Let’s focus on less-popular securities to trade energies today: Master Limited Partnership (MLP). How do they work and how can they be profitable?

By the way, a big “thank you!” goes to Simon, one of our readers, who asked us about this last Friday. Feel free to send us your questions or any topics that you would like us to write about in the forthcoming editions, and we’ll try our best to answer them!

Note: Trading positions are available to our premium subscribers.

A good way to diversify the construction of your oil and gas investment portfolio is to use a variety of assets for balanced exposure to the energy sector and its industrial components.

What is a Master Limited Partnership (MLP)?

To learn in detail what a MLP is, we invite you to read the following articles that already contain the necessary basic information you need to know before starting investing in them.

-

Master Limited Partnership (MLP), Investopedia.com.

-

The Benefits of Master Limited Partnerships, Investopedia.com.

Key reason for going into those alternative investments

The most important advantage is the high-income potential. Indeed, Master Limited Partnerships (MLPs) typically pay high yields to investors, mainly due to the fact that they do not pay corporate income taxes.

Stock watchlist (Continued)

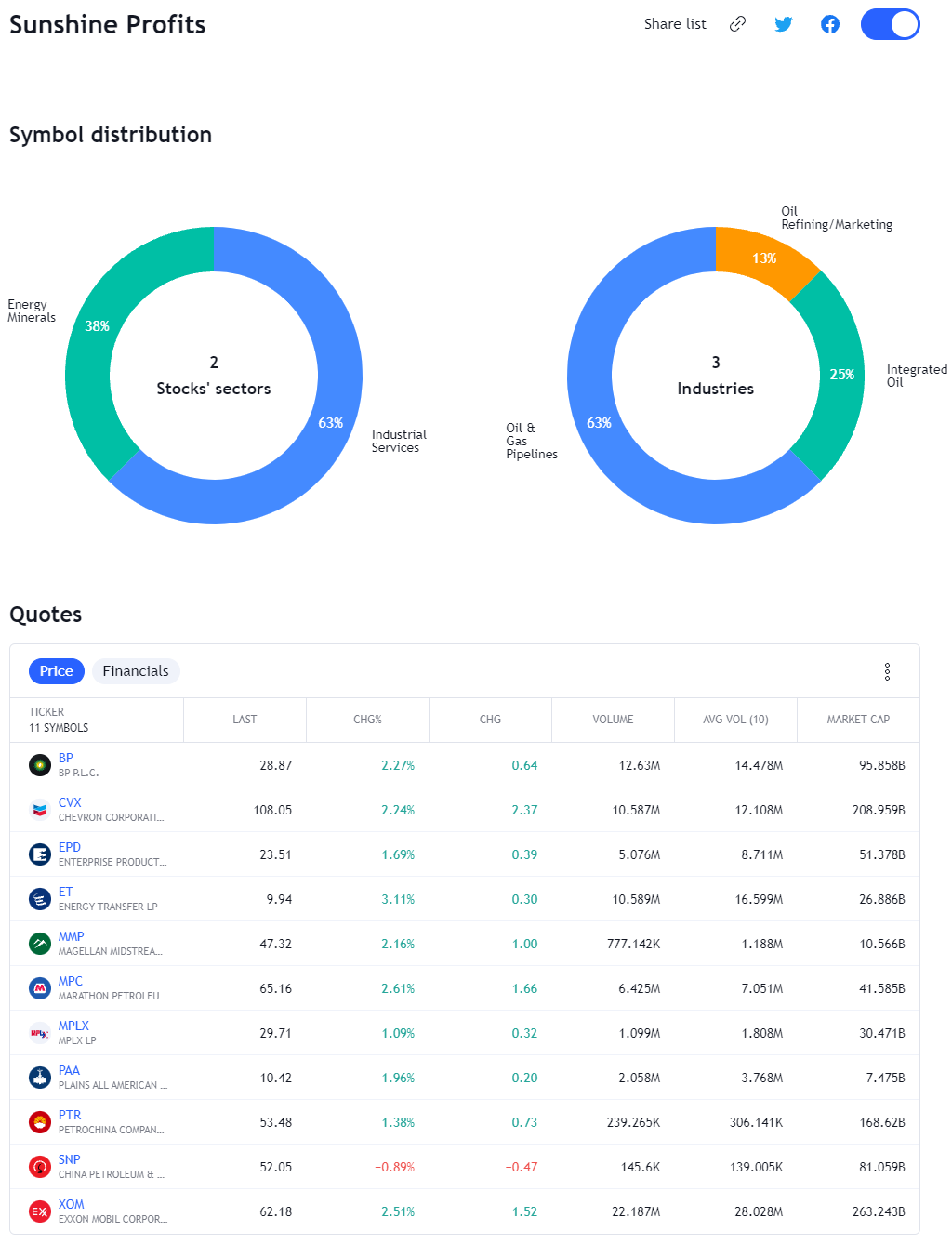

In the first article about alternative investments, we started a watchlist with some major energy stocks. Today, let’s update it!

