I’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically. Real money…real trades.

This will be a really exciting article because we are talking about rescue missions, and I know that this has been on some of your minds.

The Wheel strategy, it’s just a great strategy. I love it. You know, I’m trading it a lot because it has an incredibly high winning percentage. It’s all fun and games as long as it works, but sometimes trades get in trouble, especially after last week.

I’ve been in quite a few tech stocks this week, like AAPL, and some of them took a beating. So situations like this where many traders don’t know how to fly a rescue mission and salvage a trade that is in trouble.

So in this article, I want to show you the following three things:

- What is a rescue mission?

- How to fly a rescue mission.

- When exactly should you do this?

The Wheel Strategy Overview

For those of you who might be new to The Wheel Strategy, let me first give you a brief overview of what it is and why I love trading it so much.

So there are actually three steps to The Wheel strategy.

Step Number One is you sell put options and you collect premium.

For Step Number Two it depends on where this stock is on expiration day, you may or may not get assigned. So what does it mean? It means that if the stock is closing below your strike price on expiration day, you will own their shares if that is the case.

Then for Step Number Three, if you are assigned, you sell covered calls and collect more premium, and if you’re not getting assigned, then you just go back to step number one and sell more puts.

So it’s an easy-to-understand strategy and it’s also very, very lucrative if done CORRECTLY. Now, here is the problem. So the problem starts if you are assigned, and after assignment.

One problem that can come up is if you can’t get enough premium for the calls. For me, when I’m selling calls, I want to see at least 30 percent annualized, and if I don’t get at least 30 percent annualized, then I won’t do it.

Another thing to keep in mind is, you don’t want to sell below the assigned strike price.

What Is A Rescue Mission?

So before asking the question, “do I need to fly a rescue mission?” let’s first talk about what a rescue mission is.

OK, just so you know, “rescue mission” is not an official trading term. There’s just something I name it this way for trades that are in trouble.

So here is how “rescue missions” work. You sell MORE put options below the assigned strike price. What is the advantage of this?

First of all, you collect more premium, and that’s what we are doing with this strategy, after all. This is a premium generating strategy.

Here is the other advantage. If you are getting assigned, you lower your cost basis. So let me explain to you exactly what that means.

Let’s use my position in RIDE as an example. So I got assigned at the strike price of 21.50, and right now, it is trading at 16.50 (at the time of this writing on March 8, 2021).

So a possible idea here is that we are selling more puts at 11.50 and we would collect more premium.

Now if we were to get assigned then we would own 100 shares at $21.50, and if we get assigned here, we would own another 100 shares at $11.50, so this means that if we take the average of these two prices, so $33 divided by 2, we have $16.50.

So our average price for our shares is now $16.50, which means we have lowered our so-called cost basis. Therefore we are making it easier to get out of the trade because, in this case, RIDE would not have to go all the way up to $21.50 again, it would only need to go up to 16.50.

Now, I recommend that you sell the same amount of Put’s that you have sold previously or more if you have the buying power. But the most important thing here is for me at least to follow The Wheel Calculator.

This is a tool that I like to use to know exactly whether the expected reward is worth the risk. I want to make at least 30 percent annualized, and if I can’t then it would not make sense for me at all.

So but you see, it’s super easy. Now, the next question is when should you do this?

When Should You Fly A Rescue Mission?

When should you fly a rescue mission? Firstly, let’s talk about the concept and then I will show you some trades that I’m currently in.

Now it’s all fun and games if our trades are going our way and the markets want to give us money, but sometimes you have tough days & weeks, and this is why I’m here for you because I want to help you through these tough times by showing you what I personally do.

OK, so when should you do this? There are a few important things to remember.

First of all, you only do this if you can get enough premium for selling the calls. Think about it this way, you are already assigned, right?

You sell put options, you get assigned, and when you get assigned, you want to sell calls and collect more premium. So as long as you can get enough premium for the calls, don’t worry about it.

Here is another important thing. WAIT! Do NOT fly a rescue mission too early.

When you do this, you’re losing buying power. You need to “keep your powder dry.” So when exactly do you do this? So here is a rule of thumb that I like to do.

