I recently discussed the idea of diversifying within your 401(k) or other defined-contribution employer-sponsored retirement plan. In most of those plans, mutual funds are your only investment choices.

Mutual funds were a good idea, for their time. They allowed small investors to have diversified portfolios. They offered professional management of the funds, freeing investors from having to do as much work to study their investment choices.

There are now better choices, in the form of exchange-traded funds (ETFs), that do the job of mutual funds but at a lower cost in terms of the management fee extracted out of the fund each year. Exchange-traded funds have other important advantages over mutual funds as well, stemming from the fact that they are traded on stock exchanges.

Because they are traded continuously on exchanges, exchange-traded funds can do some things that mutual funds cannot:

-

They can be sold short

-

They can be bought on margin

-

They have put and call options attached to them

But for that money in your current employer’s pension plan, ETFs are probably not an option, and the small numbers of mutual funds offered to you by your employer are your only choices.

In the article referenced above, I explained that the available asset classes usually boil down to stock funds, bond funds, blended stock-bond funds, money market funds and sometimes a precious metal fund or two.

How then can you evaluate them and choose among them? One way is to compare their performance to relevant benchmarks. Even though you may not actually be able to buy ETFs in your pension plan, you can use them as comparison tools to select the best choices from among the mutual funds available.

Here are some ETFs that can provide good comparisons for mutual funds that you are likely to have available:

| ETF | Index/benchmark | Category |

| SPY | S&P 500 Index | Large Cap Blend Equities |

| QQQ | NASDAQ 100 Index | Large Cap Growth Equities |

| IWM | Russell 2000 Index | Small Cap Blend Equities |

| AGG | Aggregate Bond Index | Total Bond Market |

| IEF | US 7-10 year bond index | Government Bonds |

| TLT | US 20+ year bond Index | Government Bonds |

| GLD | Gold Bullion | Precious Metals |

A mutual fund’s category is usually indicated by its name – the Spartan Long-term Treasury Bond Fund, for example, whose symbol is FLBIX, is clearly composed of long-term treasury bonds and therefore the best ETF to compare it to should be TLT, whose category is long-term government bonds.

If the name alone doesn’t give enough information to determine a fund’s category, this information can be found for any fund from many online sources, including Morningstar.com. Typing morningstar FLBIX into a web browser search bar will take you to Morningstar’s page on the fund FLBIX and give this information.

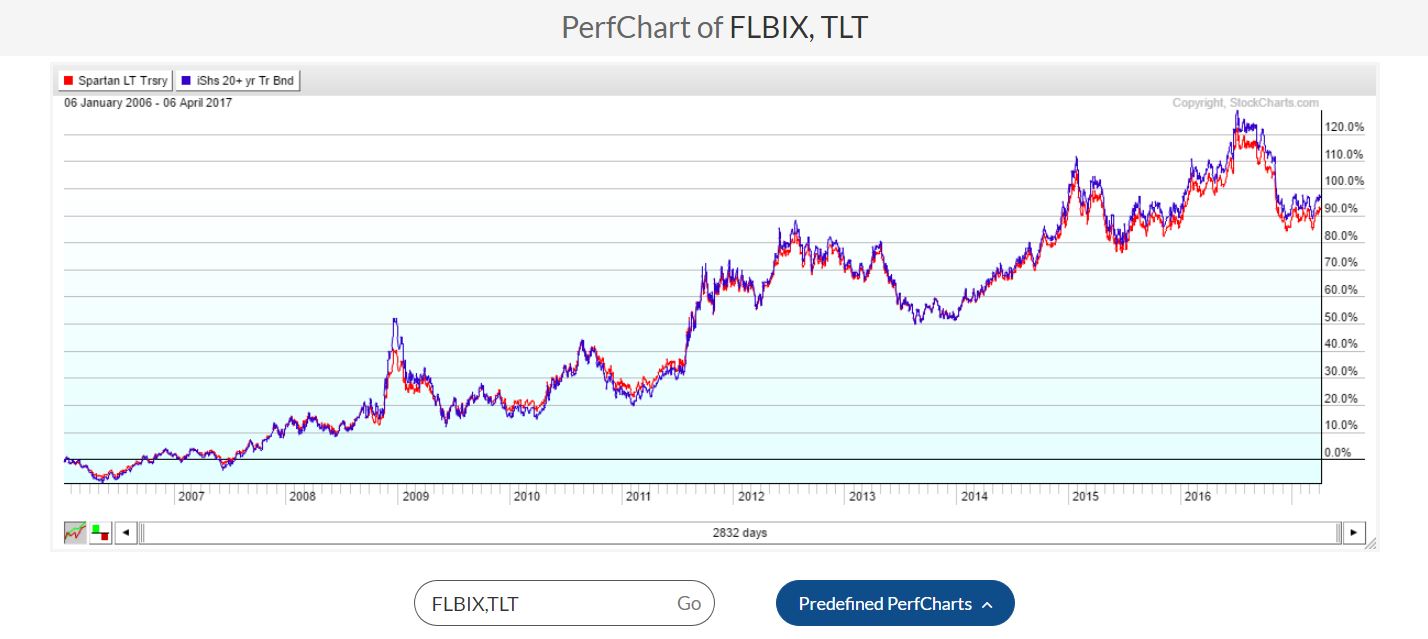

Once you know what category and therefore what ETF is comparable for a fund, you can easily make your comparison using another free online resource, this one from Stockcharts.com. In their section called Free Charts there is a tool called PerfCharts, which is short for Performance Comparison charts. There you can type in the symbols of stocks, indexes, ETFs or mutual funds that you want to compare. The resulting chart is an approximate measure of total return, including price appreciation and dividend/interest payments. Below, for example, is a PerfChart for the Spartan fund FLBIX together with its category ETF benchmark, TLT:

Here we can see that in fact FLBIX (red line) performed just a little short of its ETF benchmark TLT (blue line), and therefore would be a reasonable choice if you wanted to approximate the performance of their common index (20+ year government bonds) with part of your retirement funds. It is common that the mutual fund choice will underperform the similar ETF by some margin where the main difference is the amount of fees extracted over time.

You can do a similar comparison for funds available to you in each category. The idea is to select from three or more categories within your plan; and within each category select the best performers relative to their benchmarks. Although it is always true that past performance does not guarantee future results, it is still useful to know which of the available choices gives up the least performance in relation to its benchmark.

Dynamic Management of your retirement plan is just part of the content of our Proactive Investor course, which helps you build a solid plan for your long-term investments. For more information, contact your local center.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

AUD/USD eyes 0.7050 hurdle amid supportive fundamental backdrop

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.