Can you see yourself buying into the move below?

It’s a strong, steep rise—the kind of trade you dream about, right?

Now imagine you're a passenger in a car travelling at 50mph/80kmph on the highway, approaching a busy intersection.

The lights are amber, and you see them change to red. But your driver must be in a dream as the car isn't slowing down.

You’re about to run a red light, and it scares the daylights out of you.

Intense fear can happen when you're trading. Felt it?

But if you knew a trade was a car crash waiting to happen, that fear would stop you from entering, wouldn’t it?

In other words, Fear is Good.

Michael Marcus, who amassed an 80 million trading fortune, is famous for saying:

"I have a real fear of markets. I have found that the greatest traders are the ones who are most afraid of the markets."

Are you surprised that great traders are afraid? It debunks the notion of 'being fearless' to trade successfully, right?

Now, let’s revisit our chart.

Based on the steep, strong move to the upside above, you buy 20 lots. No big deal, right?

But suddenly, there's a violent move to the downside—without a buyer in sight.

While you're 'massaging' your exit, the price is slicing through levels like a knife in free fall.

With a 30bps price drop, you're down USD 6K/AUD 9K. If you continue to hold, it's double that.

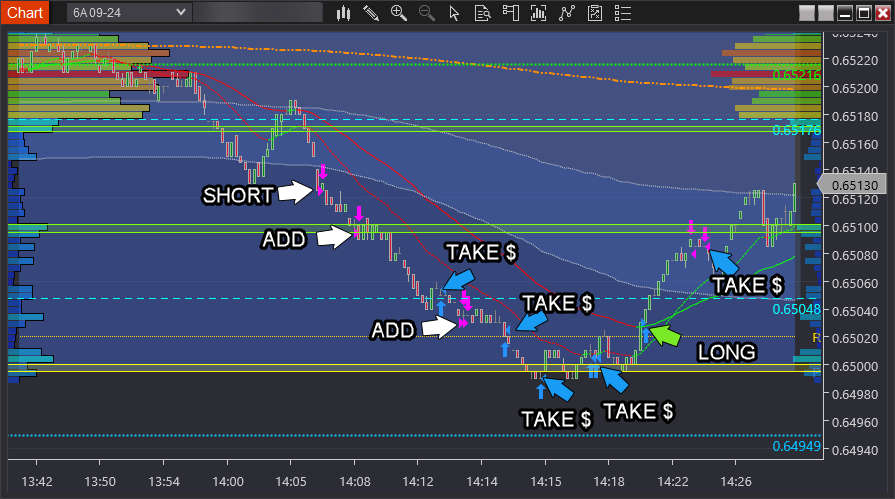

The chart below shows exactly what happened.

Have you experienced something similar?

Like red traffic lights, there are numerous signs you can learn that tell you:

"Entering 'here' is a car crash for your account waiting to happen."

These signs make such trades avoidable.

In the chart above, you can see two red lights:

-

A relative value transition at 0.6547 screams out to you, "No Longer Long".

-

Another red light is the absence of buyers 'bidding up' above the Pre-Pro High™️.

Further red lights not visible on the chart relate to market pace, liquidity, and order book activity.

But the only way I know how to illustrate these is to show you during a live trading session.

If all of the above isn't enough to stop you from going long, the price has reached one standard deviation above a volume-weighted average, anchoring it to the downside.

And what do all these red traffic lights represent? Multiple points of evidence.

Just how important is evidence? Here's what high-performance coach to elite traders, Dr Brett Steenbarger says:

"If everyone engaged in evidence-based trading, there would be no overtrading--"

Multiple points of evidence are crucial in trading because this game is about knowing and seeing what most others don't.

Evidence isn't just about avoiding pitfalls; it's equally powerful for spotting green light trades.

Check out the first trades taken after the avoided car crash trade:

I believe anyone is capable of making these trades once you've learned how to spot multiple points of evidence—but with one important caveat...

Like surfing, playing an instrument, or tennis, trading has its nuances.

You must familiarise yourself with them—and repetition is the mother of mastery.

At first, it might feel out of reach. But as someone for whom trading didn't come naturally—failure can't cope with perseverance.

Maybe you'd feel more comfortable trading if someone could just tell you what to do. And at first, it's the fastest way to progress.

But soon enough, that 'someone' becomes the market itself—once you've learned to read its language through multiple points of evidence.

Do you know why this approach is so effective?

Paying attention to what others miss is not new. As Henry Ford said:

"A handful of men have become very rich by paying attention to details that most others ignored."

Do you now see how you can get off the 'Win Some, Lose More' trading hamster wheel—taking a dramatically different approach from everything that’s failed you so far? And don't worry, you're not starting from scratch.

To be blunt: You need to experience all of trading's raw emotions before you can learn the points of evidence related to human behaviour.

Trading isn't about fearlessness—it's about harnessing fear to steer clear of disasters. The market speaks; learn its language, and you'll find yourself not just avoiding crashes but mastering the ride. Ready to listen?

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD remains heavy near 1.1600 after hot EU inflation data

EUR/USD remains heavily offered near 1.1600, six-week lows, in the European session on Tuesday. The pair fails to find any inspiration from a surprise pick up in Eurozone inflation for February, as the US Dollar continues to attract safe haven flows amid escalating geopolitical tensions in the Middle East.

WTI jumps over 6% to top $75 amid US-Iran war risks

WTI jumps more than 6%, breaking above the $75 mark. Oil prices surge as the US-Iran war raises fears of supply disruptions. Goldman Sachs estimates an $18 per barrel geopolitical risk premium in Oil.

Gold falls below $5,300 as stronger USD counter Middle East woes

Gold attracts some intraday selling and falls below $5,300 on Tuesday. The US Dollar climbs to a fresh high since January 20 and turns out to be a key factor exerting downward pressure on the commodity. However, concerns about a broader regional conflict in the Middle East continue to weigh on investors' sentiment and underpin demand for the traditional safe-haven bullion.

Stellar risks deeper losses as derivatives metrics turn negative

Stellar is trading red below $0.16 at the time of writing on Tuesday, after a slight recovery the previous day. Weakening derivatives data caps the recovery, while an unfavorable technical outlook projects a deeper correction for the XLM token in the upcoming days.

Middle East conflict ramps up a gear as energy price spike rips through markets

It’s another risk off day as geopolitical headwinds continue to batter financial markets. Although markets calmed during the US session and US stocks managed to post gains on Monday, this has not fed through to the European session, and stocks and bonds are sharply lower for a second day.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.