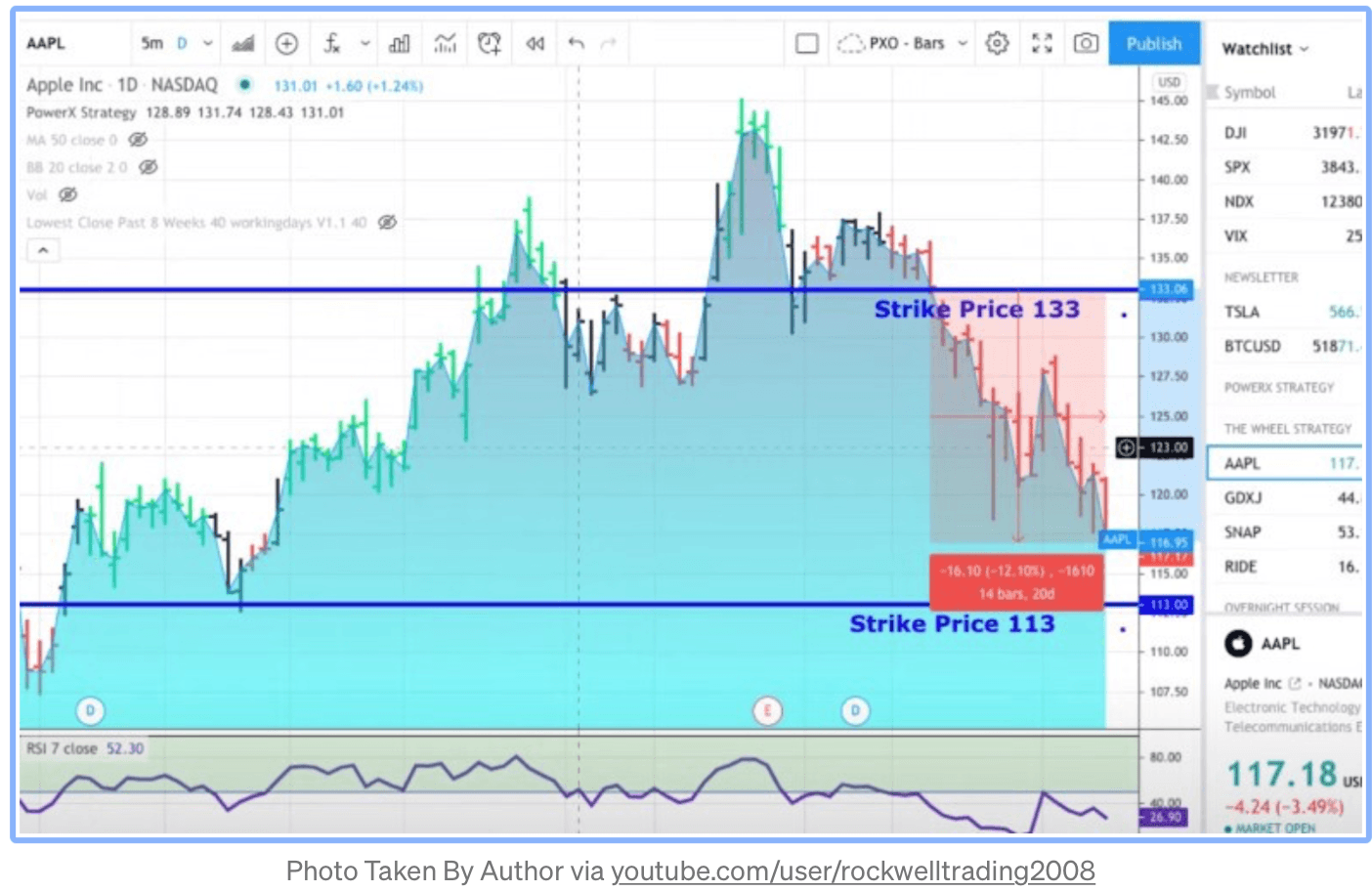

Only consider this if the stock went down at least 30 percent from your assigned price. Let’s look at my position with AAPL as an example.

AAPL is taking a beating today (March 8, 2021). So the strike price that I was assigned was $133, and right now, AAPL is trading at around $117. It is only down 12 percent.

So what does this mean? This means no rescue mission for AAPL just yet. Either wait until APPL bounces back a little bit, to make a move or, wait until AAPL is down at least 30 percent, otherwise, you’re doing it too early.

