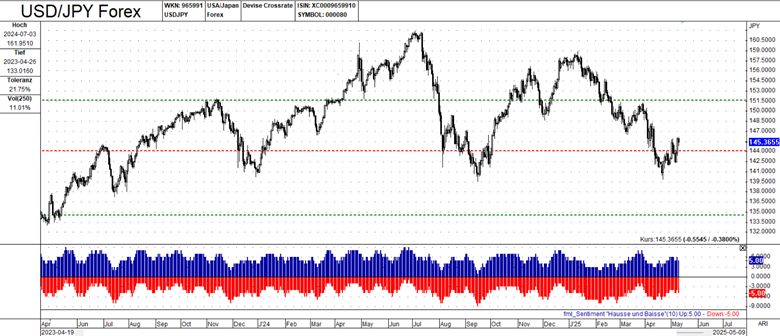

USD/JPY; downtrend on the longer timeframe; potential oversold conditions in the short term. The USD/JPY downtrend may persist if the Bank of Japan signals policy changes or global risk aversion increases. However, continued aggressive Fed rate hikes could support the USD

The Federal Reserve's interest rate policy is crucial. Aggressive rate hikes to combat inflation could strengthen the USD. The Bank of Japan's historically ultra-loose policy means any shift towards tightening could significantly strengthen the JPY. Relative economic performance plays a role. Stronger US growth could support the USD, while stronger Japanese growth could support the JPY. The JPY is a safe-haven currency; global economic uncertainty may strengthen it.

NZD/USD downtrend; oversold conditions in the short term. Combined Outlook: The downtrend is likely to continue unless there's a significant rebound in commodity prices or a shift in RBNZ policy. USD strength will also be a major headwind.

The Reserve Bank of New Zealand's interest rate decisions are critical in their fight against inflation. As a major exporter of dairy and agricultural products, global demand and prices significantly influence the NZD. Overall USD strength, driven by Fed policy or safe-haven demand, will pressure the NZD. Domestic economic performance, including employment and consumer spending, impacts the NZD.

GBP/USD uptrend; potential overbought conditions in the short term. The uptrend could be challenged if the UK economy weakens significantly or if the Bank of England signals a pause in rate hikes. USD strength remains a threat.

The Bank of England's response to high inflation and potential economic slowdown is crucial. Aggressive rate hikes could support the GBP, but recession concerns could weaken it. GDP growth, inflation, and Lingering economic effects of Brexit can still weigh on the GBP.

EUR/USD uptrend; potential overbought conditions in the short term. The uptrend could face headwinds if the Eurozone economy slows down or if geopolitical risks escalate. USD strength will also be a factor.

The European Central Bank's monetary policy is the primary driver, influenced by inflation and the Eurozone's economic health. Economic growth, inflation, and unemployment figures across the Eurozone are important. The USD's performance is a major counterbalance. The war in Ukraine and its impact on energy prices and the European economy create uncertainty for the EUR.

AUD/USD downtrend with a short-term bullish correction. The downtrend is likely to persist unless commodity prices rise significantly or the Chinese economy rebounds strongly. Global economic slowdown and USD strength are negative factors for the AUD.

The Reserve Bank of Australia's interest rate decisions are important. Australia's role as a major exporter of iron ore and coal means global demand and prices significantly influence the AUD. As a major trading partner, China's economic health impacts demand for Australian exports and the AUD. Overall global economic growth influences demand for commodities and risk sentiment, affecting the AUD. USD strength remains a key driver.

The power of combining technical and economic analysis

The most effective forex analysis integrates both technical and fundamental approaches to:

- Confirm trends: Use economic factors to validate trends identified through technical analysis.

- Identify drivers: Pinpoint the key economic forces likely to influence each currency pair.

- Assess risk: Evaluate potential risks and uncertainties associated with economic events and data releases.

- Develop scenarios: Create different trading scenarios based on potential economic outcomes and their impact on currency prices.

By understanding both the technical patterns and the underlying economic drivers, Forex traders can make more informed and strategic decisions.

FxPro Traders provides content for informational purposes only. This should not be taken as financial advice. You are solely responsible for your investment decisions. Always consult a licensed financial professional before trading. FxPro Traders will not be held liable for any losses resulting from trading activities.

Editors’ Picks

EUR/USD climbs to daily highs on US CPI

EUR/USD now accelerates it rebound and flirts with the 1.1880 zone on Friday, or daily highs, all in response to renewed selling pressure on the US Dollar. In the meantime, US inflation figures showed the headline CPI rose less than expected in January, removing some tailwinds from the Greenback’s momentum.

GBP/USD clings to gains above 1.3600

GBP/USD reverses three consecutive daily pullbacks on Friday, hovering around the low-1.3600s on the back of the vacillating performance of the Greenback in the wake of the release of US CPI prints in January. Earlier in the day, the BoE’s Pill suggested that UK inflation could settle around 2.5%, above the bank’s goal.

Gold: Upside remains capped by $5,000

Gold is reclaiming part of the ground lost on Wednesday’s marked retracement, as bargain-hunters seem to have stepped in. The precious metal’s upside, however, appears limited amid the slightly better tone in the US Dollar after US inflation data saw the CPI rise less than estimated at the beginning of the year.

Crypto Today: Bitcoin, Ethereum, XRP in choppy price action, weighed down by falling institutional interest

Bitcoin's upside remains largely constrained amid weak technicals and declining institutional interest. Ethereum trades sideways above $1,900 support with the upside capped below $2,000 amid ETF outflows.

Week ahead – Data blitz, Fed Minutes and RBNZ decision in the spotlight

US GDP and PCE inflation are main highlights, plus the Fed minutes. UK and Japan have busy calendars too with focus on CPI. Flash PMIs for February will also be doing the rounds. RBNZ meets, is unlikely to follow RBA’s hawkish path.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.

-638826102792865541.png)

-638826102931763190.png)

-638826103132201626.png)