As usual, our stock-picks will be shared through this link to our dynamic watchlist (which will be included in the position from now on). It will be updated from time to time as we progress through our portfolio construction process.

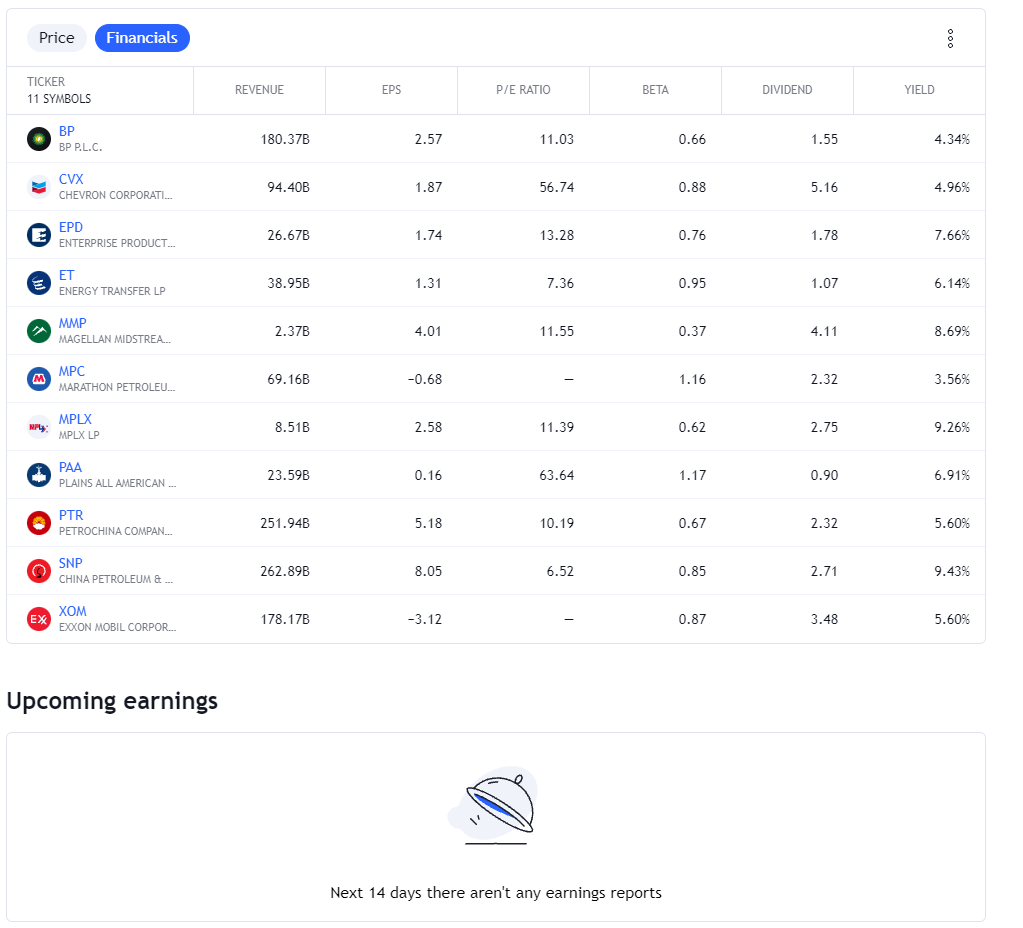

Take a look below at a few examples of some indicative metrics:

Today we picked five oil and gas Master Limited Partnership (MLP) companies that are quoted on the US exchange. Their revenues are as stated below:

Revenue (in billion US dollars):

-

Enterprise Products Partners LP (EPD) $26.67B.

-

Energy Transfer LP (ET) $38.95B.

-

Magellan Midstream Partners LP (MMP) $2.37B.

-

MPLX LP (MPLX) $8.51B.

-

Plains All American Pipeline LP (PAA) $23.59B.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.