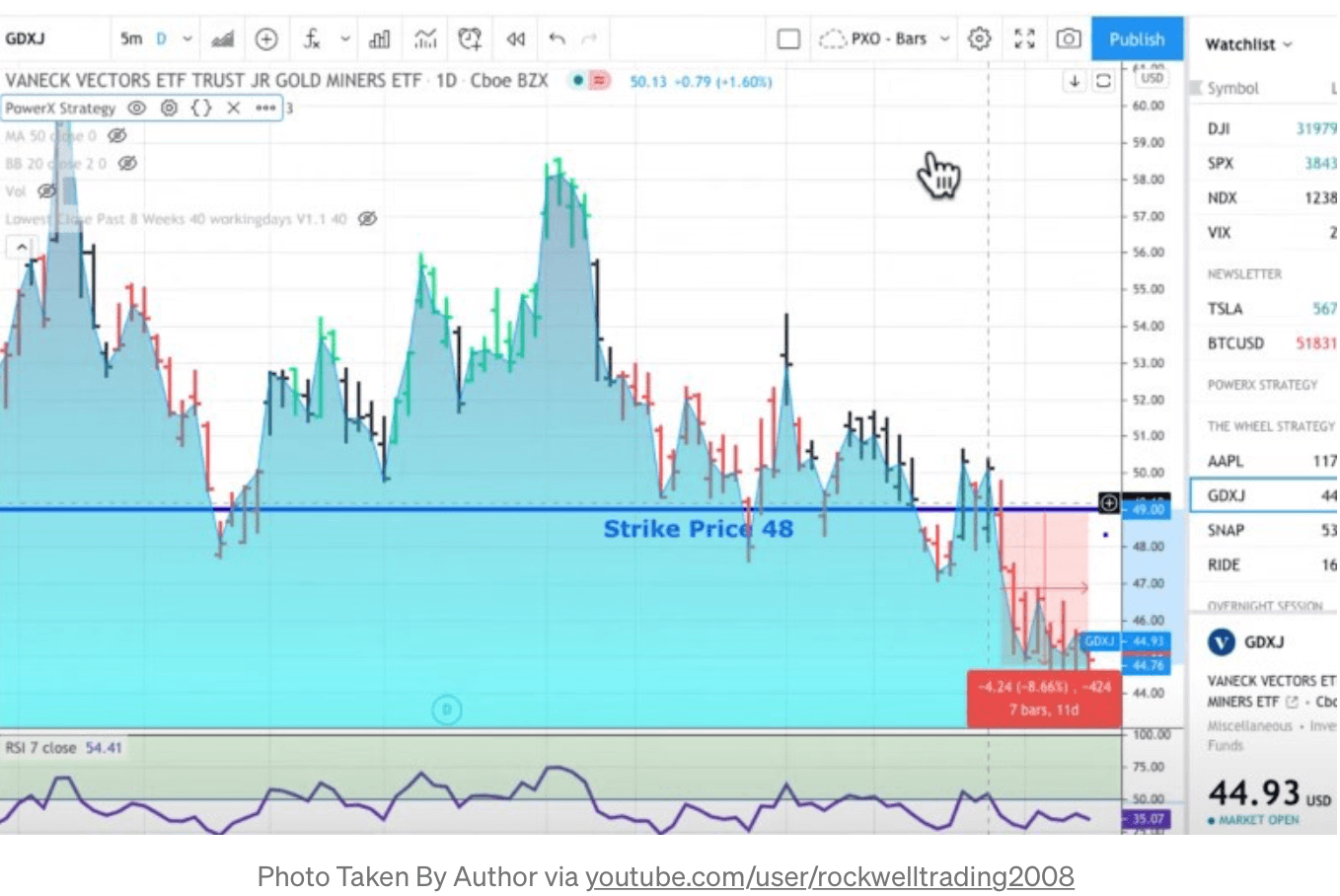

So let’s take a look at my trade with GDXJ. This is a trade where I got assigned at $48, and last week I was able to sell calls.

GDXJ is currently trading around $45 so right now we are down 9 percent. So this means for me also no rescue mission. Remember to keep your powder dry.

So don’t fly them too early. This is one of the biggest mistakes that traders do, yes, sometimes it sucks.

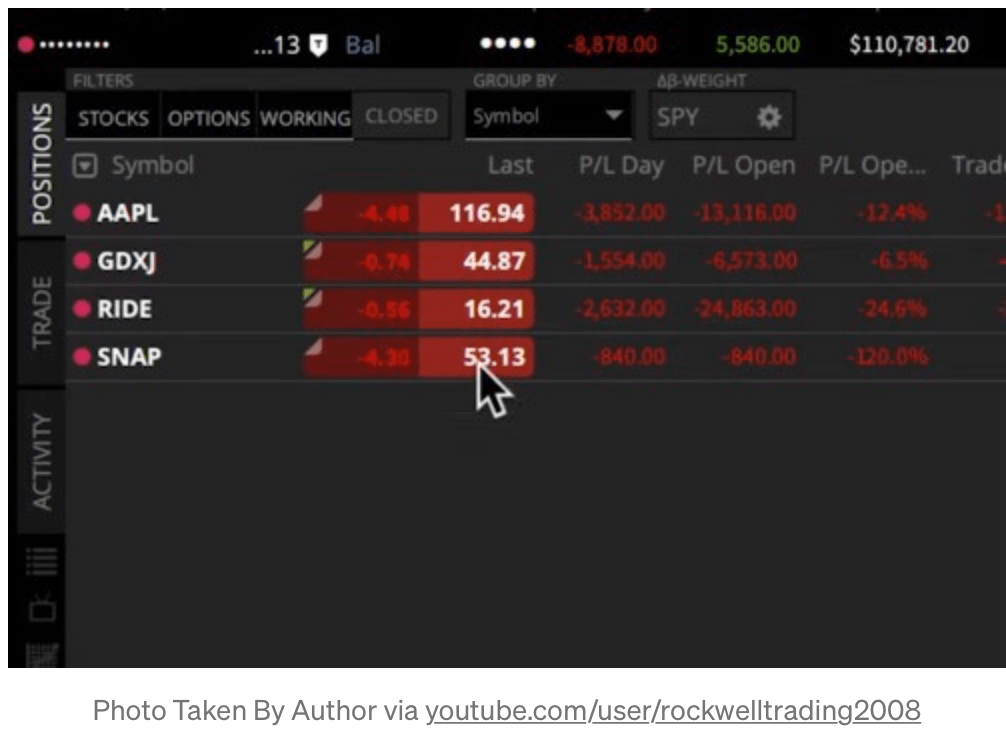

Another trade I want to look at is my trade with RIDE. I got assigned at $21.50 and right now we are down to $16.22. So this is down a little bit more than 24 percent. Right. So at about 24 percent, we don’t fly a rescue mission, but we can start thinking about it.

Let’s take a look at what’s happening with my account. As you can see right now, AAPL is down $13,000, GDXJ down $6,600, & RIDE down about $25,000.

Now, keep in mind, this here is a $250,000 dollars cash account, $500,000 in buying power. I know that this looks so ugly because it’s a larger account. But if you think about it, with AAPL is down $13,000, based on the buying power, it is down only about 2.6 percent.

So being down $25,000 overall based on the $500,000 account, it’s down about 5 percent. So for me, it’s not a big deal. This is not really a huge amount for me, with a big account.

Now, I did enter SNAP today, and SNAP right now is down. I’m not a bit surprised that it kept plummeting, but we can talk about this in a little bit.

Just remember, you don’t want to fly rescue missions too early. This is the number one mistake that I see.

So if you see that you’re down like five percent, that should not freak you out, and if it does, then you may have made a mistake with the stock selection.

This is why I talked about stock selection in the previous article.

Also, despite your best efforts, you can’t rescue every trade.

If you entered into a stupid trade, you’ve got to have got to cut it loose or HODL, Hold On for Dear Life.

How To Fly A Rescue Mission

I want to show you some very specific examples of trades that were sent to me where people asked, “OK, so how do I rescue this?”

