Week ahead – Data blitz, Fed Minutes and RBNZ decision in the spotlight

- US GDP and PCE inflation are main highlights, plus the Fed minutes.

- UK and Japan have busy calendars too with focus on CPI.

- Flash PMIs for February will also be doing the rounds.

- RBNZ meets, is unlikely to follow RBA’s hawkish path.

Dovish Fed bets suffer a fresh blow

The US jobs report for January, which was delayed slightly, didn’t do the dovish Fed bets any favours, as expectations of a soft print did not materialize, confounding the raft of weak job indicators seen in the prior week. Had the payrolls numbers disappointed, investors would likely be pricing in at least a 50% probability of a third 25-bps rate cut by year-end.

More significantly, outgoing Fed Chair Jerome Powell would have found himself in a somewhat awkward position, having dismissed concerns about the labour market at last month’s FOMC press conference. But Powell and his more hawkish colleagues can breathe a sigh of relief, as it seems that employment conditions improved in January, allowing the Fed to refocus on inflation, which remains uncomfortably above the 2% target.

Another packed US data agenda

Over the coming week, there will be plenty more data for the Fed to get its hands on, with a risk that total rate cut expectations for 2026 could slip below 50 basis points.

The Empire State manufacturing index will start things off on Tuesday, followed by durable goods orders, building permits, housing starts and industrial production on Wednesday. The Philly Fed’s manufacturing gauge is out on Thursday, along with pending home sales.

The main highlight, however, is Friday’s batch of stats, which include the first estimate of GDP growth in Q4 and the core PCE price index.

The US economy likely expanded at an annualized pace of 3.0% in the three months to December, slowing from Q3’s 4.4% pace. The Atlanta Fed’s GDPNow model puts the estimate at 3.7%, suggesting there’s a good chance of an upside surprise. A stronger reading would give the Fed hawks further ammunition to argue for a pause.

But more important will be how the PCE price indices affect the inflation picture. Both the headline and core PCE measures stood at 2.8% y/y in November. A slight moderation is possible in December, potentially reversing some of the recent unwinding of Fed rate cut bets and putting the US dollar on the backfoot again.

The personal income and spending figures will be watched too as consumption is the backbone of the American economy. Other releases on Friday include new home sales and S&P Global’s flash PMI readings for February.

Will Fed Minutes have much impact?

Aside from the data, the Fed will publish its minutes of the January policy gathering on Wednesday. The notable hawkish tilt was quite evident at this meeting, and judging from the Fedspeak since then, it’s only the usual suspects that are still pushing for immediate rate cuts, with most policymakers being comfortable to wait a bit before making up their minds on further reductions.

Nonetheless, the minutes might point to a willingness by FOMC members to put aside inflation worries in the event that the labour market sours again, and this could be positive for risk sentiment.

Yen bulls target Japanese data for more fuel

For the dollar, however, any ratcheting up of rate cut bets could be especially dangerous against the yen, as the Japanese currency is finally enjoying some buying pressure after months of being hammered in forex markets.

Prime Minister Takaichi’s landslide victory at last weekend’s snap election may have given her the green light to push through additional fiscal support measures, risking a new debt episode, but it could also have ushered in a new era of political stability in Japan, and this can be positive for a currency.

Moreover, with various senior Japanese officials repeatedly warning against excessive yen moves and the Bank of Japan sounding increasingly more hawkish, there is now talk of a ‘buy Japan’ trade. This was already demonstrated on the day of the NFP report when the dollar could only manage a short-lived spike versus the yen before drifting lower again despite the upbeat jobs data.

The yen’s rally has started to broaden against other majors and could gain further traction on Monday if the Q4 GDP estimate impresses. Japan’s economy is forecast to have grown by 0.4% q/q, recovering partially from the 0.6% contraction in Q3.

Also due over the next few days are trade figures on Wednesday, machinery orders on Thursday, and the flash February PMIs as well as the January CPI prints on Friday.

UK jobs and CPI on tap as BoE poised to cut again

The UK will not be spared by the data barrage either, as a crucial week awaits the pound. With Bank of England policymakers citing the weak labour market and sluggish growth for their dovish stance, Tuesday’s employment numbers for the three months to December will be scrutinized, particularly wage growth and the worrying uptrend in the unemployment rate.

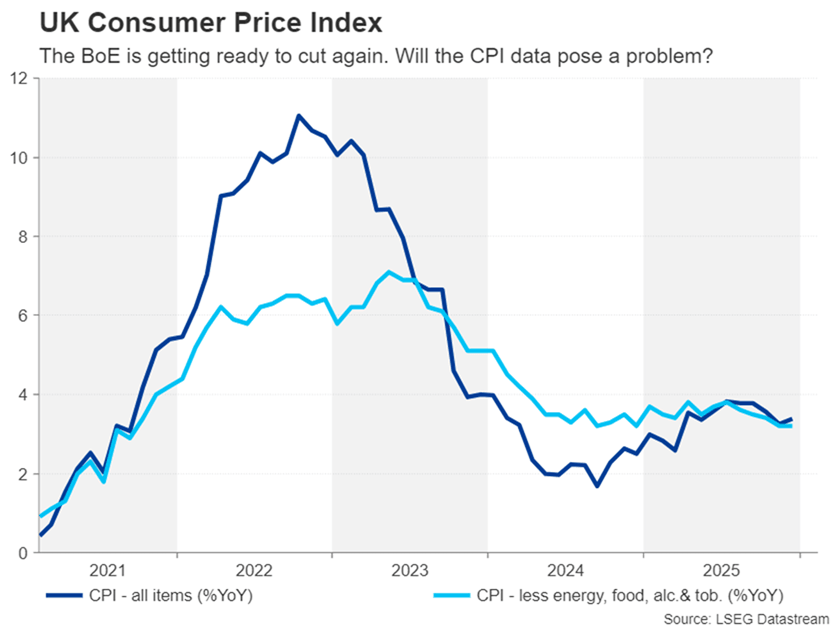

Next up is the CPI report on Wednesday. Headline CPI disappointingly edged up to 3.4% y/y in December while the core rate held steady at 3.2% y/y. Should CPI resume its decline in January, the pound is likely to come under pressure, as rate cut bets for the next BoE meeting in March would get a lift, pushing the odds of a 25-bps reduction above the current 64%.