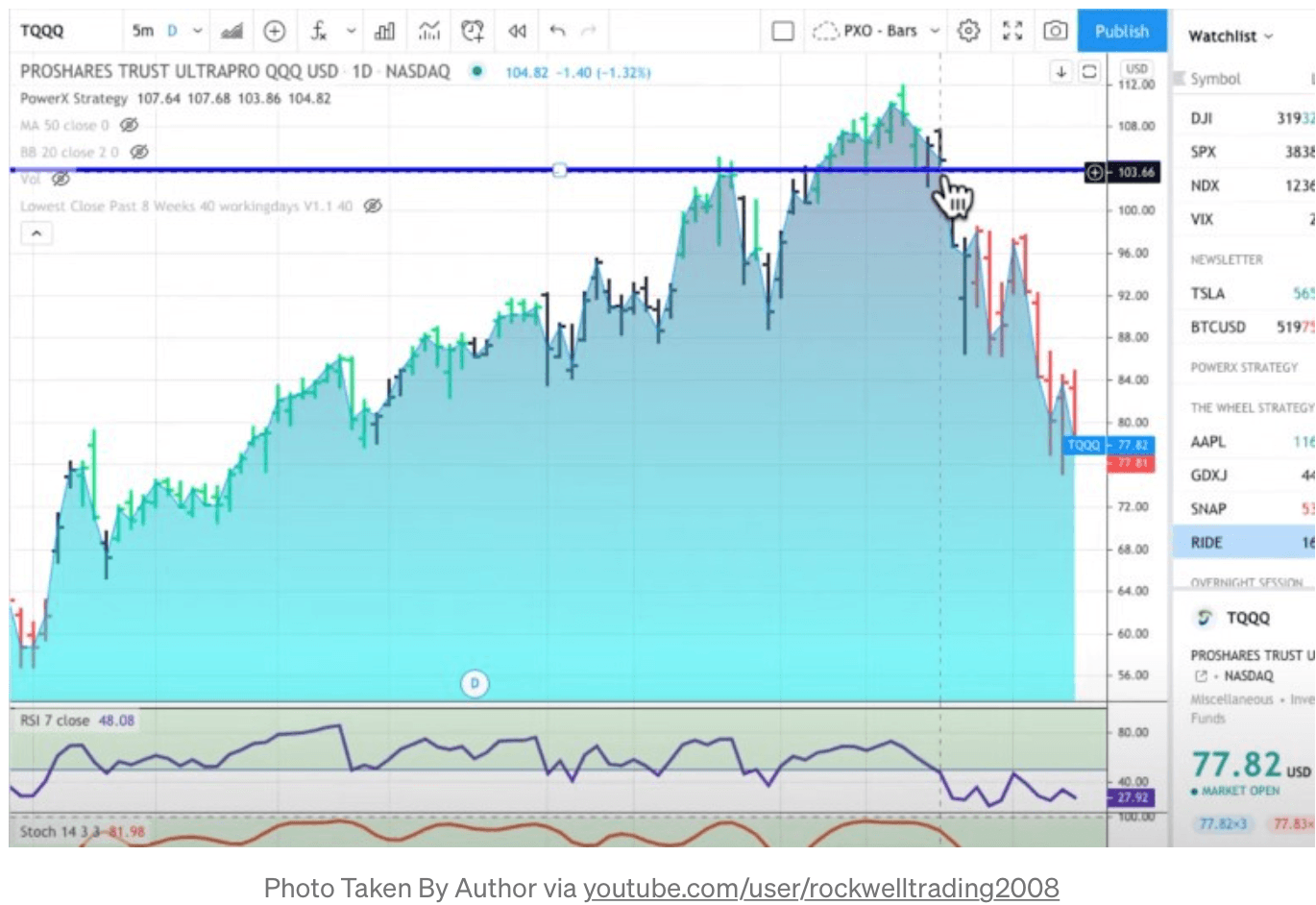

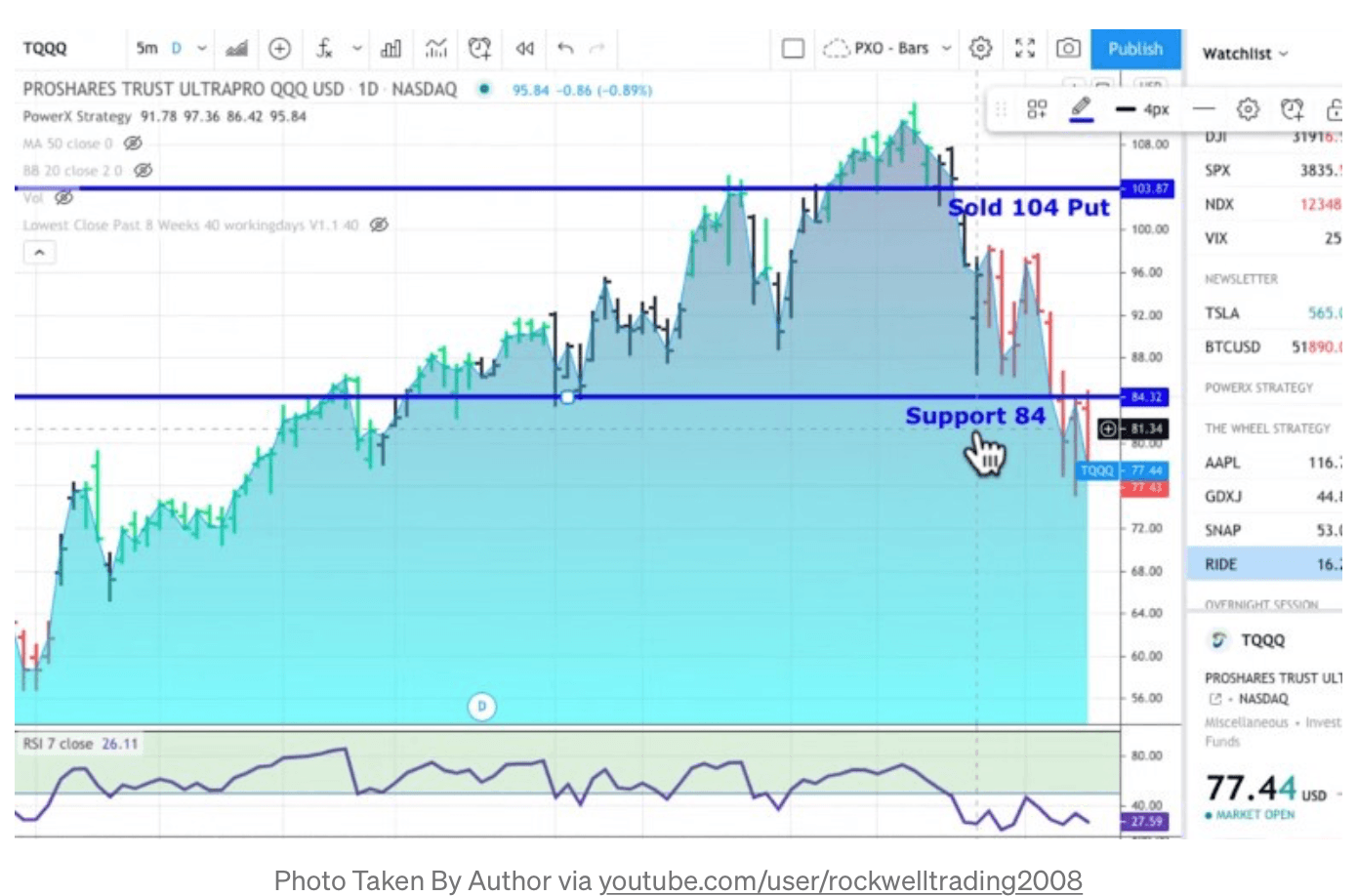

So let me show you the first trade here with TQQQ. This is where a trader got in right here at 104. So the trade here was to sell the 104 put right up there, and this is where I’m saying, “what the heck were you thinking?”

I mean, this is where they probably got a little bit too greedy, and now they are now in a whole world of pain, and you know what? Rightfully so.

This will help you to avoid these mistakes next time. So what are we always talking about? Where should you sell puts? You should sell, puts at where you see some support.

So where do you see support right here? Well, I see some support at around 84. So support 84, and not at 104. So if they had sold the 84 put instead of the 104 put, they would have been just fine.

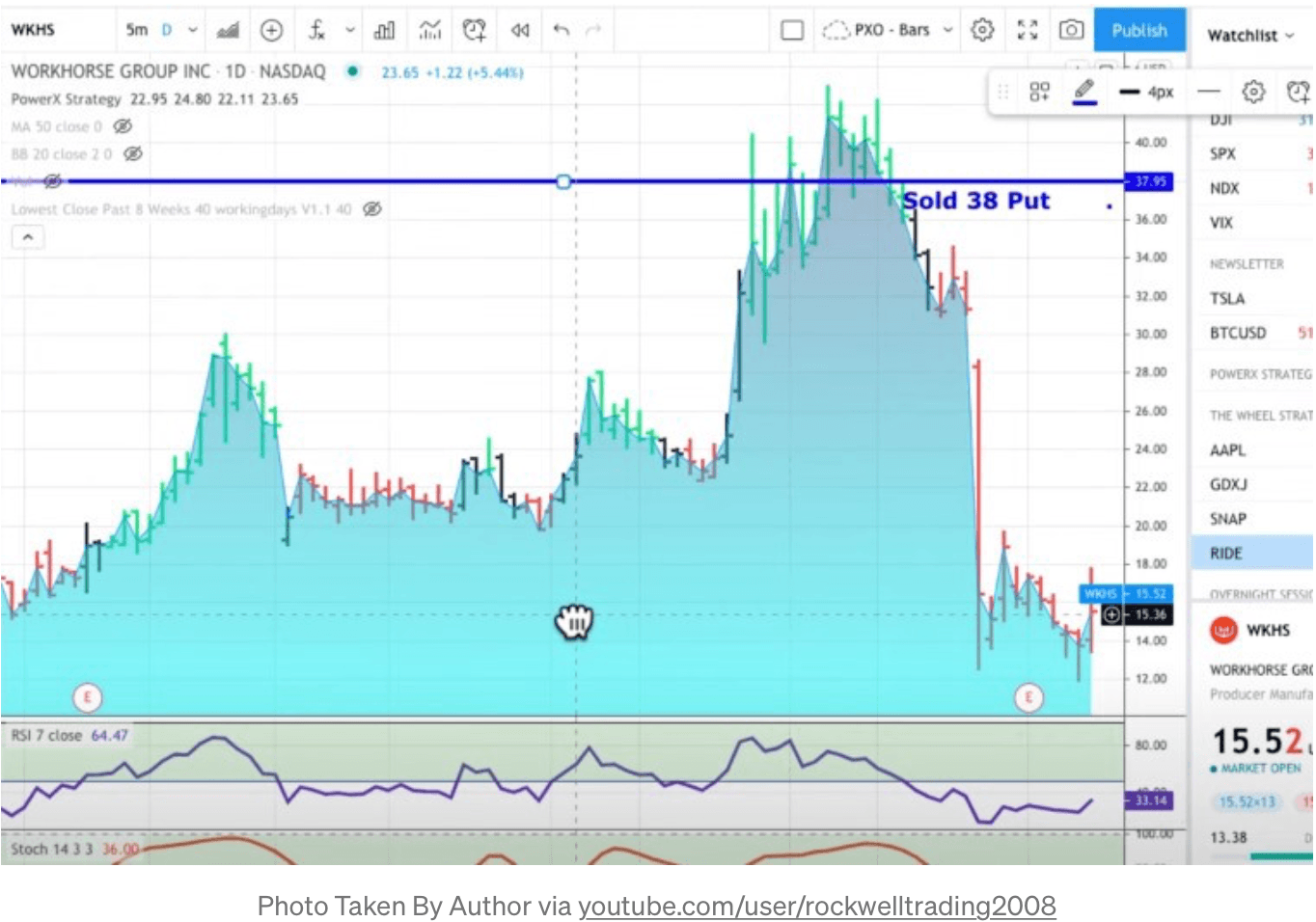

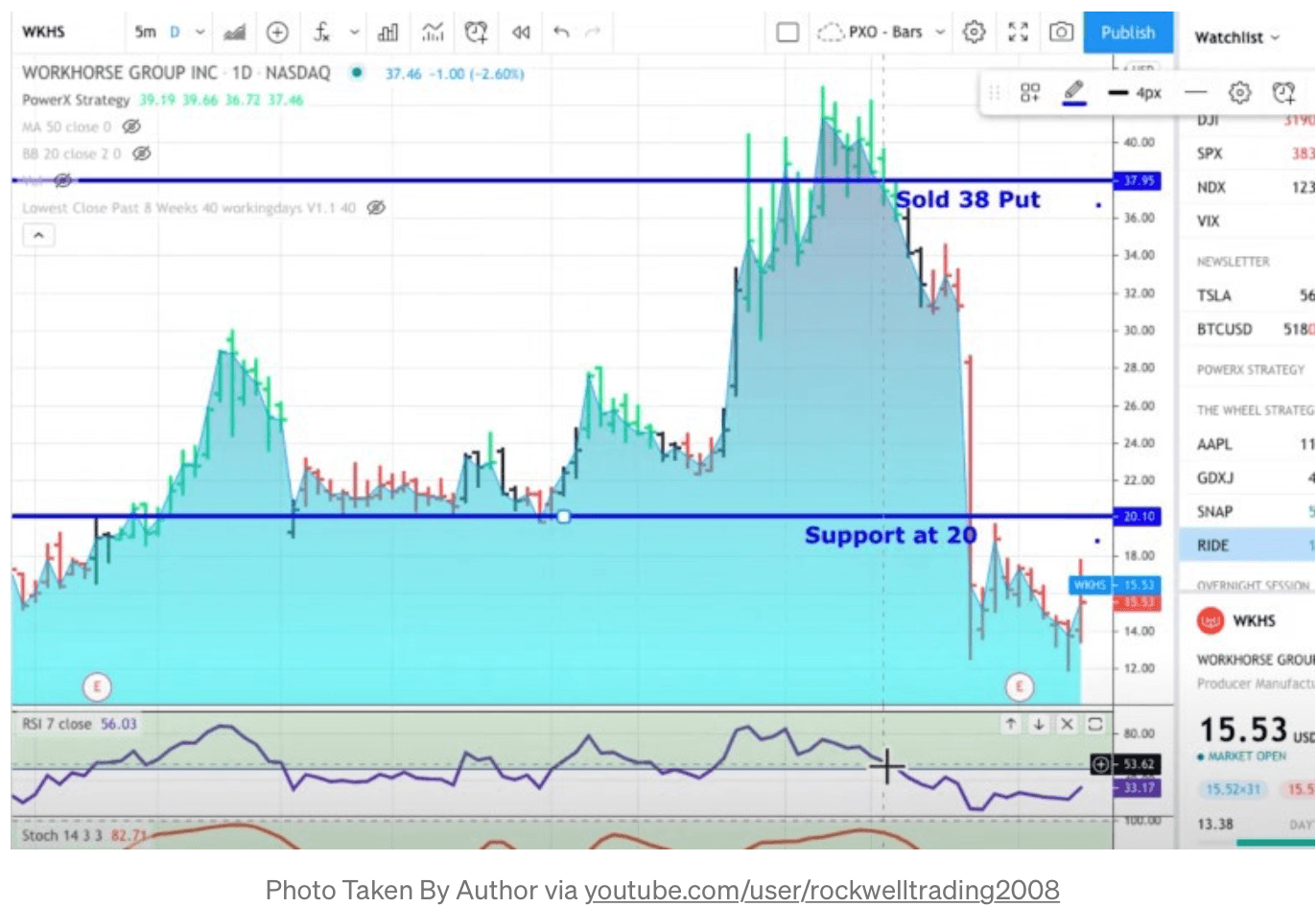

Now, let me show you another trade for WKHS.

So I heard from a trader who was sold right here, the 38 puts. This is where I say, “What the heck? Where on this chart do you see support?”

I know about you, but I see way more support at around the 20 mark, and if you would have sold a 20 put on WKHS, you would have been just fine. So this is where some traders get blinded by the premium that you can get, but don’t do this.

One of the key things is you gotta sell at major support and resistance.

5 Stocks NOT To Sell Puts On

These are five stocks that you should not sell puts on when trading The Wheel.

The first type of stock to not sell puts on is on Reddit stocks.

Reddit stocks are stock being hyped on Reddit like GME, AMC, BB, & BBBY.

All of these are “Reddit stocks,” and if you have been trading these you’re probably in a world of pain. This is where you probably can’t rescue every trade, and this is where, as I said earlier, all you can do here is to cut it loose and say, “OK, I’ll learn from my mistake and I have to make the money back.”or, you hold on for dear life.

You might be in this trade for a long, long time, and at some point, you might have to cut it loose anyhow, because honestly if you traded GME and if you sold puts, there’s not much you can do anyway. You can’t rescue trades like this.

The next one is stocks with earnings before expiration. Don’t do this.

I mean, if you did it, you made a mistake. So learn from your mistake and you might have to take a loss here. The important thing is you’ve got to follow the rules.

If you don’t follow the rules, it’ll be really tough. Right.

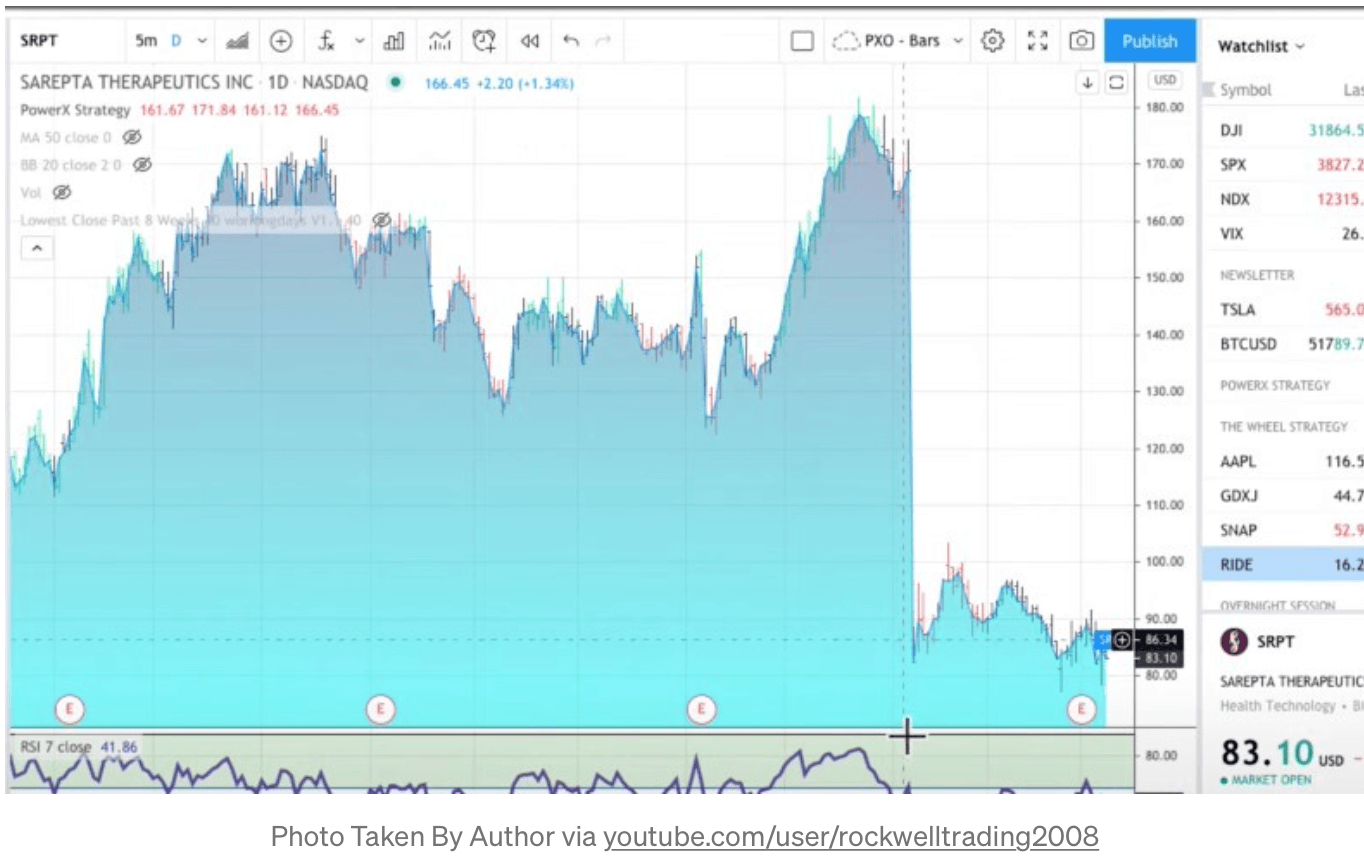

Stocks with a so-called Phase 3 clinical trial and this is especially pharmaceutical stocks, and they can go crazy.

An example of this is SRPT. This was probably a stock where you thought, you would be safe, but if you did a little bit of research, you saw that it had a clinical trial.

Results were due and it didn’t go well, as you can see. So this stock plummeted from 170 to 90, and will this ever recover? I don’t know, but if they had a failed clinical trial, they might not recover.

They may recover a little bit, but you might have to cut it loose.

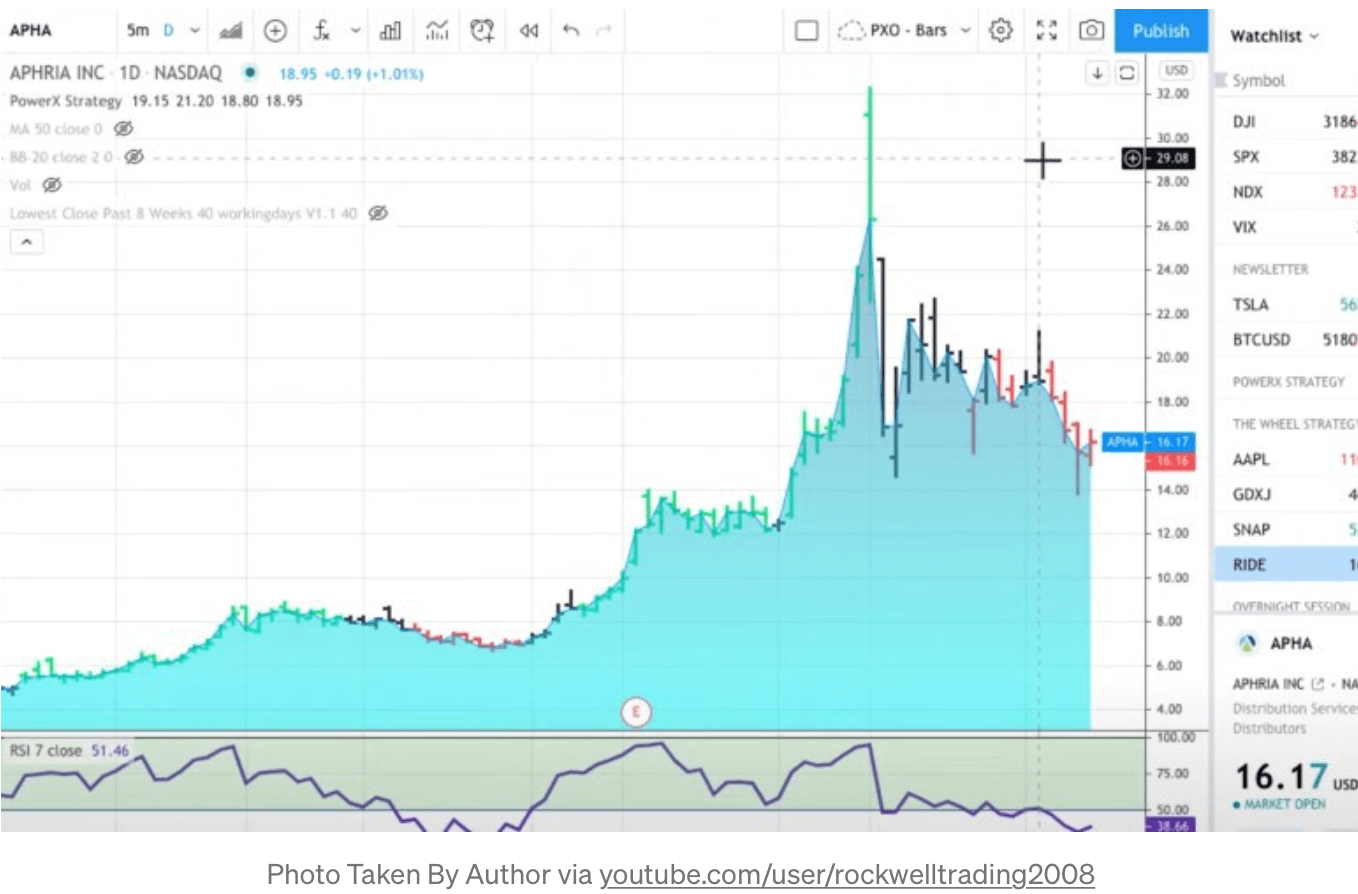

The next stock that you shouldn’t sell is crazy stocks. A stock that appeared on my scanner was APHA.

If you look at the chart you see that this stock went from about $5 to $32. You see it all the way up here. So don’t trade something like this. This is absolutely crazy.

So number five, stocks with premium’s that are too good to be true, because if it is too good to be true, which would be the stocks above, then it usually is.

Summary

Yes, you can fly rescue missions, and they make sense, right, but you need to make sure that you don’t trade stupid stocks. It’s important that you don’t make these mistakes.

The also important thing is you need to have a plan before you sell puts.

I’ll give you a plan right now. So today (March 8, 2021) I traded SNAP.

So and what I did with SNAP is that I traded a strike price of 49, but you see, this is where I already know when and where I will fly my rescue mission because as you can see, there is more support right here at 38, so this would be a possible level for a rescue mission.

Now, it doesn’t really qualify for my at least 30 percent down, but you get the idea right? If you’re looking at 30 percent down, we can fly rescue missions all the way down here because that would be a loss of around 15 dollars, which would be down at around 34. Yeah. So 34 is your 30 percent down level, and this is where we can start flying rescue missions.

So my point is, this is why I’m showing this to you is I know where to fly rescue missions before I’m selling.

You get the idea right. It’s super important that you do have a plan before you sell puts. You have to know where’s the next level. Where is the next support level? Because the next support level is where you would fly a rescue mission.

This is also very important. Don’t panic fly a rescue mission too early. You gotta keep your powder dry.

Based on my experience and the results that I want to achieve for myself, I am fine on any account. It doesn’t matter what I’m trading, whether I’m trading the PowerX strategy, The Wheel strategy, whatever I say, I’m fine with the drawdown of 20 percent because if I am trying to make 30 percent per year for me, that is OK.

I was on track to make probably, what, 50 or 60 percent. So the risk is part of our deal as traders and the reward is always a function of the risk. The more risk you are willing to take, the higher the rewards, the less risk, the less reward.

If this drawdown makes you uncomfortable, you may consider trading another trading strategy that has a lower drawdown, but therefore also a lower reward.

So this is where if you want to have a drawdown of maybe 10 percent per year, think about returns of possibly 20 percent per year, or if you want to have a drawdown of five percent, if you don’t want to have a drawdown at all, consider putting it into a savings account, then you never have a drawdown.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD off highs, back to 1.1850

EUR/USD loses some upside momentum, returning to the 1.1850 region amid humble losses. The pair’s slight decline comes against the backdrop of a marginal advance in the US Dollar as investors continue to assess the latest US CPI readings.

GBP/USD advances to daily tops around 1.3650

GBP/USD now manages to pick up extra pace, clinching daily highs around 1.3650 and leaving behind three consecutive daily pullbacks on Friday. Cable’s improved sentiment comes on the back of the inconclusive price action of the Greenback, while recent hawkish comments from the BoE’s Pill also collaborates with the uptick.

Gold surpasses $5,000/oz, daily highs

Gold is reclaiming part of the ground lost on Wednesday’s marked decline, as bargain-hunters keep piling up and lifting prices past the key $5,000 per troy ounce. The yellow metal’s upside is also propped up by the lack of clear direction around the US Dollar post-US CPI release.

Crypto Today: Bitcoin, Ethereum, XRP in choppy price action, weighed down by falling institutional interest

Bitcoin's upside remains largely constrained amid weak technicals and declining institutional interest. Ethereum trades sideways above $1,900 support with the upside capped below $2,000 amid ETF outflows.

Week ahead – Data blitz, Fed Minutes and RBNZ decision in the spotlight

US GDP and PCE inflation are main highlights, plus the Fed minutes. UK and Japan have busy calendars too with focus on CPI. Flash PMIs for February will also be doing the rounds. RBNZ meets, is unlikely to follow RBA’s hawkish path.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.