On the other hand, a surprise uptick in inflation could create a dilemma for the BoE’s less dovish MPC members.

Finally on Friday, January retail sales and the flash PMIs for February could inject some additional volatility into sterling before the week wraps up. Though, with the political storm over Prime Minister Starmer’s leadership easing for now, the downside has become more limited.

Canadian CPI may not offer any valuable insight

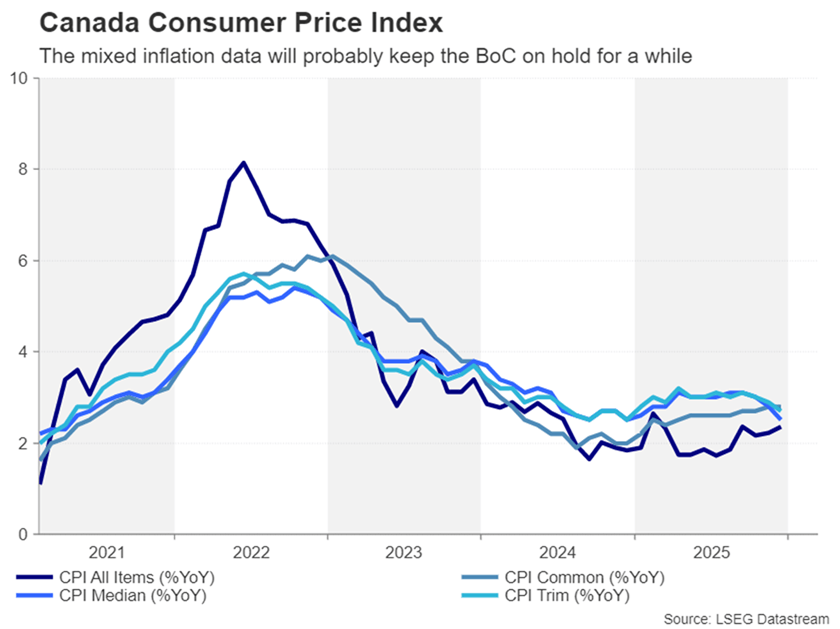

Another country that will be reporting CPI figures next week is Canada. In the minutes of its latest policy meeting published last Wednesday, the Bank of Canada acknowledged that the heightened global uncertainty is making it hard to predict the direction of interest rates.

Although the Canadian economy has been on a somewhat more solid footing lately, the BoC is concerned about the upcoming renewal of the United States-Mexico-Canada trade agreement amid President Trump’s unpredictable nature. Policymakers are also struggling to get a good read on inflation as the headline number has been inching higher in recent months but two key underlying measures have been falling.

Tuesday’s CPI readings for January are unlikely to prompt the BoC to unpause at its next meeting but may nevertheless help to clear some of the fog. Still, the Canadian dollar will probably be paying more attention to what’s happening to Fed expectations as well as to any fresh remarks by Trump on the country.

A not-so-exciting week for the Euro

In the euro area, the flash February PMIs are the main focal point for the single currency. Although the euro’s recent surge against the dollar has cooled, a revisit of the $1.20 territory remains on the cards as long as the Eurozone economy maintains its moderate but steady pace of growth and Fed rate cut bets aren’t scaled back beyond 50 bps.

The Eurozone’s composite PMI is forecast to have risen slightly in February. However, the spike in tensions between the EU and US over Greenland may have cast a shadow over business confidence in the early parts of the month, posing a downside risk.

Germany’s ZEW survey due Tuesday may also shed some light on business sentiment. But for euro/dollar, traders will probably be taking their cues from dollar developments.

Aussie hoping for jobs lift

In Asia, the impressive rally in equity markets has stumbled ahead of the long Lunar New Year holiday and could struggle further next week when liquidity is expected to be thin, as Chinese markets will be closed.

However, it may not necessarily be particularly quiet for the antipodean currencies as key jobs numbers are due on Thursday in Australia, while the Reserve Bank of New Zealand will announce its first interest rate decision of 2026 on Wednesday.

The Australian economy is showing early signs of overheating, prompting the Reserve Bank of Australia to become the first major central bank to revert back to a hiking cycle post pandemic. Moreover, RBA policymakers continue to beat the hawkish drums and Tuesday’s minutes of the February policy meeting will likely stress the upside threats to inflation.

Yet, investors see only about a 20% probability of a back-to-back rate increase at the May meeting. If the employment report for January reinforces the view of a strengthening jobs market, those odds could rise further, adding more bullish wind to the aussie’s sails. A day earlier, wage figures for Q4 will also be watched.

RBNZ to stay on hold

Interestingly, it wasn’t so long ago that the RBNZ was leading the race to hike rates first. But the recovery in New Zealand’s labour market has been slow and despite positive jobs growth in Q4, the unemployment rate hit a decade high of 5.4%.

Subsequently, investors don’t see a significant prospect of a rate hike before the autumn and the RBNZ is almost certain to keep policy unchanged on Wednesday. The New Zealand dollar, however, might still be subject to some swings if the RBNZ adopts a strong dovish or hawkish bias. The latter could even help the kiwi break the strong resistance in the $0.6075 area.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl